P60 Single Sheet to P60 Single Sheet to 2020

What is the P60 Single Sheet To P60 Single Sheet To

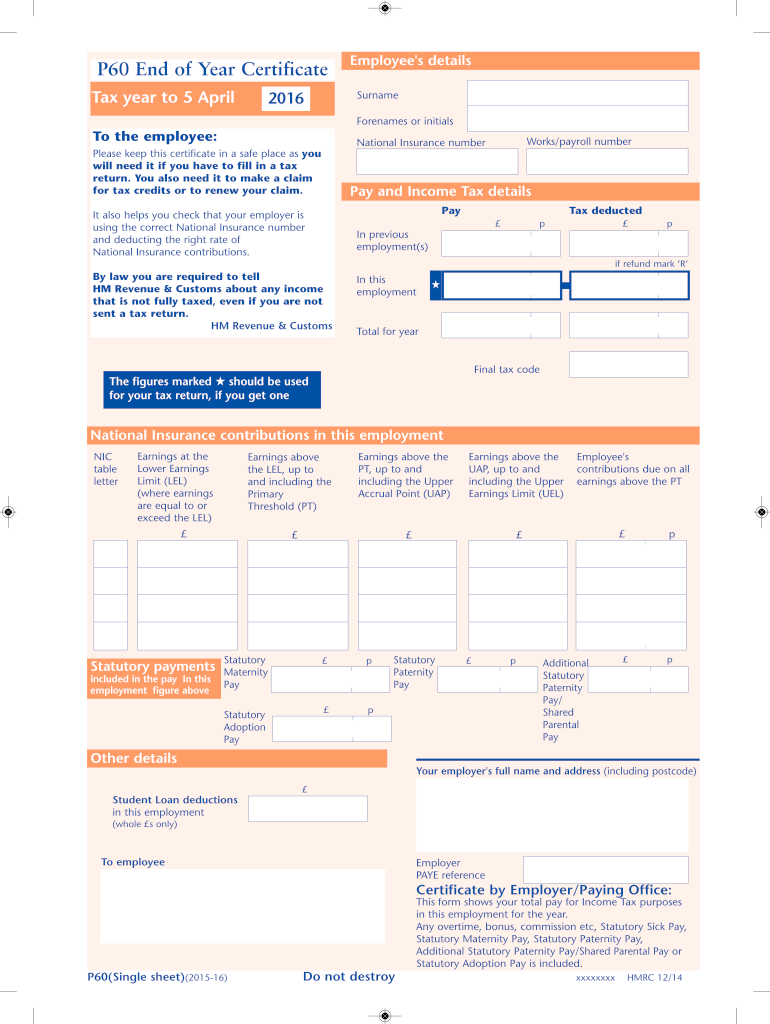

The P60 Single Sheet To P60 Single Sheet To is a crucial document used primarily in the United States for tax purposes. It serves as a summary of an employee's annual earnings and the taxes withheld by their employer. This form is essential for both employees and employers, as it provides a clear record of income and tax contributions for the year. The P60 is typically issued at the end of the tax year and is used to assist individuals in filing their tax returns accurately.

How to use the P60 Single Sheet To P60 Single Sheet To

Using the P60 Single Sheet To P60 Single Sheet To involves several straightforward steps. First, ensure you receive the form from your employer at the end of the tax year. Once you have the document, review it for accuracy, checking that your personal information, earnings, and tax withholdings are correct. This form is then utilized when completing your tax return, as it provides the necessary details for reporting income and calculating tax obligations. It is advisable to keep a copy for your records after filing.

Steps to complete the P60 Single Sheet To P60 Single Sheet To

Completing the P60 Single Sheet To P60 Single Sheet To requires careful attention to detail. Follow these steps:

- Receive the P60 from your employer at the end of the tax year.

- Check that all personal information is accurate, including your name and Social Security number.

- Verify the reported earnings and tax withholdings against your pay stubs.

- Use the information provided on the P60 to fill out your tax return.

- Keep a copy of the completed form for your records.

Legal use of the P60 Single Sheet To P60 Single Sheet To

The P60 Single Sheet To P60 Single Sheet To has legal significance as it is recognized by the IRS and other tax authorities. It serves as official documentation of your earnings and tax contributions, which can be crucial in the event of an audit or when applying for loans or financial assistance. Ensuring the accuracy of this form is essential, as discrepancies can lead to penalties or issues with tax compliance.

Who Issues the Form

The P60 Single Sheet To P60 Single Sheet To is typically issued by employers to their employees. It is important for employers to provide this form to all eligible employees at the end of the tax year, as it ensures that employees have the necessary documentation to fulfill their tax obligations. Employers must also maintain accurate records to facilitate the correct issuance of the P60.

Filing Deadlines / Important Dates

Filing deadlines for the P60 Single Sheet To P60 Single Sheet To are crucial to adhere to. Generally, employers must issue the P60 by January 31 of the following tax year. Employees should use the information on the P60 to file their tax returns by the April 15 deadline. Being aware of these dates helps ensure compliance and avoids potential penalties for late filing.

Quick guide on how to complete p60 single sheet 2015 to 2016 p60 single sheet 2015 to 2016

Complete P60 Single Sheet To P60 Single Sheet To effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly without delays. Handle P60 Single Sheet To P60 Single Sheet To on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign P60 Single Sheet To P60 Single Sheet To with ease

- Locate P60 Single Sheet To P60 Single Sheet To and click Get Form to initiate.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign P60 Single Sheet To P60 Single Sheet To and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p60 single sheet 2015 to 2016 p60 single sheet 2015 to 2016

Create this form in 5 minutes!

How to create an eSignature for the p60 single sheet 2015 to 2016 p60 single sheet 2015 to 2016

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the P60 Single Sheet To P60 Single Sheet To solution?

The P60 Single Sheet To P60 Single Sheet To solution from airSlate SignNow allows businesses to efficiently manage and e-sign their P60 documents. This solution simplifies the process of sending and receiving crucial tax forms, making it easy for businesses and individuals alike to handle their P60 paperwork swiftly and securely.

-

How much does the P60 Single Sheet To P60 Single Sheet To service cost?

airSlate SignNow offers flexible pricing options for the P60 Single Sheet To P60 Single Sheet To service, catering to various business needs. Costs typically depend on the volume of documents processed and the features required, ensuring you get the best value for your investment.

-

What features are included in the P60 Single Sheet To P60 Single Sheet To package?

The P60 Single Sheet To P60 Single Sheet To package includes features such as customizable templates, audit trails, and the ability to automate document workflows. This ensures that your P60 documents are handled efficiently, with clear visibility throughout the signing process.

-

How can the P60 Single Sheet To P60 Single Sheet To benefit my business?

By adopting the P60 Single Sheet To P60 Single Sheet To solution, your business can signNowly reduce paperwork processing time and improve accuracy. This not only enhances operational efficiency but also ensures compliance with tax regulations, providing peace of mind for your financial operations.

-

Is the P60 Single Sheet To P60 Single Sheet To fully compliant with legal requirements?

Yes, the P60 Single Sheet To P60 Single Sheet To solution is designed to meet all legal compliance standards for electronic signatures and document management. airSlate SignNow prioritizes security and compliance, ensuring that your P60 documents are managed according to industry regulations.

-

Can I integrate the P60 Single Sheet To P60 Single Sheet To with other tools?

Absolutely! The P60 Single Sheet To P60 Single Sheet To solution integrates seamlessly with various business tools and software, including CRM systems and accounting platforms. This capability streamlines your workflow, making it easier to manage P60 documents alongside other business operations.

-

What support is available for users of the P60 Single Sheet To P60 Single Sheet To?

airSlate SignNow provides comprehensive support for users of the P60 Single Sheet To P60 Single Sheet To solution. Our support team is available to assist with any questions or issues you may encounter, ensuring a smooth and efficient document management experience.

Get more for P60 Single Sheet To P60 Single Sheet To

- Td ameritrade trust account form

- Online visa fillable application for india from pakistan form

- Ldss 5023 50096019 form

- Scissor lift daily inspection checklist form

- Moving services contract form

- Aero nz auckland goods return form docx

- Restaurant agreement template form

- Restaurant investment agreement template form

Find out other P60 Single Sheet To P60 Single Sheet To

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation