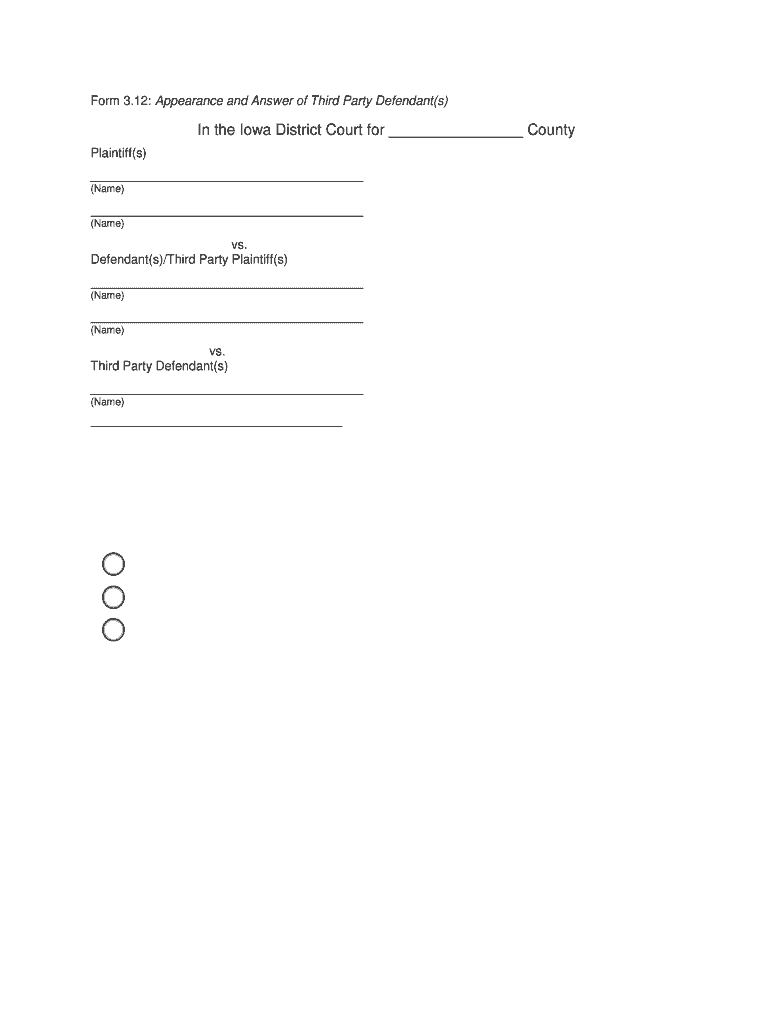

Form 3 12

What is the Form 3 12

The Form 3 12 is a specific document used primarily for tax purposes in the United States. It serves as a crucial tool for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is essential for ensuring compliance with federal tax regulations. The form collects data that may influence tax liabilities and eligibility for various credits or deductions.

How to use the Form 3 12

Using the Form 3 12 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the reporting period. This may include income statements, previous tax returns, and any relevant receipts. Next, carefully fill out the form, making sure to provide accurate figures and check for any required signatures. Once completed, the form can be submitted electronically or via mail, depending on the specific instructions provided by the IRS.

Steps to complete the Form 3 12

Completing the Form 3 12 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Review the instructions provided with the form to understand the requirements.

- Gather all relevant financial documents to ensure accurate reporting.

- Fill out the form carefully, ensuring all fields are completed as required.

- Double-check your entries for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form by the deadline, either electronically or by mail.

Legal use of the Form 3 12

The legal use of the Form 3 12 is governed by IRS regulations, which outline the requirements for its completion and submission. To ensure that the form is legally binding, it must be filled out accurately and submitted on time. Failure to comply with these regulations may result in penalties, including fines or additional scrutiny from the IRS. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3 12 are critical to avoid penalties. Typically, the form must be submitted by the annual tax deadline, which is usually April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. It is advisable to check the IRS website or consult a tax professional for the most current information regarding deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form 3 12 can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Many taxpayers choose to submit their forms electronically using IRS-approved software, which often simplifies the process and reduces errors.

- Mail: For those who prefer traditional methods, the form can be printed and mailed to the appropriate IRS address, as specified in the form instructions.

- In-Person: Some individuals may opt to deliver their forms in person at designated IRS offices, though this method is less common.

Quick guide on how to complete form 312

Effortlessly Prepare Form 3 12 on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 3 12 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 3 12 Easily

- Obtain Form 3 12 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact confidential information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your alterations.

- Decide how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 3 12 to ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 312

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 3 12, and how does it relate to airSlate SignNow?

Form 3 12 is a specific document format that can be easily managed and signed using airSlate SignNow. Our platform streamlines the eSignature process, ensuring that Form 3 12 documents are processed quickly and efficiently.

-

What features does airSlate SignNow offer for Form 3 12 eSignatures?

airSlate SignNow includes features like customizable templates, document tracking, and automated reminders specifically designed for Form 3 12. These capabilities ensure a smooth signing experience and help you stay organized while managing your documents.

-

How much does it cost to use airSlate SignNow for Form 3 12?

AirSlate SignNow offers competitive pricing plans that cater to different business needs for processing Form 3 12. Our plans include various features tailored to ensure that you get the best value for eSigning documents.

-

Can I integrate airSlate SignNow with other applications for managing Form 3 12?

Yes, airSlate SignNow provides integrations with a variety of applications and platforms that help streamline the process of handling Form 3 12. This integration enhances your workflow by allowing you to manage documents from multiple sources seamlessly.

-

What are the benefits of using airSlate SignNow for Form 3 12?

Using airSlate SignNow for Form 3 12 offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved document security. With our platform, you can ensure faster turnaround times and a more professional image for your business.

-

Is airSlate SignNow compliant with legal regulations for Form 3 12?

Absolutely, airSlate SignNow complies with all relevant eSignature laws and regulations for Form 3 12, ensuring that your signed documents are legally binding. Our platform prioritizes security and compliance to protect your business.

-

How user-friendly is airSlate SignNow for signing Form 3 12?

AirSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to eSign Form 3 12 documents without technical expertise. Our intuitive interface guides users through the signing process seamlessly.

Get more for Form 3 12

- Why did you choose this pet adopters and pet selection form

- Bayridge secondary school 40 hour community involv form

- Non compliance notification form

- Sign this form and return it to your local csst of

- Is there any change in your home address form

- Indemnification agreement form ryerson university ryerson

- Networking coffee 4 sponsorship form

- Police clearance windsor form fill out and sign signnow

Find out other Form 3 12

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later