Creditors Claim Form

What is the creditors claim form?

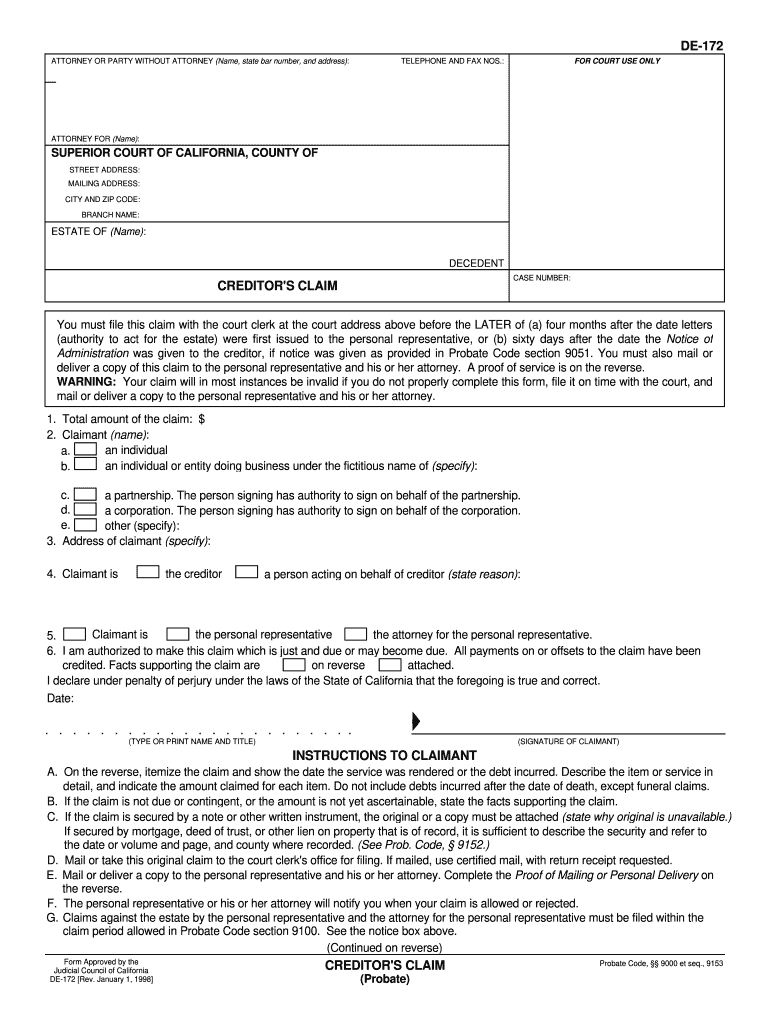

The creditors claim form, specifically the de 172 form, is a legal document used in probate proceedings. It allows creditors to formally assert their claims against a deceased person's estate. This form is essential for ensuring that creditors have the opportunity to recover debts owed to them from the estate before it is distributed to heirs. The de 172 form is typically filed in probate court and must adhere to specific legal requirements to be considered valid.

Steps to complete the creditors claim form

Completing the de 172 form involves several important steps to ensure accuracy and compliance with legal standards. First, gather all necessary information, including the deceased's details and the amount owed. Next, accurately fill out the form, ensuring that all sections are completed, including your information as the creditor. Be sure to provide a clear description of the debt and any supporting documentation. After completing the form, sign it and date it before submitting it to the appropriate probate court.

Legal use of the creditors claim form

The legal use of the de 172 form is critical in the probate process. It serves as an official notice to the estate's executor and the probate court of the creditor's claim. To be legally binding, the form must be submitted within the timeframe established by state law, typically within four months of the creditor's notice of the probate proceedings. Failure to file the form within this period may result in the loss of the right to collect the debt from the estate.

Key elements of the creditors claim form

Understanding the key elements of the de 172 form is essential for successful completion. The form typically includes sections for the creditor's name and contact information, details about the deceased, a description of the claim, and the amount owed. Additionally, it may require the creditor to provide supporting documents, such as invoices or contracts, to substantiate the claim. Accurate and complete information is vital to avoid delays or rejections.

