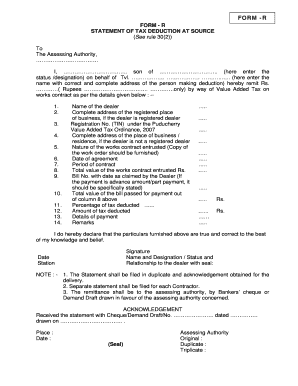

FORM R FORM R STATEMENT of TAX DEDUCTION at SOURCE See Rule 302 to the Assessing Authority,

What is the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority

The FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE is a crucial document used in the context of tax compliance. It serves as a declaration by the deductor regarding the tax deducted at source (TDS) from payments made to a payee. This form is essential for both the deductor and the recipient, as it provides a record of the tax withheld and ensures that the appropriate amount is reported to the relevant tax authority. Understanding the purpose and importance of this form is vital for maintaining compliance with tax regulations.

Steps to complete the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority

Completing the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE involves several key steps. First, gather all necessary information, including the details of the deductor and payee, as well as the amount of tax deducted. Next, accurately fill out the form, ensuring that all fields are completed correctly. It is important to review the information for accuracy before submission. Finally, submit the completed form to the appropriate assessing authority, either online or through physical mail, depending on the regulations in your jurisdiction. Proper completion of this form helps prevent issues with tax compliance.

Legal use of the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority

The legal use of the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE is governed by tax laws that require accurate reporting of taxes withheld. This form must be submitted to the assessing authority to ensure that the tax deducted is accounted for in the payee's tax records. The legal validity of this form hinges on its proper completion and timely submission. Failure to comply with these requirements may result in penalties or additional scrutiny from tax authorities.

How to obtain the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority

To obtain the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE, individuals or businesses can typically access it through the official tax authority's website or designated offices. Many jurisdictions provide downloadable versions of the form, allowing for easy access. It is advisable to ensure that you are using the most current version of the form to comply with the latest regulations. If assistance is needed, consulting a tax professional can provide guidance on obtaining and completing the form correctly.

Key elements of the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority

Key elements of the FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE include the names and contact information of both the deductor and the payee, the amount of payment made, the rate of tax deducted, and the total amount of tax withheld. Additionally, the form must include a declaration section where the deductor confirms the accuracy of the information provided. These elements are critical for ensuring that the form serves its purpose in tax reporting and compliance.

Quick guide on how to complete form r form r statement of tax deduction at source see rule 302 to the assessing authority

Effortlessly complete FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority, on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Handle FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority, on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority, without any hassle

- Obtain FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority, and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority, to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r form r statement of tax deduction at source see rule 302 to the assessing authority

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the authority of India regarding electronic signatures?

The authority of India recognizes electronic signatures as legally valid under the Information Technology Act, 2000. This means that electronic signatures made using platforms like airSlate SignNow hold equal weight in legal contexts as traditional handwritten signatures. Consequently, businesses can confidently utilize airSlate SignNow for their document signing needs.

-

How does airSlate SignNow comply with the authority of India’s regulations?

airSlate SignNow adheres to the standards set by the authority of India for electronic signatures. This involves employing advanced security measures and encryption protocols to ensure the authenticity and integrity of signed documents. By using airSlate SignNow, you can be assured that your electronic transactions comply with Indian laws.

-

What are the pricing options for airSlate SignNow in India?

airSlate SignNow offers flexible pricing options tailored for businesses of all sizes in India. The packages are designed to fit various needs, whether for small startups or larger enterprises, reflecting the authority of India’s goal to encourage digital transactions. You can choose a plan that best suits your organization's signature volume and features.

-

What features does airSlate SignNow provide that align with the authority of India’s requirements?

airSlate SignNow offers features like secure electronic signatures, document tracking, and customizable templates, aligning with the authority of India’s stipulations for valid electronic transactions. These features allow users to efficiently manage their signing processes while ensuring compliance with legal standards. Additionally, audit trails are provided for all signatures, enhancing security.

-

Can airSlate SignNow integrate with other software used in India?

Yes, airSlate SignNow easily integrates with various popular software applications used in India. This includes CRM systems, cloud storage, and other business tools to streamline document workflows. By integrating with existing systems, businesses can maintain compliance with the authority of India's electronic signature regulations.

-

What benefits does airSlate SignNow offer for businesses operating under the authority of India?

Using airSlate SignNow provides numerous benefits, including increased efficiency and reduced turnaround time for document signing. This is in alignment with the authority of India's push towards digital and paperless transactions. Businesses can improve their operational workflow and reduce costs associated with traditional signing methods.

-

Is it safe to use airSlate SignNow for sensitive documents in India?

Absolutely. airSlate SignNow employs state-of-the-art security measures, ensuring that your sensitive documents remain protected while complying with the authority of India's security requirements. Features such as data encryption and two-factor authentication help maintain the confidentiality and integrity of your documents.

Get more for FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority,

- Treatment certificate format 14816602

- Month questionnaire full spectrum pediatrics form

- Services tift regional medical center form

- Annex 1 page 1 of 2 application form for business permit

- Irs letter 324c fax number form

- Standing order form cashplus

- Rp07 application to change a companys disputed gov uk form

- Right of access general data protection regulation form

Find out other FORM R FORM R STATEMENT OF TAX DEDUCTION AT SOURCE See Rule 302 To The Assessing Authority,

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile