Annuity Full Surrender Request 2016

What is the Annuity Full Surrender Request

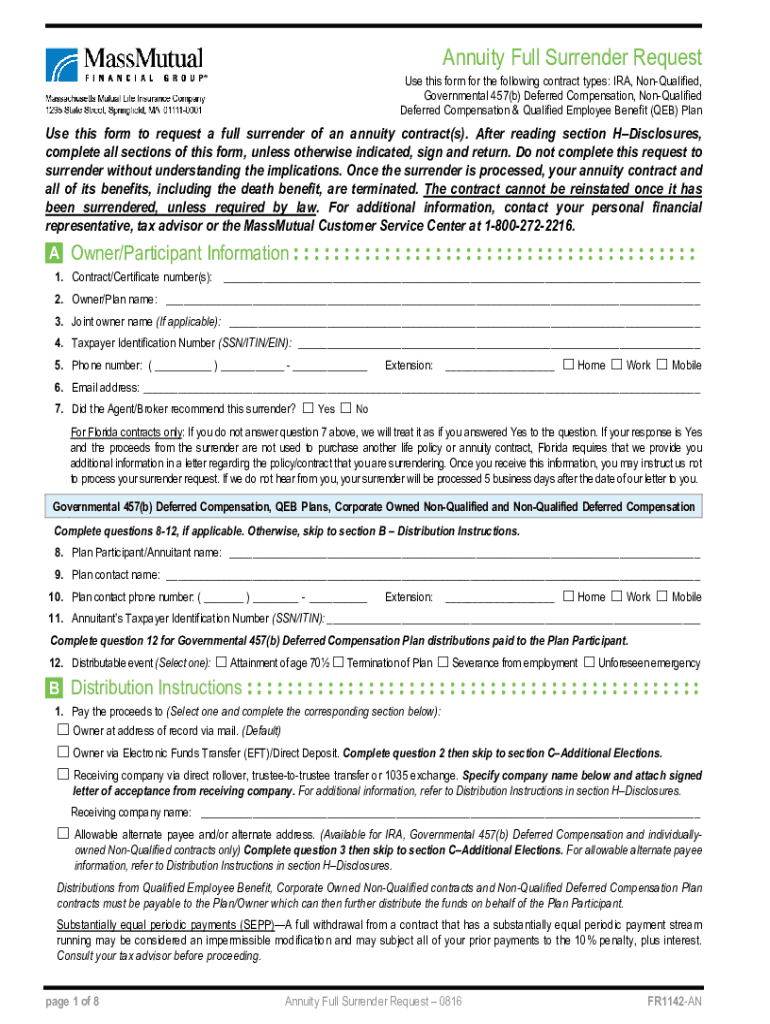

The Annuity Full Surrender Request is a formal document used by policyholders to request the complete withdrawal of funds from their annuity contract. By submitting this request, individuals can access the total value of their annuity, terminating the contract and relinquishing any future benefits associated with it. This process is often considered when policyholders need immediate access to their funds or wish to invest their money elsewhere. Understanding the implications of a full surrender is crucial, as it may affect tax liabilities and future financial planning.

Steps to complete the Annuity Full Surrender Request

Completing the Annuity Full Surrender Request involves several key steps to ensure accuracy and compliance. First, gather your annuity contract details, including the policy number and the issuing company’s information. Next, fill out the request form with your personal information, including your name, address, and Social Security number. It is important to specify the reason for the surrender and any instructions regarding the distribution of funds. After completing the form, review it carefully for any errors before signing and dating it. Finally, submit the request to your annuity provider through the specified method, whether online, by mail, or in person.

Legal use of the Annuity Full Surrender Request

The legal use of the Annuity Full Surrender Request is governed by specific regulations that ensure the process is valid and enforceable. To be legally binding, the request must include the policyholder's signature and adhere to the terms outlined in the annuity contract. Additionally, compliance with federal and state laws regarding annuities is essential. This includes understanding the tax implications that may arise from a full surrender, such as potential penalties for early withdrawal. Utilizing a reliable electronic signature platform can further enhance the legal standing of the document by providing authentication and compliance with eSignature laws.

Key elements of the Annuity Full Surrender Request

Several key elements must be included in the Annuity Full Surrender Request to ensure it is complete and valid. These elements typically include:

- Policyholder Information: Full name, address, and contact details.

- Policy Number: The unique identifier for the annuity contract.

- Reason for Surrender: A brief explanation of why the policyholder is requesting the full surrender.

- Distribution Instructions: Details on how the funds should be disbursed, including bank account information if applicable.

- Signature and Date: The policyholder’s signature and the date of signing to validate the request.

Form Submission Methods

The Annuity Full Surrender Request can typically be submitted through various methods, depending on the policies of the issuing company. Common submission methods include:

- Online Submission: Many providers offer a secure portal for electronic submission of the request.

- Mail: The completed form can be sent to the annuity provider’s designated address.

- In-Person: Some policyholders may choose to deliver the request directly to a local office of the issuing company.

Required Documents

When submitting the Annuity Full Surrender Request, certain documents may be required to verify the identity of the policyholder and the legitimacy of the request. These documents can include:

- Copy of the Annuity Contract: To confirm the details of the policy.

- Identification: A government-issued ID, such as a driver’s license or passport.

- Proof of Address: Recent utility bills or bank statements may be requested to verify the current address.

Quick guide on how to complete annuity full surrender request

Easily Prepare Annuity Full Surrender Request on Any Device

Managing documents online has gained popularity among both companies and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the right format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and without interruptions. Handle Annuity Full Surrender Request on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Most Efficient Way to Edit and Electronically Sign Annuity Full Surrender Request with Ease

- Find Annuity Full Surrender Request and click on Get Form to get going.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or cover confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just moments and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of sharing the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Annuity Full Surrender Request to ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annuity full surrender request

Create this form in 5 minutes!

How to create an eSignature for the annuity full surrender request

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is an Annuity Full Surrender Request?

An Annuity Full Surrender Request is a formal process where an annuity holder asks their insurance company to liquidate their entire annuity contract. This request typically results in the withdrawal of all cash value and can have tax implications. Understanding this request is crucial for anyone considering the full surrender of their annuity.

-

What are the benefits of submitting an Annuity Full Surrender Request?

Submitting an Annuity Full Surrender Request allows you to access the full cash value of your annuity immediately. This can be beneficial for funding other investments or covering urgent expenses. However, potential tax consequences and surrender charges should be considered before proceeding.

-

Are there any fees associated with an Annuity Full Surrender Request?

Yes, there can be fees associated with an Annuity Full Surrender Request, such as surrender charges that may apply during the early years of the contract. These fees vary by contract, so it's essential to review your annuity terms carefully. Contact your insurance provider for detailed information regarding potential fees.

-

How do I submit an Annuity Full Surrender Request?

To submit an Annuity Full Surrender Request, you will need to fill out a surrender request form provided by your insurance company. This may often be done electronically using platforms like airSlate SignNow for a convenient and efficient process. Follow the specific guidelines provided by your insurer to ensure all requirements are met.

-

What information is needed for an Annuity Full Surrender Request?

An Annuity Full Surrender Request typically requires your policy number, personal identification, and the reason for the surrender request. Additionally, you may need to provide any relevant documentation that supports your decision. Make sure to have all necessary information ready to expedite the process.

-

How long does it take to process an Annuity Full Surrender Request?

The processing time for an Annuity Full Surrender Request can vary but usually takes anywhere from 2 to 4 weeks after submission. Factors influencing this timeframe include the policies of your insurer and the completeness of your request details. Keeping accurate records and thoroughly completing the surrender request can help streamline the process.

-

Can I track the status of my Annuity Full Surrender Request?

Most insurance companies provide a way to track the status of your Annuity Full Surrender Request online or through customer service. It's important to ask your insurer about this feature when submitting your request. Staying informed about your request will help you plan your finances more effectively.

Get more for Annuity Full Surrender Request

- Tc96 184 form

- Da form 5893

- Ds 9 10 international cost trends data sheet fm global form

- Cms fire door inspection checklist form

- Maui jim repair form pdf

- Junior basketball a guide for coaches and parents heathmont form

- Referral commission agreement template form

- Recruitment service level agreement template form

Find out other Annuity Full Surrender Request

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement