Gc 400 6 a Form

What is the GC 400 6 A?

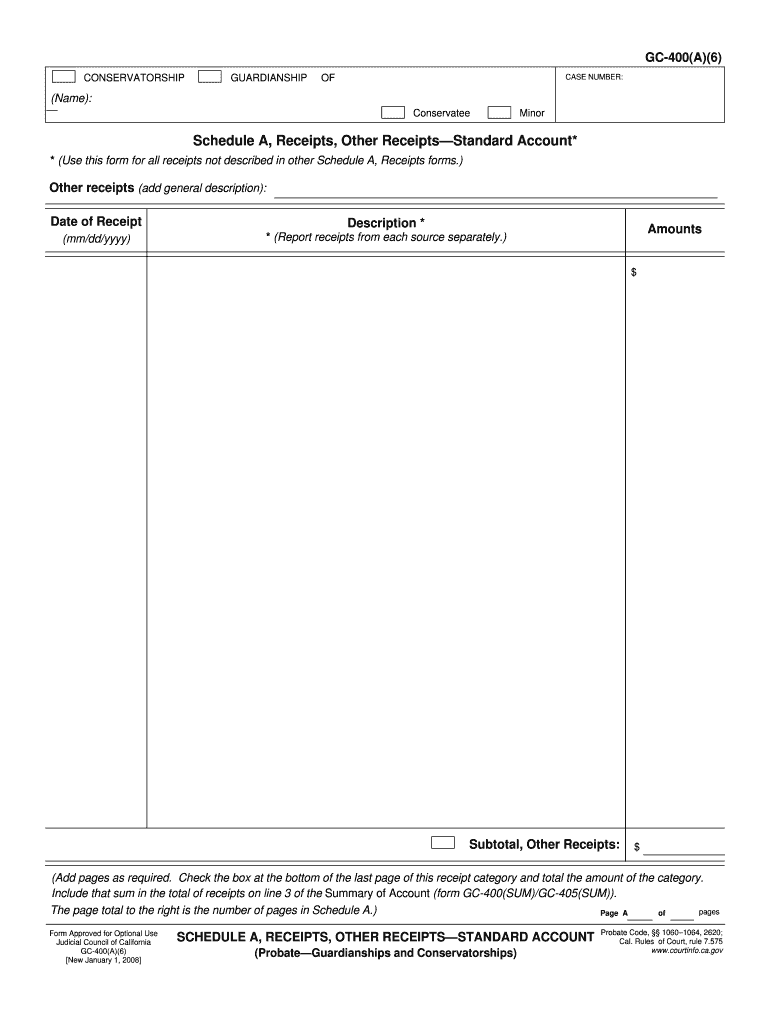

The GC 400 6 A is a specific form used in California for reporting and documenting various financial transactions. This form is essential for individuals and businesses to ensure compliance with state regulations. It captures detailed information regarding income, deductions, and other financial activities that may affect tax obligations. Understanding the purpose and requirements of the GC 400 6 A is crucial for accurate reporting and avoiding potential penalties.

How to use the GC 400 6 A

Using the GC 400 6 A involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, including income statements and receipts. Next, fill out the form by entering the required details in the appropriate sections. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the state.

Steps to complete the GC 400 6 A

Completing the GC 400 6 A requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts.

- Fill out the personal information section, including your name, address, and taxpayer identification number.

- Report all sources of income accurately in the designated sections.

- Include any applicable deductions or credits that you are eligible for.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate state office.

Legal use of the GC 400 6 A

The GC 400 6 A serves a legal purpose in documenting financial transactions for tax compliance. It is essential to ensure that the form is filled out accurately and submitted on time to avoid legal repercussions. The form must adhere to the guidelines set forth by the California state government, including any relevant laws regarding eSignature and digital submission. Understanding the legal implications of using this form can help individuals and businesses maintain compliance and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400 6 A are crucial to ensure timely compliance with state regulations. Typically, the form must be submitted by a specific date each year, often coinciding with the tax filing deadline. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Marking these dates on your calendar can help prevent late submissions and associated penalties.

Required Documents

To complete the GC 400 6 A accurately, certain documents are required. These may include:

- Income statements such as W-2s and 1099s.

- Receipts for deductible expenses.

- Previous year’s tax returns for reference.

- Any relevant financial statements that support your reported income and deductions.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete gc 400 6 a

Complete Gc 400 6 A effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Gc 400 6 A on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Gc 400 6 A with minimal effort

- Obtain Gc 400 6 A and then click Get Form to initiate.

- Use the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose how you'd like to share your form—via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Edit and eSign Gc 400 6 A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gc 400 6 a

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the gc 400 6 a and how does it benefit businesses?

The gc 400 6 a is an advanced electronic signature solution provided by airSlate SignNow. It allows businesses to send and sign documents efficiently, reducing paperwork and streamlining workflows. This tool not only saves time but also enhances security and compliance in document handling.

-

How much does the gc 400 6 a cost?

The pricing for the gc 400 6 a varies based on the features and the number of users. airSlate SignNow offers flexible subscription plans to suit different business needs. You can visit our pricing page to find the best option tailored for your organization.

-

What features are included in the gc 400 6 a?

The gc 400 6 a comes with powerful features like customizable templates, automated workflows, and real-time tracking of document status. Additionally, it supports teams with multi-user functionality and seamless integration with various apps, making it a comprehensive solution for eSigning.

-

Can the gc 400 6 a be integrated with other software?

Yes, the gc 400 6 a integrates smoothly with popular software applications such as CRM systems, cloud storage solutions, and productivity tools. This flexibility allows businesses to incorporate the eSigning process into their existing workflows without any hassle.

-

Is the gc 400 6 a secure for sensitive documents?

Absolutely, the gc 400 6 a prioritizes security and complies with industry standards such as GDPR and eIDAS. It uses advanced encryption methods to protect sensitive information, ensuring that your documents remain confidential and secure throughout the signing process.

-

What are the main benefits of using the gc 400 6 a?

Using the gc 400 6 a provides numerous benefits including signNow time savings, reduced operational costs, and a more environmentally friendly approach to business processes. Additionally, it improves customer experience by enabling quick and easy document transactions.

-

How can I get started with the gc 400 6 a?

Getting started with the gc 400 6 a is simple. You can sign up for a free trial on our website to explore its features. After the trial, you can choose a subscription plan that best fits your business requirements.

Get more for Gc 400 6 A

- Email claim form

- Dcnr dealer portal form

- Real property protest form larimer county colorado co larimer co

- Memphis city schools volunteer form

- Chp background investigation questionnaire form

- Wyoming statutory trust form

- Temporary building permit application form

- Please read carefully before signing serious in jury may result from your participation in equine activities form

Find out other Gc 400 6 A

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement