Commercial Vehicles Pinellas County Tax Form

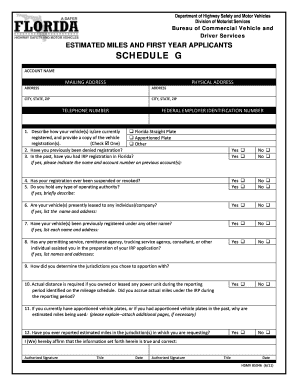

What is the Florida estimated applicants form?

The Florida estimated applicants form is a crucial document used for reporting estimated tax payments for individuals and businesses in the state. This form helps taxpayers calculate their estimated tax liabilities based on expected income, ensuring compliance with state tax regulations. By accurately completing this form, applicants can avoid underpayment penalties and manage their tax responsibilities effectively.

Key elements of the Florida estimated applicants form

Understanding the key elements of the Florida estimated applicants form is essential for accurate completion. The form typically includes sections for personal information, income estimates, deductions, and credits. Taxpayers must provide their Social Security number, filing status, and any relevant financial details to ensure the calculations reflect their tax situation. Additionally, the form may require information on previous year’s tax payments to assist in estimating current obligations.

Steps to complete the Florida estimated applicants form

Completing the Florida estimated applicants form involves several important steps:

- Gather necessary financial documents, including income statements and past tax returns.

- Determine your estimated income for the current year, factoring in any expected changes.

- Calculate allowable deductions and credits to arrive at your taxable income.

- Use the provided tax tables or guidelines to determine your estimated tax liability.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your form for accuracy before submission.

Filing deadlines for the Florida estimated applicants form

Staying aware of filing deadlines is crucial to avoid penalties. The Florida estimated applicants form typically has quarterly due dates, which are usually in April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions and maintain compliance with state tax laws.

Legal use of the Florida estimated applicants form

The Florida estimated applicants form is legally recognized as a valid document for tax reporting purposes. Properly completing and submitting this form ensures that taxpayers fulfill their obligations under state law. It is important to retain copies of submitted forms and any supporting documentation, as these may be required for future reference or in case of audits.

Required documents for the Florida estimated applicants form

To complete the Florida estimated applicants form, certain documents are necessary. Taxpayers should have:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any estimated tax payments made in previous quarters.

- Documentation for any deductions or credits claimed.

Who issues the Florida estimated applicants form?

The Florida estimated applicants form is issued by the Florida Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the department’s website or through authorized distribution channels.

Quick guide on how to complete commercial vehicles pinellas county tax

Effortlessly Prepare Commercial Vehicles Pinellas County Tax on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Commercial Vehicles Pinellas County Tax on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related operation today.

How to Edit and Electronically Sign Commercial Vehicles Pinellas County Tax with Ease

- Find Commercial Vehicles Pinellas County Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information carefully and click the Done button to save your changes.

- Select how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Commercial Vehicles Pinellas County Tax to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial vehicles pinellas county tax

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the pricing structure for airSlate SignNow for Florida estimated applicants?

airSlate SignNow offers a variety of pricing plans tailored to fit the needs of Florida estimated applicants. Each plan provides features such as unlimited document signing, templates, and integrations based on your business requirements. It's best to evaluate these options to find the most cost-effective solution for your specific needs.

-

What features does airSlate SignNow offer for Florida estimated applicants?

airSlate SignNow includes a comprehensive set of features ideal for Florida estimated applicants, such as document templates, eSignature capabilities, and automated workflows. These features enhance productivity and ensure that all users can operate efficiently while handling documents, thus catering to various business processes.

-

How does airSlate SignNow benefit Florida estimated applicants?

For Florida estimated applicants, airSlate SignNow provides a simple and efficient way to manage document signing and workflows. By streamlining the eSignature process, businesses can save time, reduce paperwork, and improve accuracy. This boosts overall productivity, making it easier for applicants to focus on their core business tasks.

-

Can airSlate SignNow integrate with other platforms for Florida estimated applicants?

Yes, airSlate SignNow seamlessly integrates with various platforms that Florida estimated applicants may already be using, such as CRM and project management tools. This connectivity enables businesses to streamline their workflows by allowing data to flow between applications. Choosing these integrations can help enhance efficiency and reduce manual data entry.

-

Is airSlate SignNow secure for Florida estimated applicants?

Absolutely, airSlate SignNow prioritizes security, making it a suitable choice for Florida estimated applicants handling sensitive documents. The platform complies with industry standards and employs encryption, secure storage, and compliance certifications to protect your data. Users can have confidence knowing their information is safeguarded at all times.

-

Can multiple users collaborate on documents within airSlate SignNow for Florida estimated applicants?

Yes, airSlate SignNow supports collaboration, allowing multiple users to work on documents together, which is beneficial for Florida estimated applicants. Teams can easily review, edit, and approve documents in real-time, streamlining the signing process. This collaborative feature enhances communication and speeds up the overall workflow.

-

What support options does airSlate SignNow offer for Florida estimated applicants?

airSlate SignNow provides various support options to assist Florida estimated applicants, including a comprehensive knowledge base, tutorials, and customer support via chat or email. This ensures that all users have access to the help they might need when navigating the platform. Prompt support enables applicants to address issues efficiently and maintain productivity.

Get more for Commercial Vehicles Pinellas County Tax

- Valic uf form

- What forms were sent out by nyc dept of housing preservation and development in march

- Sample job offer letter for any organization form

- Care advocates precertification form

- Structural permit application city of indianapolis indygov form

- Mount nittany medical center form

- Dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax form

- Dj agreement template form

Find out other Commercial Vehicles Pinellas County Tax

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure