De 3hw Form

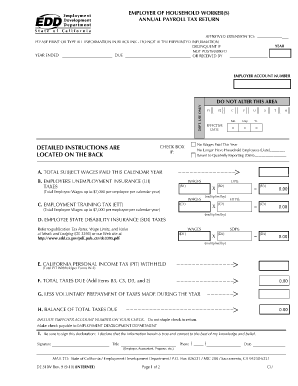

What is the DE 3HW?

The DE 3HW form is a critical document used in California for reporting employee wages and withholding exemptions. This form is particularly relevant for employers who need to document the exemptions allowances claimed by their employees. By accurately completing the DE 3HW, businesses ensure compliance with state regulations regarding payroll and taxation. The form captures essential details such as the employee's gross income, exemption claims, and other pertinent information necessary for accurate payroll processing.

Steps to Complete the DE 3HW

Completing the DE 3HW involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the employee, including their full name, Social Security number, and gross income details. Next, review the exemption criteria to determine which allowances the employee qualifies for. Fill out the form by entering the required data in the appropriate sections, ensuring that all figures are accurate. Finally, review the completed form for any errors before submission to avoid potential penalties.

Legal Use of the DE 3HW

The DE 3HW form serves a legal purpose in the context of California's employment and tax laws. It is essential for employers to understand the legal implications of the exemptions claimed by their employees. The form must be filled out in accordance with state regulations to ensure that the exemptions are valid and recognized by the California Employment Development Department (EDD). Failure to comply with these regulations can result in penalties or audits, making it crucial for businesses to maintain accurate records and documentation.

Required Documents

When completing the DE 3HW form, certain documents may be required to support the claims made. Employers should have access to the employee's previous tax returns, pay stubs, and any relevant documentation that verifies the exemptions being claimed. This information is vital for ensuring that the form is completed accurately and that the employee's claims are legitimate. Keeping thorough records will assist in the event of any inquiries from tax authorities.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the DE 3HW is crucial for employers to avoid penalties. The form must typically be submitted at the beginning of the tax year or whenever an employee's exemption status changes. Employers should mark their calendars for key dates related to payroll processing and tax reporting to ensure timely submissions. Staying informed about these deadlines helps maintain compliance and prevents unnecessary complications.

Who Issues the Form

The DE 3HW form is issued by the California Employment Development Department (EDD). This state agency oversees the administration of employment-related programs, including unemployment insurance and disability insurance. Employers can obtain the DE 3HW from the EDD’s official website or through direct contact with their offices. Understanding the issuing authority ensures that businesses are using the most current and valid version of the form for their payroll needs.

Quick guide on how to complete de 3hw

Effortlessly Prepare De 3hw on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any delays. Manage De 3hw on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign De 3hw with Ease

- Locate De 3hw and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure confidential information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to preserve your changes.

- Choose how you would like to submit your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign De 3hw and ensure efficient communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the de 3hw

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What does 'employee paid' mean in the context of airSlate SignNow?

In the context of airSlate SignNow, 'employee paid' refers to the option where employees can cover their own costs for eSigning and document management services. This approach allows companies to streamline expenses while providing employees with the necessary tools to manage their own paperwork effectively.

-

How does airSlate SignNow handle employee paid accounts?

With airSlate SignNow, you can easily set up employee paid accounts, allowing your team members to manage their individual subscriptions. This feature enables employees to access premium features without additional costs to the company, ensuring that everyone has the tools needed for seamless document workflows.

-

What are the pricing options for employee paid plans on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to employee paid accounts. These plans are designed to fit various budgets and team sizes, allowing employees to select the most suitable option for their eSigning needs while enjoying the benefits of a cost-effective solution.

-

What features are included in the employee paid plans?

Employee paid plans on airSlate SignNow include essential features such as unlimited eSigning, document templates, and integration with popular applications. These features ensure that employees can efficiently manage their documents while enjoying a user-friendly interface.

-

Can employee paid plans integrate with other software?

Yes, airSlate SignNow allows employee paid plans to integrate seamlessly with various productivity and cloud storage applications. This connectivity streamlines workflows for employees, making it easy to manage and sign documents directly from their preferred platforms.

-

What benefits do employees gain from using airSlate SignNow?

Employees benefit from using airSlate SignNow through enhanced productivity and time savings. With employee paid subscriptions, they can sign and send documents anytime, anywhere, ensuring that their workflows remain uninterrupted and efficient.

-

How does airSlate SignNow protect employee paid document security?

Security is a top priority for airSlate SignNow, particularly for employee paid documents. The platform uses advanced encryption and secure cloud storage to protect all sensitive information, providing employees with peace of mind when managing their documents.

Get more for De 3hw

- Ds 23p form

- Smoke detector amp fire extinguisher agreement form

- School entrance health form arlington public schools apsva

- Shipping approval form

- Telecom service agreement template form

- Telecommute agreement template form

- Telecommunications service level agreement template form

- Telework agreement template form

Find out other De 3hw

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter