Form FT 420906 Refund Application for Farmers Purchasing Motor Tax Ny 2006

What is the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny

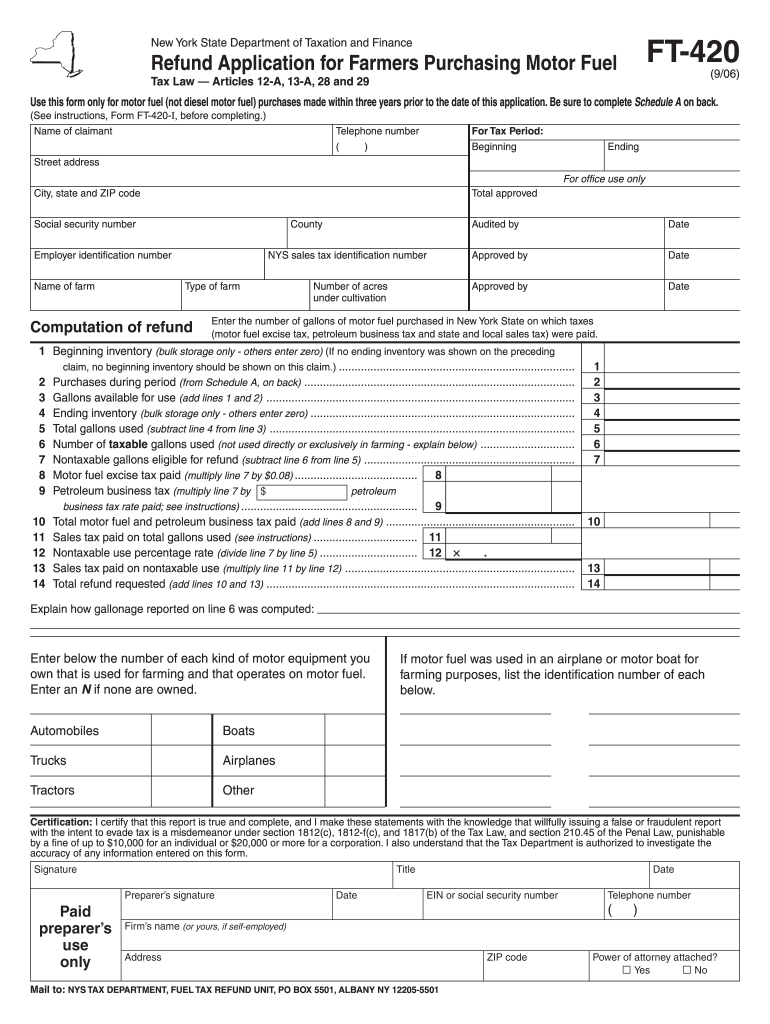

The Form FT 420906 Refund Application is specifically designed for farmers in New York seeking refunds for motor vehicle taxes paid on vehicles used primarily for agricultural purposes. This form allows eligible farmers to reclaim taxes that may have been overpaid or incorrectly assessed. By submitting this application, farmers can ensure they receive the financial relief intended for their operations, aligning with state regulations that support agricultural activities.

How to use the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny

To effectively use the Form FT 420906, farmers should first gather all necessary information regarding their vehicle purchases and tax payments. This includes details such as the vehicle identification number (VIN), purchase date, and the amount of tax paid. Once the form is completed, it should be submitted to the appropriate state tax authority. Farmers can track their application status through the state’s online portal, ensuring they stay informed about the progress of their refund request.

Steps to complete the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny

Completing the Form FT 420906 involves several key steps:

- Gather all required documentation, including proof of vehicle purchase and tax payment receipts.

- Fill out the form accurately, ensuring all personal and vehicle information is correct.

- Review the application for completeness and accuracy.

- Submit the form to the designated state tax office, either online or via mail.

- Keep a copy of the submitted form and any supporting documents for your records.

Eligibility Criteria

To qualify for a refund using the Form FT 420906, applicants must meet specific eligibility criteria. The vehicle in question must be primarily used for agricultural purposes, and the applicant must be a registered farmer in New York. Additionally, the tax must have been paid on the vehicle, and the application must be submitted within the designated timeframe set by the state tax authority. It is essential for farmers to verify their eligibility before submitting the application to avoid delays.

Form Submission Methods (Online / Mail / In-Person)

The Form FT 420906 can be submitted through various methods to accommodate different preferences. Farmers may choose to file the form online via the New York State Department of Taxation and Finance website, which is often the fastest option. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own processing times, so farmers should select the one that best meets their needs.

Required Documents

When submitting the Form FT 420906, farmers must include several required documents to support their application. These typically include:

- Proof of vehicle purchase, such as a bill of sale or purchase agreement.

- Receipts or documentation showing the amount of motor vehicle tax paid.

- Any additional forms or documentation requested by the state tax authority.

Ensuring that all required documents are submitted with the application can help expedite the refund process.

Quick guide on how to complete form ft 420906 refund application for farmers purchasing motor tax ny

Complete Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny effortlessly on any device

The management of online documents has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny without hassle

- Find Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny and click Get Form to begin.

- Use the tools we provide to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools available through airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ft 420906 refund application for farmers purchasing motor tax ny

Create this form in 5 minutes!

How to create an eSignature for the form ft 420906 refund application for farmers purchasing motor tax ny

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

The Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny is a specific application designed for farmers in New York to claim refunds on motor vehicle tax. This form allows farmers to recoup costs that are due to the purchase of motor vehicles used in their farming operations, ensuring they are not overburdened by tax expenses.

-

How can I fill out the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny using airSlate SignNow?

You can easily fill out the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny using airSlate SignNow's intuitive platform. With our user-friendly interface, you can enter your information directly into the form, ensuring all necessary details are accurately captured for a successful application.

-

Are there any fees associated with using airSlate SignNow for Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

airSlate SignNow offers competitive pricing plans with no hidden fees for submitting the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny. We have different subscription tiers that cater to your specific needs, making it a cost-effective solution for all users.

-

What features does airSlate SignNow offer for managing the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

airSlate SignNow provides a range of features for managing the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny, including eSigning capabilities, document tracking, and secure cloud storage. These features simplify the application process, ensuring you can manage your documents efficiently and securely.

-

Can I integrate airSlate SignNow with other tools for processing the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

Yes, airSlate SignNow allows seamless integration with numerous third-party applications, enhancing your workflow for processing the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny. Whether you need to link with CRMs or other productivity tools, our platform supports a variety of integrations.

-

Is there customer support available for questions about the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

Absolutely! airSlate SignNow offers comprehensive customer support for any inquiries you may have regarding the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny. Our dedicated support team is available via chat, email, or phone to assist you with any questions or concerns.

-

What are the benefits of using airSlate SignNow for submitting the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny?

Using airSlate SignNow for submitting the Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny provides several benefits, including speed, convenience, and security. Our platform enables you to complete your application faster while ensuring all your sensitive information remains protected.

Get more for Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny

- Access honorhealth com form

- State of california audit renewal paramedic license application form

- Sports player contract template form

- Sports sponsorship contract template form

- Sports team contract template form

- Spreadsheet management contract template form

- Spreadsheet contract template form

- Squarespace contract template form

Find out other Form FT 420906 Refund Application For Farmers Purchasing Motor Tax Ny

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure