Colorado Objection Form

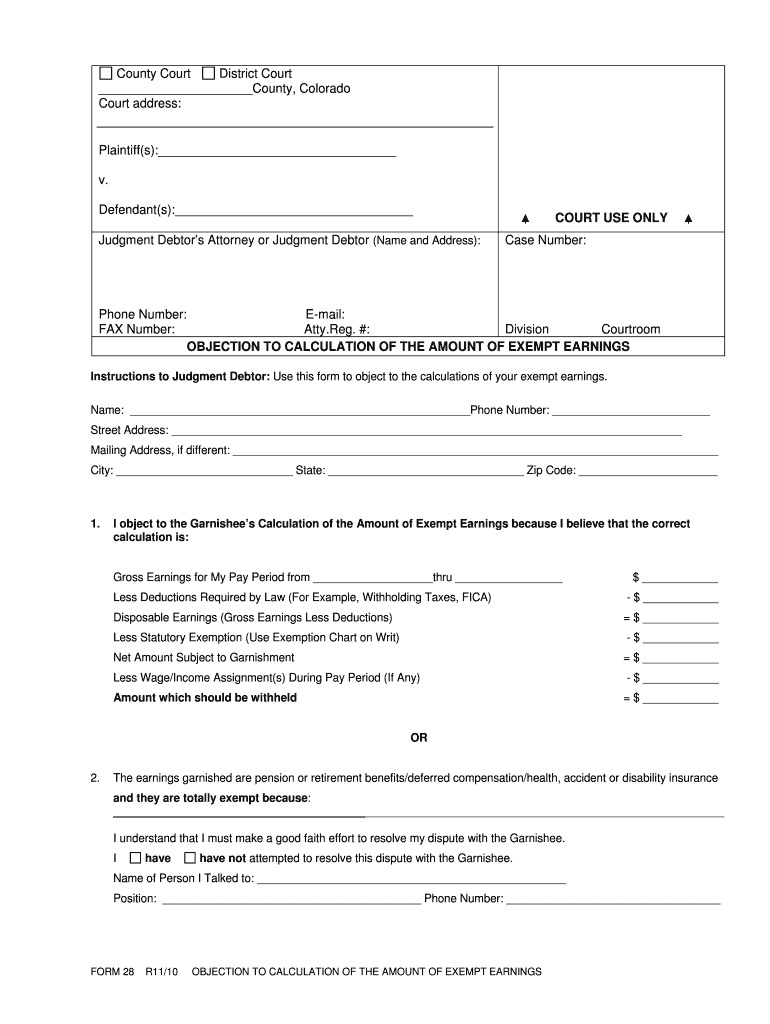

What is the Colorado Objection Form

The Colorado Objection Form is a legal document used by taxpayers to formally contest specific assessments or determinations made by tax authorities. This form allows individuals to express their disagreement with the amount of tax owed or the classification of their income. It is essential for ensuring that taxpayers have a voice in the assessment process and can seek a fair resolution regarding their tax obligations.

How to use the Colorado Objection Form

To effectively use the Colorado Objection Form, individuals must complete it with accurate information regarding their tax situation. This includes detailing the specific reasons for the objection and providing any supporting documentation. Once completed, the form should be submitted to the appropriate tax authority, either electronically or by mail, depending on the guidelines provided by the state.

Steps to complete the Colorado Objection Form

Completing the Colorado Objection Form involves several key steps:

- Gather relevant documents, including tax returns and any notices received from the tax authority.

- Fill out the form with accurate personal and tax information, ensuring all fields are completed.

- Clearly state the reasons for your objection, supported by facts and evidence.

- Review the form for accuracy before submission.

- Submit the form to the designated tax authority by the specified deadline.

Legal use of the Colorado Objection Form

The legal use of the Colorado Objection Form is grounded in state tax laws, which allow taxpayers to contest assessments. When filed correctly, the form serves as a formal request for reconsideration. It is crucial that the form is submitted within the stipulated time frame to ensure compliance with legal requirements.

Key elements of the Colorado Objection Form

Key elements of the Colorado Objection Form include:

- Taxpayer identification information, such as name, address, and Social Security number.

- Details of the tax assessment being contested.

- Specific reasons for the objection, including any relevant laws or regulations.

- Supporting documentation that substantiates the taxpayer's claims.

Form Submission Methods (Online / Mail / In-Person)

The Colorado Objection Form can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines set by the state. Options include:

- Online submission through the state tax authority's website, if available.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, where applicable.

Quick guide on how to complete colorado objection form

Effortlessly Prepare Colorado Objection Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the needed form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Colorado Objection Form on any platform with the airSlate SignNow applications for Android or iOS and simplify your document-centered tasks today.

How to Edit and Electronically Sign Colorado Objection Form with Ease

- Locate Colorado Objection Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the specialized tools available from airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a standard handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method for submitting your form: via email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, exhausting form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Colorado Objection Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado objection form

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Colorado amount exempt form used for?

The Colorado amount exempt form is used to declare specific income and expenses that are exempt from taxation in Colorado. This form helps businesses accurately report their exempt amounts, ensuring compliance with state tax regulations. Understanding how to utilize the Colorado amount exempt form is essential for accurate financial reporting.

-

How can airSlate SignNow help with the Colorado amount exempt form?

airSlate SignNow provides a seamless platform to create, sign, and send the Colorado amount exempt form electronically. Our solution simplifies the eSigning process, allowing you to fill out and send your forms securely from anywhere. Additionally, you can track the status of your form in real-time to ensure timely submission.

-

Is there a cost associated with using airSlate SignNow for the Colorado amount exempt form?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is designed to be cost-effective for businesses of all sizes. We offer various subscription plans that cater to different needs, ensuring you can efficiently manage your Colorado amount exempt form and other documents without breaking the bank. Check our pricing page for detailed information.

-

Can I edit the Colorado amount exempt form after it's been signed?

Once the Colorado amount exempt form has been signed, it generally cannot be edited to maintain the integrity of the document. However, you can send a new version of the form for signing if any changes are necessary. AirSlate SignNow allows easy management of your documents to ensure compliance and accuracy.

-

What features does airSlate SignNow offer for managing the Colorado amount exempt form?

airSlate SignNow offers several features such as template creation, secure cloud storage, and automated workflows specifically for the Colorado amount exempt form. These tools streamline the process of creating, sharing, and signing forms. Additionally, you can benefit from powerful integrations with other software to enhance your productivity.

-

How do I ensure that my Colorado amount exempt form is securely stored?

AirSlate SignNow prioritizes your data security by using advanced encryption and secure cloud storage for all documents, including the Colorado amount exempt form. Your information remains safe throughout the entire signing process. Regular audits and compliance with industry standards further empower you to trust the security of your documents.

-

What integrations are available with airSlate SignNow for handling the Colorado amount exempt form?

AirSlate SignNow integrates with various popular applications such as Google Drive, Dropbox, and CRM systems to facilitate seamless document management, including the Colorado amount exempt form. These integrations enhance efficiency by allowing you to access and manage your forms from your everyday tools effortlessly. Explore our integrations to find the best fit for your workflow.

Get more for Colorado Objection Form

- Liberty mutual bid bond form

- Godparent certificate of eligibility 327751119 form

- Form first b notice

- Customer debit mandate form rbl bank

- Certificate of dissolution of marriage illinois form

- Antrag auf erstattung der fahrtkosten bei benutzung form

- Tel 020 2603334 mobile 0722992469 p o box 91006 form

- Loan form pdf 658890696

Find out other Colorado Objection Form

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document