Fillable Online ASR License No Fax Email Print pdfFiller 2020-2026

What is the HMRC P60 Form?

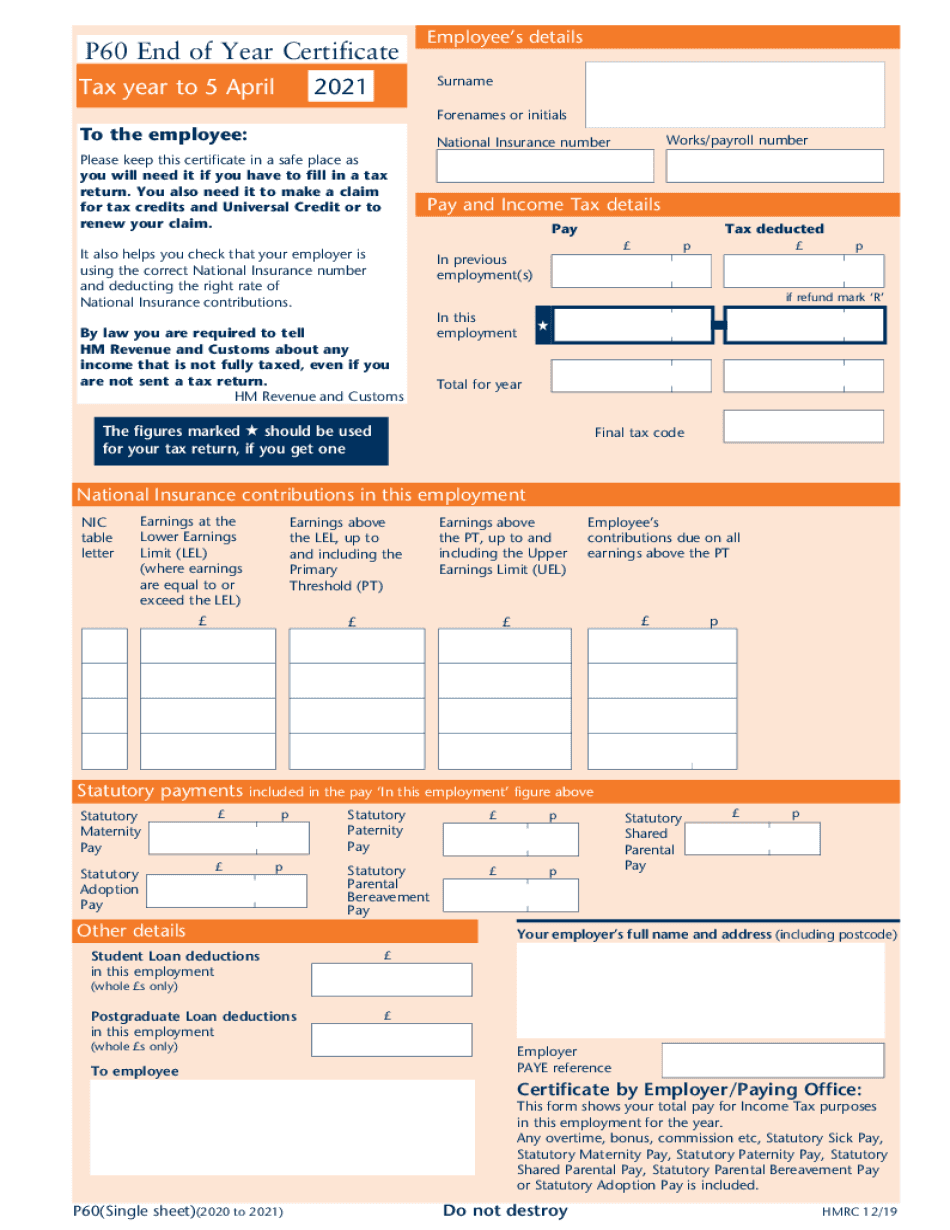

The HMRC P60 form is an important document issued by employers in the UK, summarizing an employee's total pay and the taxes deducted during a tax year. It serves as an official record of earnings and tax contributions, providing essential information for tax returns and personal financial records. The P60 form is typically issued annually, reflecting the earnings from the previous tax year, which runs from April sixth to April fifth of the following year. This form is crucial for employees to verify their income and ensure that they have paid the correct amount of tax.

How to Obtain the HMRC P60 Form

Employees can obtain their HMRC P60 form directly from their employer. Employers are required to provide this document to their employees by May thirty-first following the end of the tax year. If an employee has not received their P60, they should first check with their payroll department or human resources. In some cases, employees may also access their P60 online through their employer's payroll system if available. It is important to keep this document safe, as it may be required for tax purposes or when applying for loans and mortgages.

Steps to Complete the HMRC P60 Form

Completing the HMRC P60 form involves several key steps:

- Gather Information: Collect all relevant information such as your total earnings, tax code, and National Insurance contributions for the tax year.

- Fill in Personal Details: Enter your name, address, and National Insurance number accurately to ensure the form is correctly associated with your tax records.

- Input Earnings and Deductions: Record your total earnings and the amounts deducted for income tax and National Insurance contributions.

- Review for Accuracy: Double-check all entries to ensure that they are correct and match your pay stubs or online payroll records.

- Submit the Form: If you are required to submit the P60 for tax purposes, ensure that it is sent to the appropriate tax authority or retained for your records.

Legal Use of the HMRC P60 Form

The HMRC P60 form is legally recognized as a formal document that provides proof of income and tax paid. It is essential for fulfilling tax obligations and can be used to claim tax refunds or adjustments. Employers must ensure that the information on the P60 is accurate and complies with HMRC regulations. Employees should retain their P60 forms for at least five years, as they may be required for future tax assessments or audits.

Filing Deadlines and Important Dates

For employees, the P60 form must be received by May thirty-first following the end of the tax year. Employers are responsible for issuing P60s to their employees by this deadline. Additionally, employees should be aware of the tax return deadlines, which typically fall on January thirty-first of the following year for online submissions. Keeping track of these dates is crucial for ensuring compliance with tax regulations and avoiding penalties.

Penalties for Non-Compliance

Failure to provide or accurately complete the HMRC P60 form can result in penalties for both employers and employees. Employers may face fines from HMRC for not issuing P60s on time or for providing incorrect information. Employees may also encounter issues with their tax returns, which could lead to underpayment penalties or complications with tax credits. It is essential to ensure that all information is accurate and submitted within the required timeframes to avoid these penalties.

Quick guide on how to complete fillable online asr license no fax email print pdffiller

Complete Fillable Online ASR License No Fax Email Print PDFfiller effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fillable Online ASR License No Fax Email Print PDFfiller on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Fillable Online ASR License No Fax Email Print PDFfiller with ease

- Find Fillable Online ASR License No Fax Email Print PDFfiller and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all details and click the Done button to save your adjustments.

- Select your preferred method of delivering your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Edit and eSign Fillable Online ASR License No Fax Email Print PDFfiller while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online asr license no fax email print pdffiller

Create this form in 5 minutes!

How to create an eSignature for the fillable online asr license no fax email print pdffiller

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the HMRC P60 form and why is it important?

The HMRC P60 form is a crucial document that summarizes an employee's total pay and tax deductions for the tax year. It's important because it provides employees with vital information needed for tax returns and ensures compliance with HMRC regulations. Understanding its significance can help you manage your financial responsibilities.

-

How can airSlate SignNow help with the HMRC P60 form process?

airSlate SignNow streamlines the process of creating, signing, and managing the HMRC P60 form with ease. Our platform allows businesses to send the form securely and electronically, reducing the delays associated with paper forms. This ensures that your tax documentation is processed efficiently and accurately.

-

Is it easy to integrate airSlate SignNow for managing the HMRC P60 form?

Yes, integrating airSlate SignNow for managing the HMRC P60 form is straightforward. Our platform offers seamless integration with various accounting and payroll systems, making it easy for businesses to automate their documentation processes. This means you can handle your HMRC P60 forms effortlessly alongside your existing workflows.

-

What are the pricing options for using airSlate SignNow for HMRC P60 forms?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Whether you're a small business or a larger enterprise, we provide a cost-effective solution for managing your HMRC P60 forms. You can choose from multiple subscription plans that deliver value without compromising on features.

-

Can I track changes made to the HMRC P60 form using airSlate SignNow?

Absolutely! airSlate SignNow includes robust tracking features that allow you to monitor any changes made to the HMRC P60 form in real time. This ensures that all stakeholders are aware of updates, enhancing transparency and accountability in your document management process.

-

What features does airSlate SignNow offer for the HMRC P60 form?

airSlate SignNow provides a variety of features tailored for managing the HMRC P60 form efficiently. These include templates for easy creation, electronic signatures for swift approvals, and secure storage for compliance. Our user-friendly interface makes it simple to navigate through the entire process.

-

How secure is the airSlate SignNow platform for handling HMRC P60 forms?

The security of your data is our top priority at airSlate SignNow. Our platform employs advanced encryption and secure cloud storage to ensure that your HMRC P60 forms are protected against unauthorized access. You can confidently manage sensitive tax documents knowing they are secure with us.

Get more for Fillable Online ASR License No Fax Email Print PDFfiller

- Florida dept of revenue discretionary sales surtaxdiscretionary sales surtax rate tablediscretionary sales surtax information

- Florida secondhand dealer license form

- Instructions residential petition for review of valuation fill form

- Arizona department of revenue gaostateazus form

- Arizona withholding tax arizona department of revenue azdor form

- Azdorgovformsindividualresident personal income tax form non fillable form azdor

- Az form 140 2020 2022 fill out tax template online us legal forms

- Azdorgovformsindividualform 140 resident personal income tax form non fillable

Find out other Fillable Online ASR License No Fax Email Print PDFfiller

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF