Texas Form Inheritance 2018-2026

What is the Texas Form Inheritance

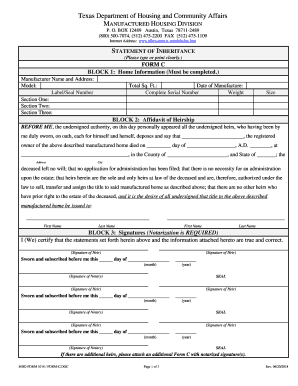

The Texas Form Inheritance is a legal document used to declare and formalize the distribution of an individual's estate after their passing. This form is essential for outlining how assets, including property and financial holdings, will be divided among heirs. The Texas statement of inheritance serves as a crucial tool in ensuring that the deceased's wishes are honored and legally recognized. It is particularly important in Texas, where specific laws govern the distribution of assets, making the accurate completion of this form vital for all parties involved.

How to use the Texas Form Inheritance

Using the Texas Form Inheritance involves several steps to ensure that it is completed accurately and in compliance with state laws. First, gather all necessary information regarding the deceased's assets, liabilities, and the intended beneficiaries. Next, fill out the form with precise details, including the names and contact information of heirs, as well as a clear description of the assets being inherited. Once completed, the form must be signed by all relevant parties, ensuring that it reflects the agreement among heirs. It is advisable to consult with a legal professional to confirm that the form meets all legal requirements.

Steps to complete the Texas Form Inheritance

Completing the Texas Form Inheritance involves a series of organized steps:

- Gather necessary documents, including the deceased's will, asset lists, and beneficiary information.

- Fill out the form accurately, ensuring all information is correct and complete.

- Have all beneficiaries review the form to confirm their agreement with the distribution outlined.

- Sign the form in the presence of a notary public to ensure its legal validity.

- Submit the completed form to the appropriate court or agency as required by Texas law.

Key elements of the Texas Form Inheritance

The Texas Form Inheritance includes several key elements that are essential for its validity. These elements typically consist of:

- The full name and contact information of the deceased.

- A detailed list of the deceased's assets and liabilities.

- The names and relationships of all beneficiaries.

- A clear statement of how the assets are to be distributed.

- Signatures of all beneficiaries, confirming their agreement with the distribution.

Required Documents

To successfully complete the Texas Form Inheritance, several documents are required. These typically include:

- The deceased's will, if available.

- A list of all assets and liabilities belonging to the deceased.

- Identification documents for all beneficiaries.

- Any previous inheritance documents that may be relevant.

Legal use of the Texas Form Inheritance

The legal use of the Texas Form Inheritance is crucial for ensuring that the distribution of assets is recognized by the state. This form must comply with Texas laws regarding inheritance and estate distribution. Properly executed, it serves as a binding agreement among heirs and can be used in legal proceedings to validate the distribution of assets. Failure to use the form correctly may result in disputes among beneficiaries or complications in the probate process.

Quick guide on how to complete texas form inheritance

Effortlessly prepare Texas Form Inheritance on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without complications. Handle Texas Form Inheritance on any system with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Texas Form Inheritance with ease

- Obtain Texas Form Inheritance and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Texas Form Inheritance and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas form inheritance

Create this form in 5 minutes!

How to create an eSignature for the texas form inheritance

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Texas form inheritance?

Texas form inheritance refers to the legal process of distributing a deceased person's assets in accordance with Texas state laws. It involves filling out specific forms and following the proper procedures to ensure that all assets are transferred appropriately. Understanding Texas form inheritance is crucial for anyone managing an estate or will in Texas.

-

How can airSlate SignNow help with Texas form inheritance?

AirSlate SignNow streamlines the process of handling Texas form inheritance by allowing users to easily create, send, and eSign necessary documents. With its user-friendly interface, you can quickly prepare Texas form inheritance paperwork and manage the electronic signatures required, making the process more efficient and less time-consuming.

-

Are there any costs associated with using airSlate SignNow for Texas form inheritance?

AirSlate SignNow offers various pricing plans to suit different needs, including options for individuals handling Texas form inheritance. The cost is competitive compared to traditional methods and includes features that simplify the eSignature process. You can find a plan that best fits your budget while ensuring compliance with Texas form inheritance requirements.

-

What features does airSlate SignNow provide for Texas form inheritance?

AirSlate SignNow provides a range of features beneficial for Texas form inheritance, including document templates, secure electronic signatures, and real-time tracking. These tools help ensure that all forms are filled out correctly and completed on time, reducing the risks of errors during the inheritance process.

-

Can I integrate airSlate SignNow with other software for Texas form inheritance?

Yes, airSlate SignNow offers integrations with various software applications that are commonly used in estate planning and management. This allows you to streamline your workflow for Texas form inheritance, making it easier to access and share documents across different platforms while maintaining a seamless experience.

-

Is airSlate SignNow secure for handling Texas form inheritance documents?

Absolutely! AirSlate SignNow employs industry-leading encryption and security measures to protect your documents and personal information during the Texas form inheritance process. You can confidently store, send, and receive sensitive information while meeting all necessary legal requirements.

-

How does airSlate SignNow improve the efficiency of Texas form inheritance?

AirSlate SignNow improves the efficiency of Texas form inheritance by allowing users to manage all documentation online. You can draft, edit, send for signature, and store all necessary forms in one place, signNowly reducing paper usage and speeding up the overall process, which is crucial during sensitive times.

Get more for Texas Form Inheritance

- Download form gas 1276 formupack

- Application form for a teaching post challney high school for girls tes co

- The helmsman uscg u s coast guard uscg form

- Health information departments h

- Registration form for college credit bethel college bethelcollege

- Spousal impoverishment income allocation worksheet form

- 80115248 form

- Instructions for permit application to import restricted form

Find out other Texas Form Inheritance

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement