Form Ct 656a

What is the Form CT-656A

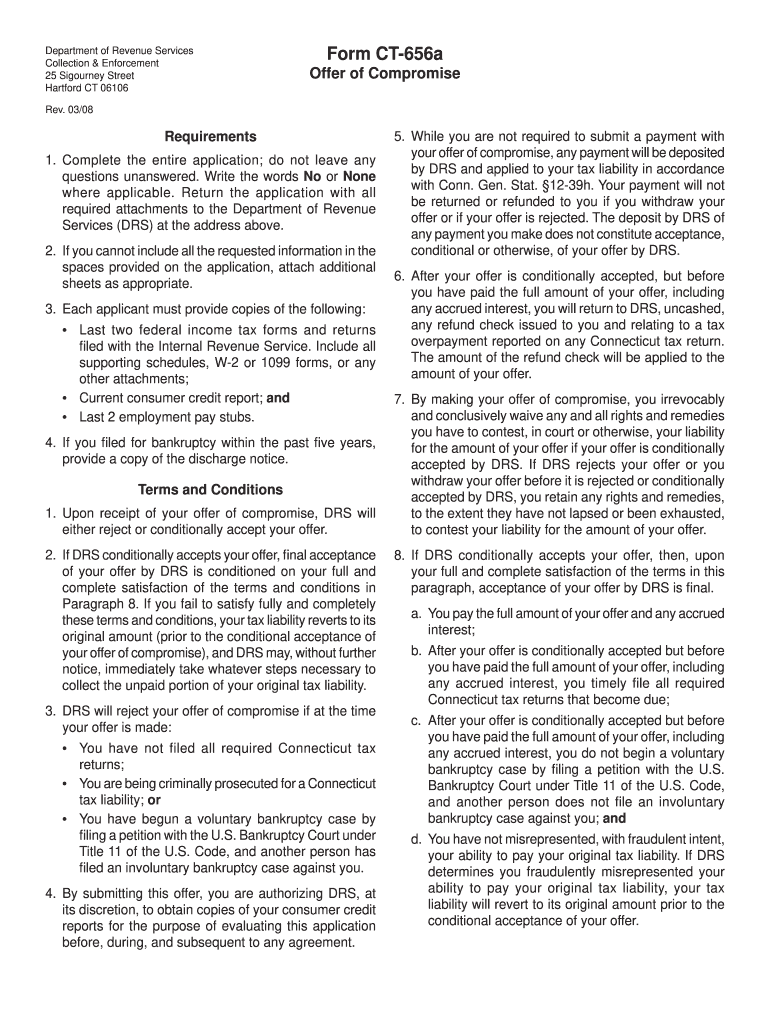

The Form CT-656A is an official document used by taxpayers in Connecticut to request an offer in compromise with the Connecticut Department of Revenue Services. This form allows individuals or businesses facing financial difficulties to settle their tax liabilities for less than the full amount owed. By submitting this form, taxpayers can propose a reduced payment based on their ability to pay, which can provide significant relief from overwhelming tax debts.

How to Use the Form CT-656A

To effectively use the Form CT-656A, taxpayers must first gather all necessary financial documentation that supports their offer. This includes income statements, expenses, and any other relevant financial information. Once the form is completed, it should be submitted to the Connecticut Department of Revenue Services for review. It is crucial to ensure that all information is accurate and complete to avoid delays in processing.

Steps to Complete the Form CT-656A

Completing the Form CT-656A involves several key steps:

- Download the form from the Connecticut Department of Revenue Services website.

- Fill out personal and financial information accurately, including income, expenses, and assets.

- Calculate the proposed offer amount based on your financial situation.

- Attach supporting documentation that validates your financial claims.

- Review the completed form for accuracy and completeness.

- Submit the form along with any required fees to the appropriate department.

Legal Use of the Form CT-656A

The legal use of the Form CT-656A is governed by state tax laws and regulations. It is essential for taxpayers to understand that submitting this form does not guarantee acceptance of the offer. The Connecticut Department of Revenue Services will evaluate each submission based on the taxpayer's financial situation and the likelihood of collecting the full tax amount. Compliance with all legal requirements is necessary to ensure that the offer is considered valid.

