Boe 261 G Form

What is the BOE 261 G?

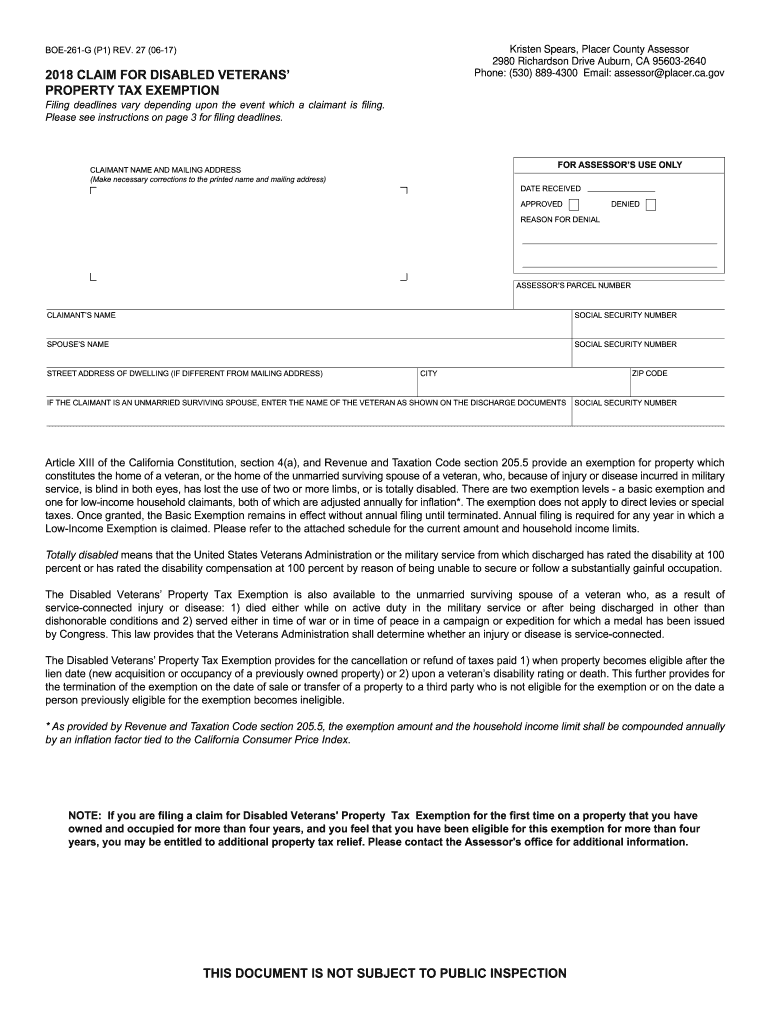

The BOE 261 G is a property tax exemption form used in the United States, specifically designed for veterans and certain disabled individuals. This form allows eligible applicants to claim exemptions on property taxes, which can significantly reduce their financial burden. Understanding the purpose and benefits of the BOE 261 G is crucial for those who qualify, as it can lead to substantial savings on annual property tax bills.

How to Use the BOE 261 G

Using the BOE 261 G involves several steps to ensure that applicants accurately complete the form and submit it correctly. First, individuals must gather necessary documentation, including proof of military service and any relevant medical records if claiming disability. Next, they should fill out the form with accurate information regarding their property and personal details. Finally, the completed form can be submitted to the appropriate local tax authority for review and approval.

Eligibility Criteria

Eligibility for the BOE 261 G is primarily based on the applicant's veteran status and any disabilities. Generally, veterans who have been honorably discharged from military service may qualify. Additionally, individuals with specific disabilities may also be eligible for exemptions. It is important to review local regulations, as eligibility criteria can vary by state and municipality, impacting the overall benefits of the exemption.

Steps to Complete the BOE 261 G

Completing the BOE 261 G requires careful attention to detail. The following steps can guide applicants through the process:

- Gather all necessary documentation, including proof of veteran status and any relevant medical records.

- Obtain the BOE 261 G form from the local tax authority or download it from their website.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the local tax authority by the specified deadline.

Required Documents

To successfully complete the BOE 261 G, applicants must provide certain documents to verify their eligibility. Commonly required documents include:

- Proof of military service, such as a DD-214 form.

- Medical documentation verifying any disabilities, if applicable.

- Identification documents, such as a driver's license or state ID.

- Property ownership documents, including a deed or tax bill.

Form Submission Methods

The BOE 261 G can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form to the designated office.

- In-person submission at the local tax authority’s office.

Quick guide on how to complete boe 261 g

Effortlessly Prepare Boe 261 G on Any Device

Managing documents online has become increasingly preferred by both companies and individuals. It offers a sustainable alternative to conventional printed and signed forms, as you can access the correct template and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hassle. Manage Boe 261 G on any device using the airSlate SignNow Android or iOS applications and streamline your document-centered processes today.

The Easiest Way to Modify and Electronically Sign Boe 261 G with Ease

- Find Boe 261 G and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Boe 261 G to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe 261 g

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the 261 property tax?

The 261 property tax refers to a specific type of property tax that may have unique implications for businesses. Understanding this tax is crucial for ensuring compliance and maximizing financial planning strategies. airSlate SignNow provides resources that can help you navigate the complexities of the 261 property tax.

-

How can airSlate SignNow help with document signing related to the 261 property tax?

airSlate SignNow allows businesses to easily eSign documents related to the 261 property tax, making the process efficient and secure. By using our platform, you can quickly obtain signatures on crucial tax-related paperwork, ensuring timely submissions and compliance. Our easy-to-use interface enhances the experience of managing tax-related documents.

-

What are the pricing options for airSlate SignNow regarding managing 261 property tax documents?

airSlate SignNow offers several pricing tiers to suit different business needs, all of which provide robust features for managing 261 property tax documents. With our cost-effective solution, businesses can streamline their document processes without breaking the bank. Explore our pricing plans to find the best fit for your requirements.

-

Does airSlate SignNow integrate with tax filing software related to the 261 property tax?

Yes, airSlate SignNow integrates seamlessly with various tax filing software that can assist in managing the 261 property tax. This integration streamlines the process of sending and signing necessary documents directly within your preferred software. This ensures a smoother workflow and minimizes the risk of errors.

-

What features does airSlate SignNow offer for handling the 261 property tax documentation?

airSlate SignNow features an intuitive document editor, workflow automation, and secure eSigning capabilities tailored for handling 261 property tax documentation. These tools help businesses manage their documents effectively, ensuring that all necessary forms are completed and signed in a timely manner. Enhanced tracking features also keep you informed about the document status.

-

What security measures does airSlate SignNow implement for 261 property tax documents?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards for all documents, including those related to the 261 property tax. Our platform ensures that sensitive information is protected throughout the signing process. You can trust that your tax documents are secure with airSlate SignNow.

-

How does airSlate SignNow improve the efficiency of managing 261 property tax documents?

By utilizing airSlate SignNow, businesses can signNowly enhance their efficiency in managing 261 property tax documents. Our digital signature platform eliminates the need for paper-based processes, allowing for faster turnaround times and reduced administrative burdens. This efficiency translates into time and cost savings for your business.

Get more for Boe 261 G

Find out other Boe 261 G

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile