Rptl 730 2016-2026

What is the Rptl 730

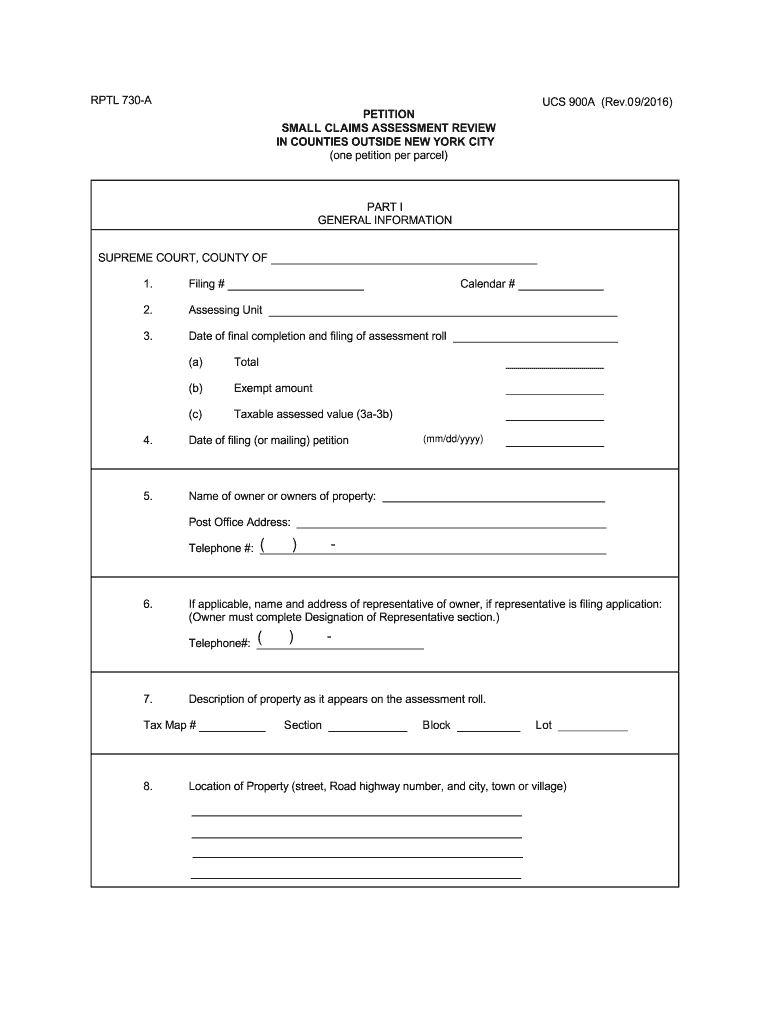

The Rptl 730, also known as the Rptl 730 form, is a crucial document used in the assessment review process for certain properties in New York State. This form is primarily utilized by property owners who wish to challenge their property tax assessments. By filing the Rptl 730, property owners can present their case to local assessment boards, seeking a potential reduction in their property tax obligations. Understanding the purpose and implications of this form is essential for property owners looking to navigate the assessment review process effectively.

How to Use the Rptl 730

Using the Rptl 730 form involves several key steps that property owners must follow to ensure their submission is valid and effective. First, gather all relevant information about your property, including the current assessment, property details, and any supporting evidence that may bolster your case. Next, accurately fill out the Rptl 730 form, ensuring that all required fields are completed. Once the form is filled out, submit it to the appropriate local assessment board by the specified deadline. It is advisable to keep a copy of the submitted form for your records.

Steps to Complete the Rptl 730

Completing the Rptl 730 form requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the Rptl 730 form from a reliable source.

- Fill in your personal information, including your name, address, and contact details.

- Provide specific details about the property in question, such as its location and current assessed value.

- Include any evidence supporting your claim, such as recent property appraisals or comparable property assessments.

- Review the completed form for accuracy before submission.

- Submit the form to the designated assessment board, ensuring it is sent by the deadline.

Legal Use of the Rptl 730

The Rptl 730 form is legally recognized in New York State as a formal request for an assessment review. To ensure its legal validity, property owners must comply with specific regulations and guidelines set forth by state law. This includes adhering to submission deadlines and providing accurate information. The legal framework surrounding the Rptl 730 ensures that property owners have a fair opportunity to contest their assessments and seek adjustments based on factual evidence.

Eligibility Criteria

To file the Rptl 730 form, property owners must meet certain eligibility criteria. Primarily, the property in question must be located within a jurisdiction that allows for assessment reviews using this form. Additionally, the property owner must be the individual or entity responsible for paying the property taxes. Understanding these criteria is essential for ensuring that the Rptl 730 is the appropriate form for your situation.

Filing Deadlines / Important Dates

Filing deadlines for the Rptl 730 form are critical to the assessment review process. Typically, property owners must submit their forms within a specific timeframe following the receipt of their property tax assessment notice. These deadlines can vary by locality, so it is important to check with your local assessment office for the exact dates. Missing the deadline may result in the inability to contest the assessment for that tax year.

Quick guide on how to complete rptl 730

Set up Rptl 730 effortlessly on any gadget

Web-based document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your files swiftly without interruptions. Administer Rptl 730 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest method to alter and eSign Rptl 730 with ease

- Locate Rptl 730 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and possesses the same legal authority as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Rptl 730 and ensure top-notch communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rptl 730

Create this form in 5 minutes!

How to create an eSignature for the rptl 730

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the rptl 730 form?

The rptl 730 form is a document used to apply for a property tax exemption in New York. It contains essential details about the property and the owner to determine eligibility for tax benefits. By utilizing the rptl 730 form, property owners can ensure they are taking advantage of available reductions in their tax obligations.

-

How can airSlate SignNow help with the rptl 730 form?

airSlate SignNow allows users to easily upload, complete, and eSign the rptl 730 form efficiently. This digital process ensures that your application is submitted promptly and accurately without the hassle of printing or traditional mailing. Plus, you can access your signed documents anytime, anywhere.

-

What are the pricing options for using airSlate SignNow for rptl 730 form submissions?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs when submitting documents like the rptl 730 form. Whether you are a small business or a larger organization, there are various subscription tiers that provide affordability without compromising on features. You can start with a free trial to assess how it meets your requirements.

-

Is airSlate SignNow secure for signing the rptl 730 form?

Yes, airSlate SignNow implements robust security measures to ensure that your documents, including the rptl 730 form, are safe and confidential. The platform uses advanced encryption methods and follows industry standards for data protection. Users can feel confident submitting their sensitive information securely.

-

Can I integrate airSlate SignNow with other tools for managing the rptl 730 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems, enhancing your workflow for managing the rptl 730 form. This integration allows you to automate and streamline processes, making document management more efficient.

-

What features does airSlate SignNow offer for completing the rptl 730 form?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and automated reminders for completing the rptl 730 form. Users can enjoy an intuitive interface that simplifies the eSigning process, making it convenient for all parties involved in the submission.

-

How quickly can I complete the rptl 730 form with airSlate SignNow?

With airSlate SignNow, you can complete your rptl 730 form in just minutes. The platform’s user-friendly design allows for quick entry of information, and the eSigning process is streamlined to eliminate delays. This ensures you can submit your property tax exemption application without unnecessary wait times.

Get more for Rptl 730

- Rspca radcliffe form

- Melinda gooderham form

- Diabetes management plan for schools akron childrenamp39s hospital akronchildrens form

- Tennessee quitclaim deed from individual to individual form

- Sober solutions transitional housing services form

- Product design non disclosure agreement template form

- Product development agreement template form

- Product loan agreement template form

Find out other Rptl 730

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now