Required Documents

When submitting the Form CT-656A, taxpayers must include several required documents to support their offer. These documents typically include:

- Recent tax returns.

- Proof of income, such as pay stubs or bank statements.

- Documentation of monthly expenses, including bills and lease agreements.

- Any additional financial statements that demonstrate the taxpayer's financial condition.

Form Submission Methods

The Form CT-656A can be submitted through various methods to ensure convenience for taxpayers. These methods include:

- Online submission through the Connecticut Department of Revenue Services portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local Department of Revenue Services offices.

Eligibility Criteria

To qualify for an offer in compromise using the Form CT-656A, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Demonstrating an inability to pay the full tax liability.

- Providing accurate financial information.

- Being compliant with all filing and payment requirements for the last five years.

Quick guide on how to complete form ct 656a

Complete Form Ct 656a effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage Form Ct 656a across any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to alter and eSign Form Ct 656a with ease

- Obtain Form Ct 656a and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and eSign Form Ct 656a and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 656a

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the 2008 Connecticut CT Revenue Service Offer in Compromise?

The 2008 Connecticut CT Revenue Service Offer in Compromise is a program that allows taxpayers to settle their tax debts for less than the full amount owed. This option is particularly beneficial for individuals who are facing financial hardships and cannot fully pay their taxes. By understanding this program, you can explore opportunities to lighten your tax burden.

-

Who qualifies for the 2008 Connecticut CT Revenue Service Offer in Compromise?

To qualify for the 2008 Connecticut CT Revenue Service Offer in Compromise, taxpayers must demonstrate that they are unable to pay their tax debts in full due to financial difficulties. Factors such as income, expenses, and overall financial situation are evaluated. Consulting with tax professionals can help individuals navigate the qualifying criteria effectively.

-

How can airSlate SignNow assist with the 2008 Connecticut CT Revenue Service Offer in Compromise process?

airSlate SignNow simplifies the document preparation and submission process for the 2008 Connecticut CT Revenue Service Offer in Compromise. Our platform allows you to easily eSign and manage all necessary paperwork securely and efficiently. This streamlined approach saves time and ensures you submit all required information accurately.

-

What are the costs associated with the 2008 Connecticut CT Revenue Service Offer in Compromise?

The costs associated with the 2008 Connecticut CT Revenue Service Offer in Compromise may include application fees and possible legal fees if you hire a tax professional. The exact amount can vary depending on your specific situation and the complexity of your case. It's essential to budget accordingly to ensure a successful application process.

-

What features does airSlate SignNow offer for preparing offers in compromise?

airSlate SignNow provides numerous features for preparing offers in compromise, including cloud storage, secure eSigning, and customizable templates. With our solution, you can organize your financial documentation efficiently, ensuring that you have everything ready for your 2008 Connecticut CT Revenue Service Offer in Compromise application. These features help facilitate a smoother filing process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, particularly for the 2008 Connecticut CT Revenue Service Offer in Compromise, offers signNow benefits such as increased efficiency and enhanced security. Our platform allows you to track document status in real-time and provides enhanced encryption for sensitive information. This makes managing your tax documents easier and safer.

-

Is it possible to integrate airSlate SignNow with other tax software for the 2008 Connecticut CT Revenue Service Offer in Compromise?

Yes, airSlate SignNow integrates with a variety of tax software solutions, making it easier for users to manage their tax responsibilities, including the 2008 Connecticut CT Revenue Service Offer in Compromise. These integrations allow for seamless data transfer and document management, enhancing your overall experience. You can connect your preferred applications easily within our platform.

Get more for Form Ct 656a

- Restrictive covenant agreement sample form

- Physicians statement ohio department of public safety form

- Statement of conversion foreign or non registered to form

- Vs 400rev form

- Notice for final hearing non jury trial state of florida fifth judicial form

- This packet contains forms and henry county georgia

- Preferred notary form kentucky labor cabinet labor ky

- E verify affidavit columbusga form

Find out other Form Ct 656a

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement