Fsa 211 Form

What is the FSA 211 Form?

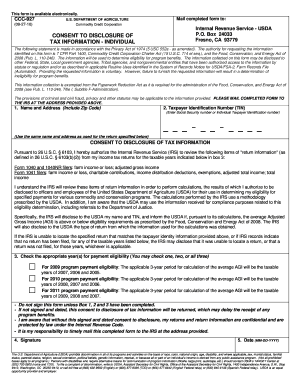

The FSA 211 form, also known as the CCC-927 disclosure form, is a critical document used in agricultural programs administered by the United States Department of Agriculture (USDA). This form is primarily utilized to collect essential information regarding the applicant's eligibility for various USDA programs, including those related to farm assistance and disaster relief. The FSA 211 form ensures that the USDA can accurately assess the applicant's needs and determine the appropriate support and resources available.

Steps to Complete the FSA 211 Form

Completing the FSA 211 form involves several straightforward steps to ensure accuracy and compliance with USDA requirements. Here are the key steps:

- Gather necessary documentation, including identification and any relevant agricultural records.

- Access the FSA 211 form online or obtain a printed copy from your local FSA office.

- Fill out the form carefully, providing all requested information, such as your name, address, and details about your agricultural operations.

- Review the completed form for accuracy and completeness before submission.

- Submit the form electronically through the USDA's online platform or mail it to the appropriate FSA office.

Legal Use of the FSA 211 Form

The FSA 211 form is legally binding when completed and submitted in accordance with USDA guidelines. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or denial of assistance. The form must be signed by the applicant or an authorized representative, affirming that the information is correct to the best of their knowledge. Compliance with the legal stipulations surrounding this form is crucial for maintaining eligibility for USDA programs.

Required Documents for the FSA 211 Form

When filling out the FSA 211 form, certain documents may be required to verify the information provided. These documents typically include:

- Proof of identity, such as a driver's license or state ID.

- Tax identification number or Social Security number.

- Records of agricultural production, including receipts, contracts, or previous application forms.

- Any other documentation that supports the claims made in the application.

Form Submission Methods

The FSA 211 form can be submitted through several methods to accommodate different preferences and situations. Applicants have the option to:

- Submit the form online via the USDA's electronic filing system, which offers a convenient and efficient process.

- Mail the completed form to their local FSA office, ensuring it is sent well before any deadlines.

- Visit the local FSA office in person to submit the form and receive assistance if needed.

Examples of Using the FSA 211 Form

The FSA 211 form is used in various scenarios related to agricultural assistance. Examples include:

- Farmers applying for disaster relief programs after experiencing crop loss due to natural disasters.

- Producers seeking financial assistance for implementing sustainable farming practices.

- Individuals applying for loans or grants to support agricultural development or expansion.

Quick guide on how to complete fsa 211 form 11525742

Effortlessly Prepare Fsa 211 Form on Any Device

The utilization of online document management has increased signNowly among companies and individuals. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents quickly and without delays. Manage Fsa 211 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

The Simplest Method to Edit and Electronically Sign Fsa 211 Form with Ease

- Obtain Fsa 211 Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of your documents or obscure confidential information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry about lost or disorganized documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Edit and electronically sign Fsa 211 Form to guarantee outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsa 211 form 11525742

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 927 disclosure form online and why do I need it?

The 927 disclosure form online is a critical document used for providing essential information related to transactions. It ensures compliance with regulatory requirements and promotes transparency in your dealings. Using this form online simplifies the entire process, allowing you to fill it out quickly and efficiently.

-

How can I complete the 927 disclosure form online using airSlate SignNow?

You can easily complete the 927 disclosure form online with airSlate SignNow by uploading your document and using our intuitive editing tools. Simply drag and drop fields where necessary, sign with an eSignature, and finalize your document in just a few clicks. Our platform guides you through each step to ensure a seamless experience.

-

Is there a cost associated with using the 927 disclosure form online?

Yes, there is a cost associated with utilizing the 927 disclosure form online through airSlate SignNow. Our pricing is designed to be cost-effective, offering various subscription plans to meet different business needs. Visit our pricing page to find the plan that suits you best.

-

What features are available when using the 927 disclosure form online with airSlate SignNow?

When using the 927 disclosure form online, you get access to features like customizable templates, eSigning capabilities, and secure document storage. Other functionalities include team collaboration, audit trails, and integration with popular applications to streamline your workflow. These features enhance your overall document signing experience.

-

Can I integrate the 927 disclosure form online with other software?

Absolutely! airSlate SignNow allows for seamless integration of the 927 disclosure form online with various third-party applications such as CRM systems, cloud storage services, and project management tools. This integration enhances productivity and ensures that your documents are easily accessible across platforms.

-

What are the benefits of using the 927 disclosure form online with airSlate SignNow?

Using the 927 disclosure form online with airSlate SignNow offers numerous benefits, including increased efficiency, reduced paper usage, and simplified compliance processes. Additionally, it enables faster turnaround times for agreements and promotes a professional image for your business. The user-friendly interface further enhances your overall experience.

-

Is the 927 disclosure form online secure for sensitive information?

Yes, the 927 disclosure form online is designed with security in mind. airSlate SignNow employs advanced encryption protocols and authentication measures to safeguard your sensitive information. You can trust that your data remains protected throughout the signing process.

Get more for Fsa 211 Form

- App leg wa govrcwdefaultchapter 64 37 rcw short term rentals wa form

- Com wesley commons hoa homeowner information sheet property address homeowners name spouse or coowners name owners mailing

- Public housing section 8 application update form

- Pdf carbon benefits from avoiding and repairing forest degradationfrancis putz form

- Ma shared housing verification form

- All about you form 74691748

- Rfp 21 24 lease or purchase of space for assembly square fire form

Find out other Fsa 211 Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF