Employee Pay Stub Form

What is the Employee Pay Stub

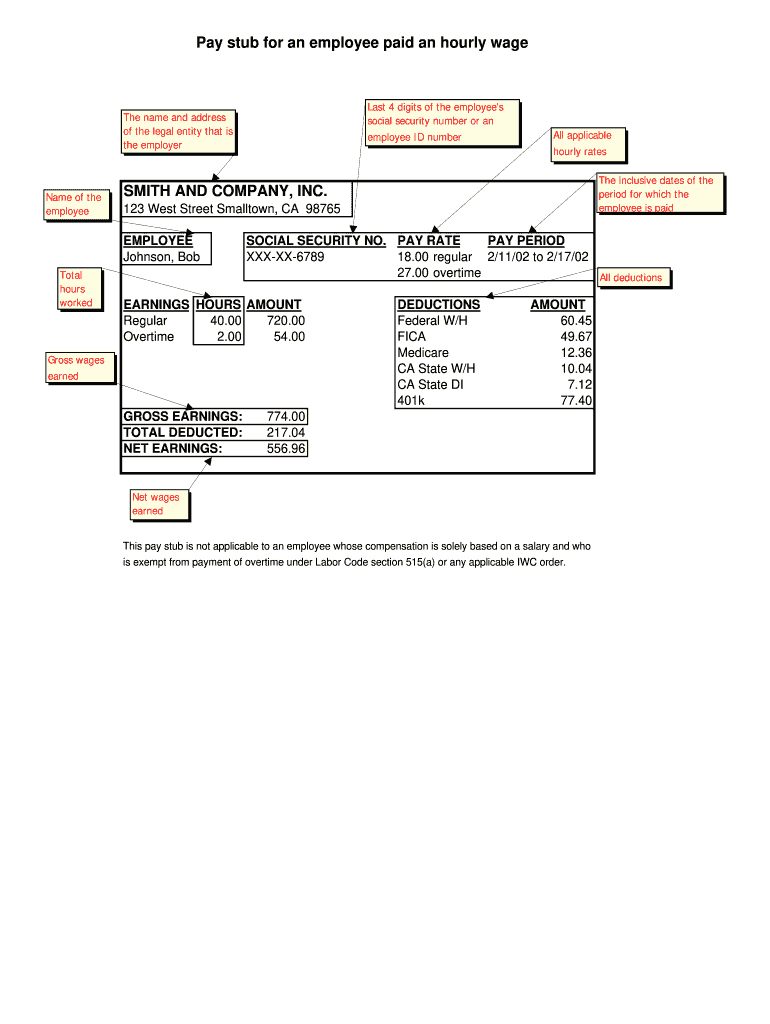

The employee pay stub is a document provided by employers that outlines an employee's earnings for a specific pay period. It serves as a detailed record of wages earned, deductions made, and the net amount received. Typically, a pay stub includes essential information such as the employee's name, pay period dates, gross pay, taxes withheld, and any other deductions, such as health insurance or retirement contributions. Understanding the components of a pay stub is crucial for employees to ensure they are compensated accurately and to help them manage their finances effectively.

Key Elements of the Employee Pay Stub

Several key elements make up an employee pay stub, which are vital for understanding one's earnings and deductions. These elements typically include:

- Employee Information: Name, address, and identification number.

- Employer Information: Company name, address, and tax identification number.

- Pay Period: The specific dates for which the employee is being paid.

- Gross Pay: Total earnings before any deductions.

- Deductions: Taxes, insurance, retirement contributions, and other withholdings.

- Net Pay: The final amount the employee receives after all deductions.

Familiarity with these components helps employees verify their pay and understand how their earnings are calculated.

Steps to Complete the Employee Pay Stub

Completing an employee pay stub involves several steps to ensure accuracy and compliance with legal requirements. Here are the essential steps:

- Gather Employee Information: Collect the necessary details such as name, address, and identification number.

- Determine Pay Period: Specify the start and end dates for the pay period.

- Calculate Gross Pay: Calculate the total earnings based on hourly rates or salaries for the pay period.

- Apply Deductions: Deduct applicable taxes and contributions to arrive at the net pay.

- Review for Accuracy: Double-check all calculations and information to ensure correctness.

- Distribute Pay Stubs: Provide the completed pay stubs to employees in a timely manner, either electronically or in paper form.

Following these steps helps maintain transparency and trust between employers and employees.

Legal Use of the Employee Pay Stub

The legal use of an employee pay stub is governed by various federal and state regulations. Employers are required to provide pay stubs to their employees, which serve as proof of earnings and deductions. This documentation is essential for tax purposes and can be used in disputes regarding wages or employment status. Compliance with laws such as the Fair Labor Standards Act (FLSA) ensures that employees receive accurate and timely pay stubs, which helps protect their rights and interests in the workplace.

How to Obtain the Employee Pay Stub

Employees can obtain their pay stubs through various methods, depending on the employer's practices. Common ways to access pay stubs include:

- Employer Portal: Many companies provide online portals where employees can log in to view and download their pay stubs.

- Email Notifications: Some employers send pay stubs directly to employees via email.

- Physical Copies: Employers may distribute printed pay stubs during paydays.

Employees should familiarize themselves with their employer's procedures to ensure they can access their pay stubs promptly.

Examples of Using the Employee Pay Stub

Employee pay stubs serve various practical purposes. Here are a few examples of how they can be used:

- Loan Applications: Lenders often require pay stubs to verify income when assessing loan applications.

- Tax Filing: Pay stubs provide essential information for filing federal and state taxes accurately.

- Budgeting: Employees can use pay stubs to track income and plan their personal budgets effectively.

Understanding these applications can help employees make the most of their pay stubs in managing their financial responsibilities.

Quick guide on how to complete employee pay stub

Complete Employee Pay Stub effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Employee Pay Stub on any platform with airSlate SignNow Android or iOS applications and simplify any document-based process today.

The simplest way to modify and eSign Employee Pay Stub without effort

- Locate Employee Pay Stub and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Employee Pay Stub and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee pay stub

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is a paid stub and how can I create one with airSlate SignNow?

A paid stub is a document that provides a detailed record of payment, including wages and deductions. With airSlate SignNow, you can easily create a paid stub by using customizable templates that allow you to input necessary information. This ensures that your paid stubs are accurate and professionally formatted, making it easy to manage payroll documentation.

-

Is there a cost associated with generating a paid stub using airSlate SignNow?

Yes, there are various pricing plans available with airSlate SignNow, which can accommodate different business needs. The cost depends on the features you require, including the ability to create and manage paid stubs. Check our pricing page for detailed information on plans tailored for your business.

-

Can I include my company logo on the paid stub created with airSlate SignNow?

Absolutely! One of the benefits of using airSlate SignNow is the ability to customize your paid stub with your company logo. This professional touch enhances your branding and ensures that your documents maintain a consistent look in line with your business identity.

-

How secure is the paid stub information I provide on airSlate SignNow?

airSlate SignNow utilizes advanced security measures to ensure that all sensitive information, including paid stubs, is protected. We use encryption and secure servers to safeguard your data from unauthorized access, giving you peace of mind while managing payroll records.

-

Can I integrate airSlate SignNow with other tools for easier paid stub management?

Yes, airSlate SignNow offers integrations with various business tools such as accounting software and payroll systems. This means you can streamline your workflow and enhance the management of paid stubs, making it easier to sync data across different platforms.

-

What are the advantages of using airSlate SignNow for creating paid stubs?

Using airSlate SignNow for your paid stubs provides signNow advantages, including ease of use, time-saving features, and access to customizable templates. Additionally, with eSignature capabilities, you can ensure that all necessary approvals are secured without the need for physical paperwork.

-

Are there any limitations on the number of paid stubs I can create with airSlate SignNow?

The number of paid stubs you can create depends on the pricing plan you choose. Each plan comes with its own set of limitations, but many users find that the available plans allow for ample creation and management of paid stubs for their business needs.

Get more for Employee Pay Stub

Find out other Employee Pay Stub

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later