Visio 1160 Rollover Divorce 03 Vsd PSERS Psers State Pa Form

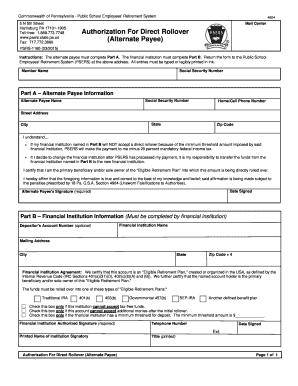

Understanding the authorization direct rollover alternate payee

The authorization direct rollover alternate payee is a specific form used primarily in the context of retirement plans. This form allows for the transfer of retirement funds directly to an alternate payee, such as an ex-spouse, in accordance with a divorce decree or court order. It is essential for ensuring that the funds are moved without incurring tax penalties, as it qualifies as a direct rollover under IRS regulations.

Steps to complete the authorization direct rollover alternate payee

Completing the authorization direct rollover alternate payee form involves several key steps:

- Gather necessary information, including the retirement account details and the alternate payee's information.

- Fill out the form accurately, ensuring that all required fields are completed.

- Obtain signatures from both the account holder and the alternate payee, as required.

- Submit the completed form to the retirement plan administrator or custodian for processing.

Legal use of the authorization direct rollover alternate payee

The legal use of the authorization direct rollover alternate payee form is crucial for compliance with divorce settlements. This form must be executed in accordance with the terms set forth in the divorce decree. It is important to ensure that the form meets all legal requirements to avoid complications, such as tax implications or disputes regarding the transfer of funds.

Eligibility criteria for using the authorization direct rollover alternate payee

To utilize the authorization direct rollover alternate payee form, certain eligibility criteria must be met:

- The account holder must have a qualified retirement plan.

- The alternate payee must be designated in a divorce decree or court order.

- Both parties must agree to the terms of the rollover as specified in the legal documents.

Required documents for the authorization direct rollover alternate payee

When completing the authorization direct rollover alternate payee form, several documents may be required:

- A copy of the divorce decree or court order specifying the distribution of retirement assets.

- Identification documents for both the account holder and the alternate payee.

- Any additional forms required by the retirement plan administrator.

Form submission methods for the authorization direct rollover alternate payee

The authorization direct rollover alternate payee form can typically be submitted through various methods, depending on the retirement plan's policies:

- Online submission through the retirement plan's secure portal.

- Mailing the completed form to the plan administrator.

- In-person submission at the plan administrator's office.

Quick guide on how to complete visio 1160 rollover divorce 03 2015vsd psers psers state pa

Effortlessly Prepare Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa with Ease

- Find Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal authority as a traditional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the visio 1160 rollover divorce 03 2015vsd psers psers state pa

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is an authorization direct rollover alternate payee?

An authorization direct rollover alternate payee refers to a process allowing a designated alternate payee to receive funds from a retirement account directly. This option enables smoother transitions for funds without incurring penalties or tax implications. Understanding this mechanism is crucial for ensuring proper financial planning and compliance.

-

How does airSlate SignNow assist with authorization direct rollover alternate payee documentation?

airSlate SignNow provides an intuitive platform for creating, sending, and signing documents related to authorization direct rollover alternate payee transactions. Our solution streamlines the paperwork process, ensuring that all necessary documentation is easy to complete and securely signed. This efficiency helps reduce errors and delays involved in the rollover process.

-

Are there any fees associated with using airSlate SignNow for authorization direct rollover alternate payee documents?

airSlate SignNow offers a variety of pricing plans that cater to different business needs. While some features are included at no extra cost, certain advanced functionalities may incur additional fees. We recommend reviewing our pricing page to identify the best plan for managing authorization direct rollover alternate payee documentation.

-

What features does airSlate SignNow offer for managing authorization direct rollover alternate payee transactions?

Our platform includes features like customizable templates, automated reminders, and real-time tracking of document status, all tailored for authorization direct rollover alternate payee processes. These features enhance the user experience by simplifying document management and ensuring timely execution. Moreover, our cloud-based solution guarantees secure access to documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for handling authorization direct rollover alternate payee needs?

Yes, airSlate SignNow offers extensive integration capabilities with various software applications to facilitate authorization direct rollover alternate payee tasks. Our platform seamlessly connects with popular tools such as CRM systems, accounting software, and cloud storage services. This integration ensures that you can manage all aspects of your documents in one cohesive workflow.

-

What benefits does airSlate SignNow provide for businesses handling authorization direct rollover alternate payee documents?

Using airSlate SignNow for authorization direct rollover alternate payee documentation can result in signNow time savings and increased efficiency. Our eSigning capabilities eliminate the need for physical paperwork, reducing errors and delays in the process. Additionally, businesses can improve compliance with signed records and secure document handling.

-

Is airSlate SignNow compliant with regulations for authorization direct rollover alternate payee transactions?

airSlate SignNow complies with industry regulations and standards to ensure that all authorization direct rollover alternate payee documents are handled securely and legally. Our platform employs robust security measures, such as encryption and secure user authentication, to protect sensitive information. This compliance helps businesses confidently manage their documentation.

Get more for Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa

Find out other Visio 1160 Rollover Divorce 03 vsd PSERS Psers State Pa

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online