Filing deadlines / important dates

Filing deadlines for the de 172 form are crucial for creditors seeking to recover debts from an estate. Generally, creditors must file their claims within four months from the date they receive notice of the probate proceedings. It is important to check state-specific laws, as deadlines may vary. Missing the deadline can result in the inability to collect the debt, making timely submission essential for creditors.

Form submission methods

The de 172 form can be submitted through various methods, depending on the probate court's requirements. Common submission methods include filing the form in person at the probate court, mailing it to the court, or, in some jurisdictions, submitting it electronically. It is important to confirm the accepted methods with the specific probate court to ensure compliance and proper processing of the claim.

Who issues the form?

The de 172 form is typically issued by the probate court in the jurisdiction where the deceased person resided at the time of death. Each state may have its own version of the form, so it is important for creditors to obtain the correct version from the appropriate court. This ensures that the form meets local legal requirements and is processed correctly during the probate proceedings.

Quick guide on how to complete creditors claim form

Effortlessly Prepare Creditors Claim Form on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Creditors Claim Form on any device using the airSlate SignNow applications available for Android and iOS, and simplify any document-related process today.

The simplest way to modify and eSign Creditors Claim Form without any hassle

- Obtain Creditors Claim Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Alter and eSign Creditors Claim Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the creditors claim form

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the DE 172 form?

The DE 172 form is a crucial document for businesses in California that need to report certain tax deductions and credits. Understanding how to fill out and submit the DE 172 form correctly is essential for compliance and maximizing benefits. With airSlate SignNow, you can easily manage and eSign the DE 172 form to ensure timely submissions.

-

How can airSlate SignNow help with the DE 172 form?

airSlate SignNow offers a seamless platform for businesses to create, send, and eSign the DE 172 form efficiently. The software eliminates paperwork and enhances document tracking, which helps maintain compliance and reduces errors. Plus, its user-friendly interface makes it easy for anyone to manage the DE 172 form.

-

Is there a cost associated with using airSlate SignNow for the DE 172 form?

Yes, there is a competitive pricing structure for using airSlate SignNow, which varies based on the plan you choose. Our pricing is designed to offer a cost-effective solution for businesses, allowing you to create and manage the DE 172 form without breaking the bank. You'll find that the investment pays off in time savings and increased efficiency.

-

What features does airSlate SignNow provide for managing the DE 172 form?

airSlate SignNow includes features like customizable templates, document routing, and electronic signatures, all specifically useful for handling the DE 172 form. These features streamline the process of collecting signatures and ensure that all parties involved can access the document anytime. This enhances productivity and simplifies compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for managing the DE 172 form?

Absolutely! airSlate SignNow offers integrations with various CRM and document management systems, making it easy to manage the DE 172 form within your existing workflows. This capability allows you to streamline processes further and keep all your relevant documents and data organized in one place.

-

How does eSigning the DE 172 form work with airSlate SignNow?

eSigning the DE 172 form using airSlate SignNow is straightforward. Once you've completed the form, you can send it to relevant parties for signatures electronically. The process is fast, secure, and allows tracking of who has signed and when, ensuring timely compliance with submission deadlines.

-

What benefits can I expect when using airSlate SignNow for the DE 172 form?

Using airSlate SignNow for the DE 172 form provides numerous benefits, including faster processing times and reduced paperwork. The solution enhances collaboration among team members and external partners while minimizing the risk of errors. This efficiency can ultimately lead to higher productivity and better compliance with tax obligations.

Get more for Creditors Claim Form

- Ccnc ca enrollment form

- Torontomls net form

- Compliance declaration form 41377373

- Vereinfachte einnahmen ausgaben rechnung vereine form

- Jameskuttyinfo form

- Repossessed motor vehicle affidavit form

- Release and hold harmless agreement pony tail ranch form

- Apa format outline template apa format outline template

Find out other Creditors Claim Form

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile