Self Employment Ledger Form 2018

What is the Self Employment Ledger Form

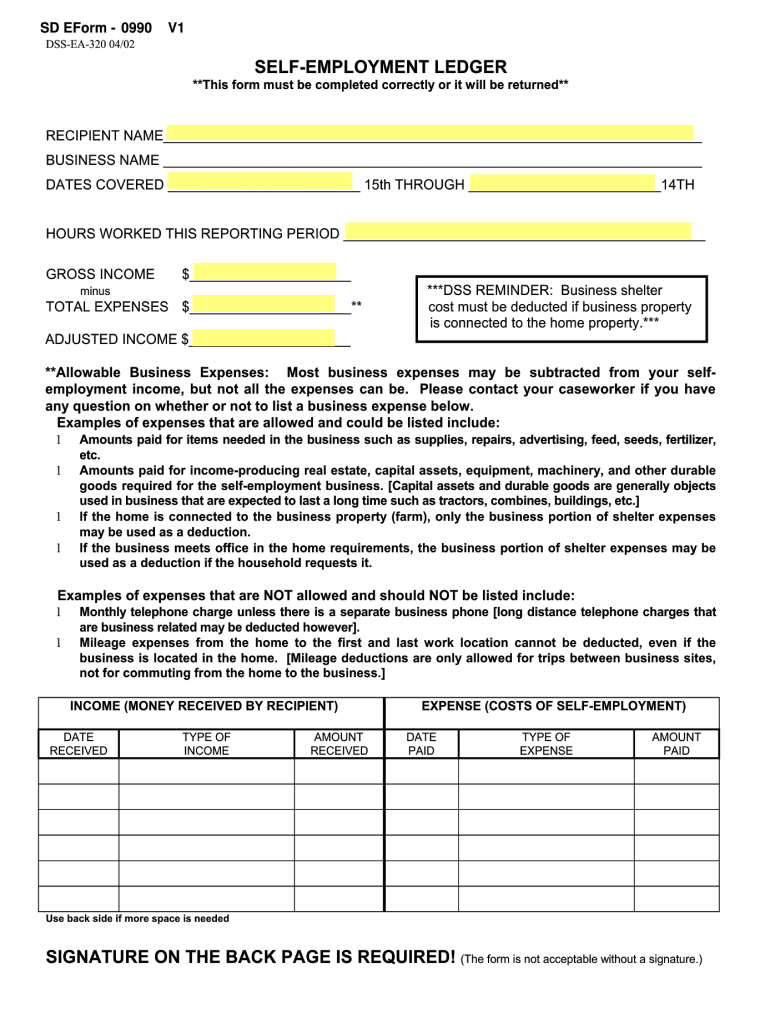

The Self Employment Ledger Form is a crucial document designed for individuals who operate their own businesses or work as freelancers. This form helps self-employed individuals track their income and expenses, providing a clear financial overview necessary for tax reporting and business management. By maintaining an accurate ledger, self-employed persons can ensure compliance with IRS regulations and prepare for potential audits.

How to use the Self Employment Ledger Form

Using the Self Employment Ledger Form involves systematically recording all business-related income and expenses. Each entry should include the date, description, and amount. It is essential to categorize expenses accurately, such as office supplies, travel costs, and utilities. Regularly updating the ledger will help in monitoring financial health and simplifying the tax preparation process. Many self-employed individuals find it beneficial to use accounting software for digital record-keeping, which can streamline this process.

Steps to complete the Self Employment Ledger Form

Completing the Self Employment Ledger Form requires a few straightforward steps:

- Gather all financial documents, including receipts and invoices.

- Record each income source with the corresponding date and amount.

- List all business expenses, categorizing them as necessary.

- Calculate total income and total expenses at the end of the reporting period.

- Review the entries for accuracy and completeness.

Key elements of the Self Employment Ledger Form

Several key elements are essential for a comprehensive Self Employment Ledger Form:

- Date: The date of each transaction.

- Description: A brief explanation of the transaction.

- Income Amount: The total income received.

- Expense Amount: The total expenses incurred.

- Net Profit/Loss: The difference between total income and total expenses.

Legal use of the Self Employment Ledger Form

The Self Employment Ledger Form serves as a legal document that can be used to substantiate income and expenses during tax filings. Keeping this ledger organized and accurate is vital for compliance with IRS guidelines. In the event of an audit, having a well-maintained ledger can provide evidence of financial transactions, thereby supporting claims made on tax returns.

IRS Guidelines

The IRS provides specific guidelines regarding the documentation of income and expenses for self-employed individuals. According to IRS regulations, self-employed persons must report all income received and can deduct necessary business expenses. The Self Employment Ledger Form aids in this process by ensuring that all financial activities are documented accurately. It is advisable to refer to IRS publications for detailed instructions on what constitutes deductible expenses and how to report them correctly.

Quick guide on how to complete self employment ledger 2002 form

Complete Self Employment Ledger Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Self Employment Ledger Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Self Employment Ledger Form with ease

- Obtain Self Employment Ledger Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Self Employment Ledger Form and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self employment ledger 2002 form

Create this form in 5 minutes!

How to create an eSignature for the self employment ledger 2002 form

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is a Self Employment Ledger Form?

A Self Employment Ledger Form is a document that helps self-employed individuals track their income and expenses. It provides a clear overview of financial transactions, making tax preparation and financial analysis easier. By using airSlate SignNow, you can digitize your forms for efficient management.

-

How can a Self Employment Ledger Form benefit my business?

Utilizing a Self Employment Ledger Form helps you maintain accurate financial records, which can lead to better tax reporting and financial decisions. It ensures that you document all income and expenses, helping you maximize deductions. With airSlate SignNow, you can streamline this process with easy eSigning.

-

Is the Self Employment Ledger Form customizable?

Yes, the Self Employment Ledger Form available through airSlate SignNow can be customized to fit your specific business needs. You can add or remove fields as necessary, ensuring that all relevant financial information is captured. This customization makes it easier to manage your self-employment records.

-

What features does airSlate SignNow offer for Self Employment Ledger Forms?

airSlate SignNow offers features like eSigning, document sharing, and template creation for Self Employment Ledger Forms. You can easily send forms for electronic signatures, track their status, and securely store completed documents. These features simplify your workflow and enhance productivity.

-

Are there any integrations available with the Self Employment Ledger Form?

Yes, airSlate SignNow seamlessly integrates with various applications, including popular accounting software. This integration allows for automatic transfer of data, reducing manual entry and the potential for errors. By using the Self Employment Ledger Form alongside these tools, you can improve your financial management.

-

How much does it cost to use the Self Employment Ledger Form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that provide access to the Self Employment Ledger Form along with various features. Pricing often depends on the number of users and the features required. You can start with a free trial to assess whether it meets your needs before committing.

-

Can I access my Self Employment Ledger Form from anywhere?

Absolutely! With airSlate SignNow, your Self Employment Ledger Form is accessible from any device with internet connectivity. This flexibility allows you to manage your finances on-the-go, ensuring that you can easily update and review your records whenever necessary.

Get more for Self Employment Ledger Form

- Science fair proposal 215085610 form

- Landlord registration statement jersey city form

- Crew release form

- Restaurant lease agreement template form

- Retail lease agreement template form

- Retail space lease agreement template form

- Retail sublease agreement template form

- Right of first refl clause in lease agreement template form

Find out other Self Employment Ledger Form

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation