Florida Dr418c 2017-2026

What is the Florida Dr418c

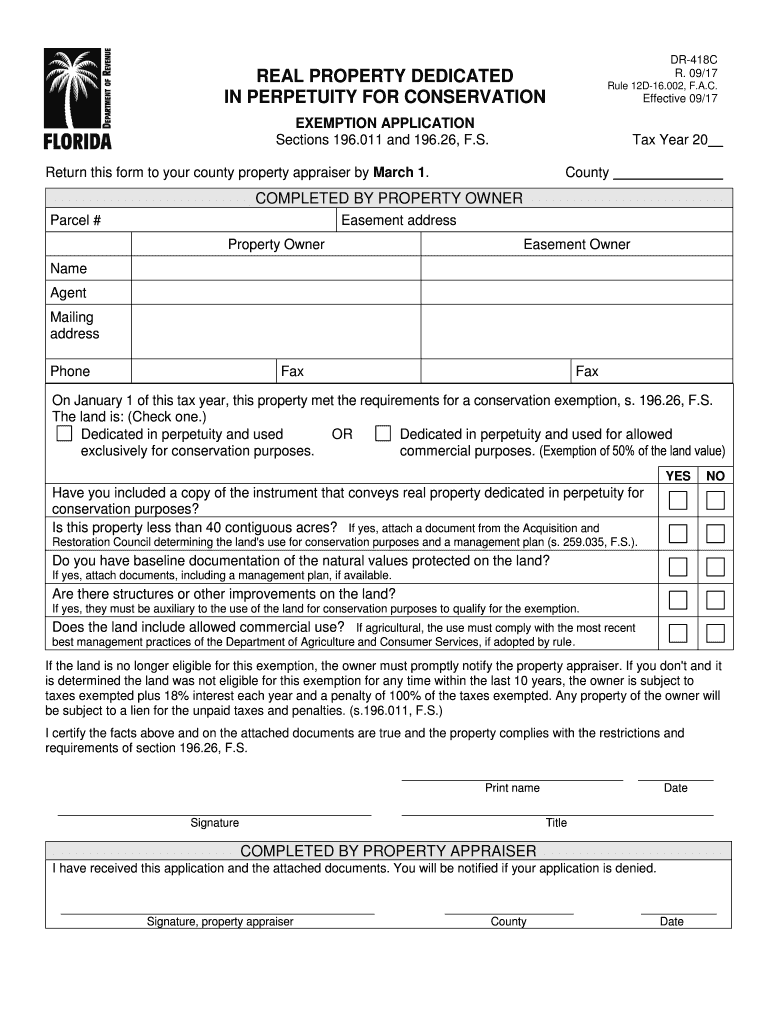

The Florida Dr418c is a property exemption form specifically designed for property owners in Florida seeking to apply for certain tax exemptions. This form is crucial for individuals or entities that qualify for exemptions related to real property, including those looking to benefit from conservation or perpetuity exemptions. By completing the Dr418c, property owners can potentially reduce their tax liabilities, making it an essential document for financial planning and property management.

How to use the Florida Dr418c

Using the Florida Dr418c involves several straightforward steps. First, property owners must ensure they meet the eligibility criteria for the exemption they are applying for. Next, they need to accurately fill out the form, providing all required information, including property details and the specific exemption being sought. Once completed, the form can be submitted through designated channels, which may include online submission, mailing, or in-person delivery to the appropriate local tax authority.

Steps to complete the Florida Dr418c

Completing the Florida Dr418c requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation, such as proof of ownership and any relevant property assessments.

- Access the Dr418c form, which can typically be found on the Florida Department of Revenue website or through local tax offices.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to ensure consideration for the exemption.

Eligibility Criteria

To qualify for the exemption associated with the Florida Dr418c, applicants must meet specific eligibility criteria. Generally, these criteria include being the legal owner of the property, using the property for the intended purpose of the exemption, and complying with any local regulations. It is essential for applicants to verify their eligibility before submitting the form to avoid delays or denials in the exemption process.

Required Documents

When applying for the Florida Dr418c, certain documents are typically required to support the application. These may include:

- Proof of property ownership, such as a deed or title.

- Documentation demonstrating the property's use, especially for conservation-related exemptions.

- Any previous tax exemption approvals, if applicable.

Providing complete and accurate documentation can significantly enhance the chances of a successful application.

Form Submission Methods

The Florida Dr418c can be submitted through various methods, depending on local tax authority guidelines. Common submission methods include:

- Online submission via the local tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person delivery to local tax authority offices during business hours.

Choosing the appropriate submission method is crucial to ensure timely processing of the exemption application.

Quick guide on how to complete florida dr418c

Complete Florida Dr418c seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed documents, as you can access the proper form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Florida Dr418c on any gadget with airSlate SignNow Android or iOS applications and streamline any document-oriented workflow today.

How to edit and eSign Florida Dr418c with ease

- Locate Florida Dr418c and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your preference. Edit and eSign Florida Dr418c and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dr418c

Create this form in 5 minutes!

How to create an eSignature for the florida dr418c

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to dr real?

airSlate SignNow is an easy-to-use, cost-effective solution designed for businesses to send and eSign documents efficiently. With dr real, you can ensure all your documents are securely signed, enhancing your workflow and productivity.

-

How much does airSlate SignNow cost and does it include dr real features?

airSlate SignNow offers various pricing plans to fit different business needs, and all plans include essential dr real features such as unlimited eSignature requests and document storage. You can choose the plan that best aligns with your requirements and budget.

-

What features does airSlate SignNow offer with dr real?

airSlate SignNow provides a suite of features like customizable templates, team collaboration, and real-time notifications, all enhanced with dr real capabilities. This ensures that your document management process is streamlined and efficient.

-

Can airSlate SignNow integrate with other tools and does it support dr real?

Yes, airSlate SignNow integrates seamlessly with multiple applications, allowing you to connect your existing tools while benefiting from dr real functionalities. This integration enhances your workflow and data management practices.

-

What benefits does using airSlate SignNow with dr real provide?

Using airSlate SignNow along with dr real enables businesses to streamline their signing processes, save time, and reduce errors. The user-friendly interface ensures that both senders and recipients find it easy to navigate and manage documents.

-

Is airSlate SignNow secure for handling sensitive documents and dr real signatures?

Absolutely! airSlate SignNow prioritizes security, employing top-tier encryption and compliance measures, making it safe for handling sensitive documents and dr real signatures. You can trust that your data remains protected.

-

How can I get started with airSlate SignNow and dr real?

Getting started with airSlate SignNow and its dr real capabilities is quick and easy. Simply sign up for a free trial, explore the features, and see how the platform can simplify your document signing and management processes.

Get more for Florida Dr418c

- Whistle stop manual ver ws115 shaffer distributing company form

- Loudoun county buildingzoning permit application form

- Adams county jail inmate release form

- 1001 n w 63rd street suite 305 oklahoma city ok form

- Supreme court of mississippi appearance form case

- Tennessee construction contract cost plus or fixed fee form

- Use this form for requesting a self audit under the provisions of m

- Mc 07 default request and entry form

Find out other Florida Dr418c

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe