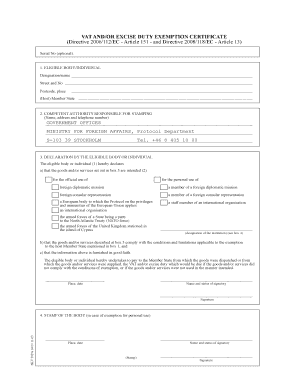

Vat Exemption Certificate Form

What is the Vat Exemption Certificate

The Vat Exemption Certificate is a crucial document that allows businesses to purchase goods and services without paying Value Added Tax (VAT). This certificate is essential for organizations that qualify for VAT exemptions, enabling them to manage their tax liabilities effectively. Understanding the specifics of this certificate is vital for ensuring compliance with tax regulations and optimizing financial operations.

How to Obtain the Vat Exemption Certificate

To obtain the Vat Exemption Certificate, businesses must first determine their eligibility based on specific criteria set by tax authorities. Generally, this involves completing an application form and providing necessary documentation, such as proof of business status and details of the goods or services for which the exemption is sought. Once submitted, the application will be reviewed, and upon approval, the certificate will be issued.

Steps to Complete the Vat Exemption Certificate

Completing the Vat Exemption Certificate involves several key steps:

- Gather necessary documents, including business registration details and previous tax returns.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions.

- Submit the completed form along with supporting documents to the appropriate tax authority.

Following these steps helps ensure a smooth application process and increases the likelihood of approval.

Key Elements of the Vat Exemption Certificate

The Vat Exemption Certificate contains several important elements that must be accurately filled out:

- Business Information: Name, address, and tax identification number of the business.

- Exemption Reason: A clear statement of why the exemption is being requested.

- Details of Purchases: A description of the goods or services for which the exemption applies.

- Signature: Authorized signature of the business representative to validate the application.

Legal Use of the Vat Exemption Certificate

The legal use of the Vat Exemption Certificate is governed by tax laws that specify under what circumstances the certificate can be utilized. Businesses must ensure that they are compliant with these regulations to avoid penalties. The certificate should only be used for eligible purchases, and misuse can lead to legal consequences, including fines or revocation of the exemption status.

Eligibility Criteria

Eligibility for the Vat Exemption Certificate typically includes factors such as the type of business entity, the nature of the goods or services purchased, and the intended use of those goods or services. Organizations that primarily serve non-profit sectors or engage in specific exempt activities may qualify. It is essential to review the specific criteria outlined by tax authorities to determine if your business is eligible.

Quick guide on how to complete vat exemption certificate

Effortlessly Prepare Vat Exemption Certificate on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without any holdups. Handle Vat Exemption Certificate on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Vat Exemption Certificate

- Obtain Vat Exemption Certificate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Vat Exemption Certificate and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT certificate?

A VAT certificate is an official document issued by a tax authority that confirms your registration for Value Added Tax (VAT). It provides proof that your business is authorized to collect VAT on sales and reclaim VAT on purchases. Understanding what a VAT certificate is essential for legal compliance and tax reporting.

-

How can airSlate SignNow help with managing VAT certificates?

airSlate SignNow streamlines the process of managing VAT certificates by allowing businesses to eSign and send documents electronically. This saves time and reduces the risk of errors associated with traditional document handling. By using airSlate SignNow, you can quickly create and manage your VAT certificates, ensuring compliance and accuracy.

-

What benefits does a VAT certificate offer my business?

A VAT certificate allows your business to operate legally within the VAT system, enabling you to charge VAT on sales and recover VAT on eligible expenses. This can improve cash flow and help maintain compliance with tax regulations. Overall, knowing what a VAT certificate offers can signNowly benefit your financial management practices.

-

How much does airSlate SignNow cost for managing VAT certificates?

airSlate SignNow offers various pricing plans that cater to teams and businesses of all sizes. While costs may vary based on the plan and features chosen, leveraging airSlate SignNow for managing VAT certificates is a cost-effective solution compared to manual processing. To find the best plan for your needs, visit our pricing page.

-

Can VAT certificates be integrated with other accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions for efficient management of VAT certificates. This integration helps streamline workflows by allowing automatic updates and document sharing between platforms. Understanding these integrations enhances your overall business efficiency and ensures accurate tax reporting.

-

Is it easy to eSign a VAT certificate using airSlate SignNow?

Yes, eSigning a VAT certificate using airSlate SignNow is straightforward and user-friendly. The platform allows you to digitally sign documents with just a few clicks, which speeds up the process signNowly compared to traditional signing methods. Discovering how easy it is to eSign can enhance your team's productivity.

-

What documents do I need to provide for a VAT certificate?

To obtain a VAT certificate, you typically need to submit your business registration details, proof of identity, and any other specific documents required by your local tax authority. The exact requirements may vary by jurisdiction, so it’s essential to check the guidelines applicable to your region. Knowing what documents to prepare ensures a smoother application process for your VAT certificate.

Get more for Vat Exemption Certificate

- Film release form

- Genetic counseling intake form 1 diablo valley

- Icici lombard claim form

- Idcfs authorization for background checks for child welfare employee licensure form

- Edd appeal letter sample 393453588 form

- Notes for claiming australian pension social security agreement between australia and spain notas para solicitar una pensi n form

- Defamation settlement agreement template form

- Deferment agreement template form

Find out other Vat Exemption Certificate

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement