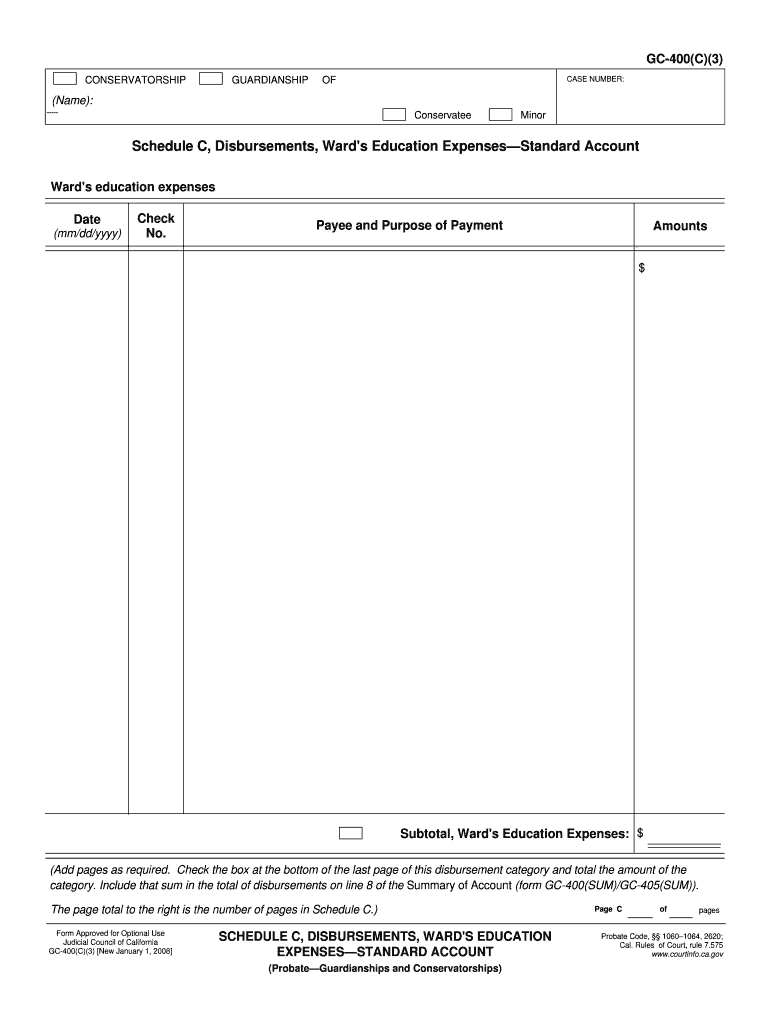

Gc400c Form

What is the GC400C?

The GC400C, also known as the GC C3 Schedule C Form, is a crucial document used by self-employed individuals and business owners in the United States to report income and expenses. This form is essential for accurately calculating net profit or loss from a business and is typically filed with the IRS as part of an individual's tax return. Understanding the GC400C is vital for ensuring compliance with federal tax regulations and for optimizing tax liabilities.

Steps to Complete the GC400C

Completing the GC400C involves several key steps to ensure all necessary information is accurately reported. Here are the primary steps:

- Gather Necessary Information: Collect all relevant financial records, including income statements, receipts for expenses, and any other documents that substantiate your business activities.

- Fill Out Basic Information: Start by entering your name, Social Security number, and business name if applicable. This information is crucial for proper identification.

- Report Income: Document all sources of income generated by your business. This includes sales, services rendered, and any other income streams.

- Detail Expenses: List all business-related expenses, categorized appropriately. Ensure you include costs such as supplies, utilities, and wages paid to employees.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Review and Submit: Carefully review all entries for accuracy before submitting the form with your tax return.

Legal Use of the GC400C

The GC400C is legally binding when completed correctly and submitted to the IRS. To ensure its legal validity, it is essential to adhere to the guidelines set forth by the IRS regarding eSignature and document submission. Utilizing a secure platform for electronic signatures can enhance the legitimacy of the form, as it provides a digital certificate that verifies the signer's identity. Compliance with federal regulations, such as the ESIGN Act and UETA, is also critical in maintaining the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the GC400C align with the standard tax return deadlines. Generally, individual tax returns, including the GC400C, are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid potential penalties and ensure timely processing of your tax return.

Required Documents

To accurately complete the GC400C, certain documents are essential. These include:

- Income Statements: Documentation of all income received from business activities.

- Expense Receipts: Detailed receipts for all business-related expenses incurred throughout the year.

- Previous Year’s Tax Returns: Reference to prior tax filings can provide valuable insights and help in completing the current form.

- Bank Statements: Statements that reflect business transactions can assist in verifying income and expenses.

Examples of Using the GC400C

The GC400C is commonly used by various types of self-employed individuals and small business owners. Examples include:

- Freelancers: Independent contractors providing services in fields such as writing, graphic design, or consulting.

- Small Business Owners: Owners of sole proprietorships or single-member LLCs who report business income on their personal tax returns.

- Gig Economy Workers: Individuals earning income through platforms such as ride-sharing or delivery services.

Quick guide on how to complete gc400c

Effortlessly prepare Gc400c on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Gc400c on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Gc400c with ease

- Locate Gc400c and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Gc400c and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gc400c

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is the ca c ward standard in document signing?

The ca c ward standard refers to industry best practices for secure electronic signatures. Utilizing such standards ensures that your signed documents are authentic and legally binding, making airSlate SignNow compliant with these necessary regulations.

-

How does airSlate SignNow implement the ca c ward standard?

airSlate SignNow incorporates the ca c ward standard by utilizing advanced encryption and authentication protocols. This commitment to security ensures that the integrity of every signed document is maintained, reassuring users of its compliance with relevant regulations.

-

What are the pricing plans for airSlate SignNow that support ca c ward standard?

airSlate SignNow offers various pricing plans that accommodate businesses of all sizes while adhering to the ca c ward standard. Each plan is designed to provide value, featuring unlimited signing and eSignature capabilities at competitive prices.

-

Can airSlate SignNow integrate with other applications while maintaining the ca c ward standard?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, enabling you to enhance your workflow while upholding the ca c ward standard. These integrations ensure that the security of your documents remains uncompromised, no matter the platform.

-

What features of airSlate SignNow are aligned with the ca c ward standard?

Key features of airSlate SignNow that align with the ca c ward standard include advanced authentication methods, audit trails, and customizable templates. These features ensure your eSigning process is secure, compliant, and efficient for all users.

-

How can businesses benefit from using airSlate SignNow with the ca c ward standard?

By using airSlate SignNow in accordance with the ca c ward standard, businesses can streamline their document processes while ensuring security and compliance. This not only saves time but also reduces the risk of legal issues associated with improper document handling.

-

Is airSlate SignNow suitable for international businesses regarding the ca c ward standard?

Absolutely! airSlate SignNow is designed to cater to international businesses, ensuring compliance with various regulations, including the ca c ward standard. This global compatibility allows companies to manage their eSignature needs effectively across different regions.

Get more for Gc400c

Find out other Gc400c

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online