Massachusetts Certificate Tax Form

Understanding the Massachusetts Certificate of Tax Compliance

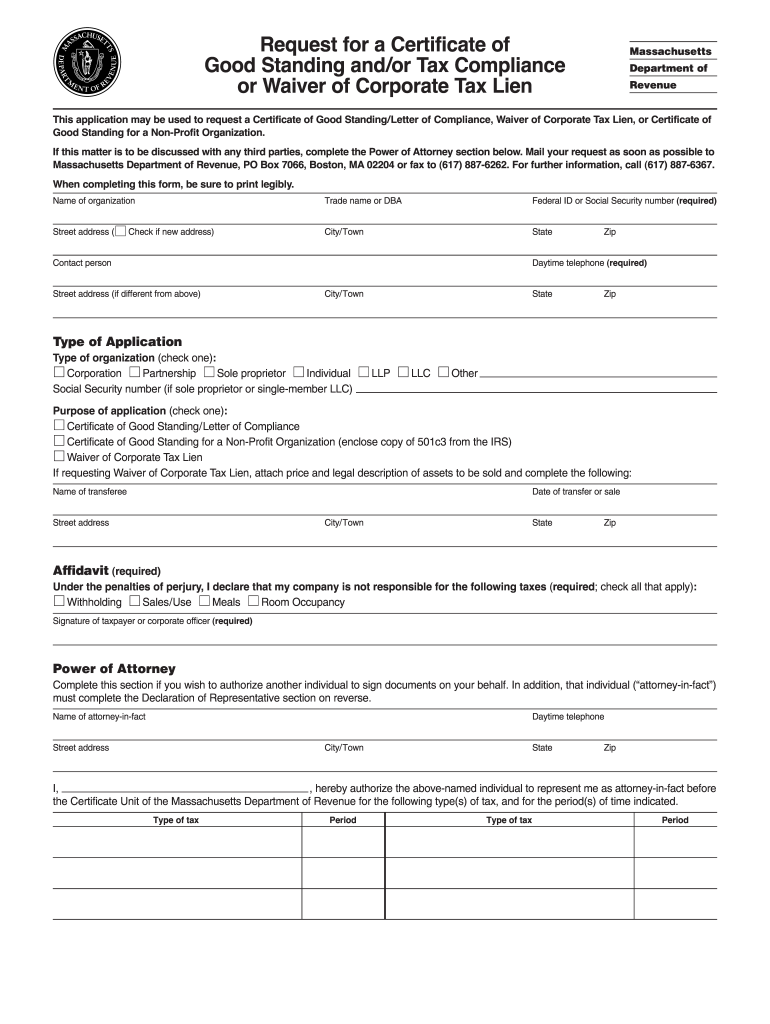

The Massachusetts Certificate of Tax Compliance, often referred to as a certificate of good standing, is an official document that verifies a business entity's compliance with state tax obligations. This certificate is essential for various business activities, including securing loans, entering contracts, and maintaining good standing with the state. It confirms that the entity has filed all required tax returns and paid all due taxes, making it a crucial element for businesses operating in Massachusetts.

Steps to Obtain the Massachusetts Certificate of Tax Compliance

To obtain the Massachusetts Certificate of Tax Compliance, follow these steps:

- Ensure all tax returns are filed and all taxes are paid. This includes income, sales, and any other applicable taxes.

- Gather necessary documentation, such as your business identification number and any previous tax filings.

- Visit the Massachusetts Department of Revenue (DOR) website or contact their office to request the certificate.

- Complete any required forms, which may include providing details about your business and its tax history.

- Submit your request along with any applicable fees, if required.

Legal Uses of the Massachusetts Certificate of Tax Compliance

The Massachusetts Certificate of Tax Compliance serves several legal purposes. It is often required when:

- Applying for business loans or credit lines.

- Entering into contracts with other businesses or government entities.

- Renewing business licenses or permits.

- Establishing credibility with potential partners and clients.

Having this certificate demonstrates that your business is in good standing with the state, which can enhance your reputation and facilitate smoother business operations.

Required Documents for the Massachusetts Certificate of Tax Compliance

When applying for the Massachusetts Certificate of Tax Compliance, you may need to provide the following documents:

- Your business identification number or Social Security number, if applicable.

- Copies of recent tax returns.

- Proof of tax payments made to the Massachusetts Department of Revenue.

- Any additional forms specified by the DOR for the certificate request.

Filing Deadlines and Important Dates

It is important to be aware of key deadlines related to the Massachusetts Certificate of Tax Compliance. Generally, businesses should ensure that all tax filings and payments are completed by the state’s tax deadlines to avoid penalties. Notably, the state may have specific periods during which the certificate can be requested, especially for businesses seeking to renew licenses or apply for loans. Regularly check the Massachusetts DOR website for updates on deadlines and compliance requirements.

Digital vs. Paper Version of the Certificate

The Massachusetts Certificate of Tax Compliance can be obtained in both digital and paper formats. The digital version is often more convenient, allowing for quicker processing and delivery. It can be accessed through the Massachusetts DOR online portal. However, some businesses may prefer a paper version for their records or when submitting to certain institutions. Regardless of the format, both versions are legally valid and serve the same purpose in confirming tax compliance.

Quick guide on how to complete massachusetts certificate taxpdffillercom form

Your assistance manual on how to prepare your Massachusetts Certificate Tax

If you’re curious about how to generate and submit your Massachusetts Certificate Tax, here are a few straightforward instructions on how to make tax reporting easier.

To begin, you just need to set up your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a user-friendly and powerful document solution that enables you to edit, produce, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to modify details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Massachusetts Certificate Tax in a matter of minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to search for any IRS tax form; examine versions and schedules.

- Click Obtain form to open your Massachusetts Certificate Tax in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Review your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return mistakes and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

Where can I get the form for migration certificate?

Migration is issued by the Universities themselves.The best way is to inquire your college they will guide you further.In case you happen to be from A.P.J Abdul Kalam Technical Universityhere is the link to get it issued online.Hope it helpsStudent Service (Dashboard) Dr. A.P.J. Abdul Kalam Technical University (Lucknow)Regards

Create this form in 5 minutes!

How to create an eSignature for the massachusetts certificate taxpdffillercom form

How to generate an eSignature for the Massachusetts Certificate Taxpdffillercom Form in the online mode

How to generate an eSignature for the Massachusetts Certificate Taxpdffillercom Form in Chrome

How to make an eSignature for signing the Massachusetts Certificate Taxpdffillercom Form in Gmail

How to generate an eSignature for the Massachusetts Certificate Taxpdffillercom Form straight from your mobile device

How to make an electronic signature for the Massachusetts Certificate Taxpdffillercom Form on iOS

How to create an electronic signature for the Massachusetts Certificate Taxpdffillercom Form on Android

People also ask

-

What is a Massachusetts Certificate Tax and why do I need it?

A Massachusetts Certificate Tax is a document issued by the Massachusetts Department of Revenue that certifies your tax status in the state. This certificate is essential for businesses looking to confirm compliance with state tax regulations, particularly when bidding for contracts or applying for licenses.

-

How does airSlate SignNow facilitate the management of Massachusetts Certificate Tax documents?

With airSlate SignNow, you can easily create, send, and eSign your Massachusetts Certificate Tax documents securely and efficiently. Our platform streamlines the process, allowing you to focus on your business while ensuring that all your tax documentation is handled correctly.

-

What are the pricing options for using airSlate SignNow for Massachusetts Certificate Tax?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for creating and managing Massachusetts Certificate Tax documents. Our cost-effective solutions ensure you only pay for the features you need, making it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for managing Massachusetts Certificate Tax?

Yes, airSlate SignNow seamlessly integrates with various business applications such as CRM systems and accounting software, which can help streamline the management of your Massachusetts Certificate Tax documents. This integration enhances your workflow, making it easier to maintain compliance.

-

What are the key features of airSlate SignNow that help with Massachusetts Certificate Tax?

AirSlate SignNow offers robust features such as customizable templates, secure eSigning, and real-time tracking for your Massachusetts Certificate Tax documents. These features ensure that your documents are processed quickly and securely, minimizing the risk of errors.

-

How secure is airSlate SignNow for handling Massachusetts Certificate Tax documents?

Security is a priority at airSlate SignNow. We utilize advanced encryption and compliance measures to safeguard your Massachusetts Certificate Tax documents, ensuring that sensitive information remains protected throughout the signing process.

-

Can I access my Massachusetts Certificate Tax documents from mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage your Massachusetts Certificate Tax documents from any device. This flexibility ensures you can handle your tax documentation on the go, without any hassle.

Get more for Massachusetts Certificate Tax

Find out other Massachusetts Certificate Tax

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word