Texas Fillable Tax Exemption Form 2010

What is the Texas Fillable Tax Exemption Form

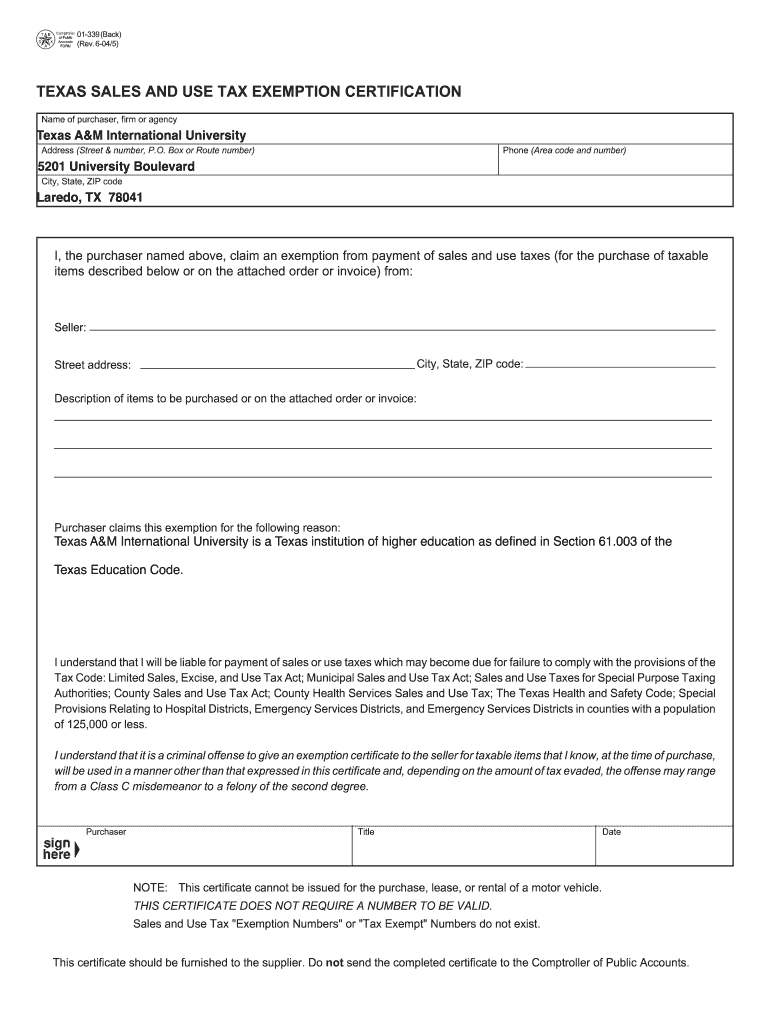

The Texas Fillable Tax Exemption Form is a document that allows eligible individuals and organizations to claim exemption from certain taxes in Texas. This form is primarily used to assert that the applicant qualifies for tax exemptions based on specific criteria set forth by the state. Common exemptions may include those for non-profit organizations, religious institutions, and certain types of businesses. Understanding the purpose and requirements of this form is crucial for ensuring compliance with Texas tax laws.

How to use the Texas Fillable Tax Exemption Form

Using the Texas Fillable Tax Exemption Form involves several key steps. First, ensure that you meet the eligibility criteria for the exemption you are claiming. Next, download the fillable form from a reliable source, such as the Texas Comptroller's website. After downloading, fill in the necessary information, including your name, address, and details relevant to the exemption. Once completed, review the form for accuracy before submitting it as directed.

Steps to complete the Texas Fillable Tax Exemption Form

Completing the Texas Fillable Tax Exemption Form requires careful attention to detail. Follow these steps for successful completion:

- Download the form from a trusted source.

- Fill in your personal or business information accurately.

- Provide the necessary documentation to support your claim.

- Review all entries for completeness and correctness.

- Sign and date the form as required.

- Submit the form according to the instructions provided.

Legal use of the Texas Fillable Tax Exemption Form

The legal use of the Texas Fillable Tax Exemption Form is governed by Texas tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with state guidelines. This includes providing truthful information and supporting documentation. Misrepresentation or failure to comply with the legal requirements may result in penalties or the denial of the exemption.

Eligibility Criteria

Eligibility for the Texas Fillable Tax Exemption Form varies based on the type of exemption being claimed. Generally, individuals or entities must meet specific criteria, such as being a non-profit organization, a religious institution, or a business operating in a designated sector. It is essential to review the eligibility requirements outlined by the Texas Comptroller to determine if you qualify for the exemption.

Required Documents

When submitting the Texas Fillable Tax Exemption Form, certain documents may be required to support your application. These documents can include:

- Proof of non-profit status, such as a 501(c)(3) letter.

- Tax identification numbers for individuals or businesses.

- Financial statements or budgets for organizations.

- Any additional documentation specified for the type of exemption claimed.

Form Submission Methods

The Texas Fillable Tax Exemption Form can typically be submitted through various methods. Common submission options include:

- Online submission via the Texas Comptroller's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure timely processing of your exemption claim.

Quick guide on how to complete texas fillable tax exemption form 2004

Complete Texas Fillable Tax Exemption Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents promptly without interruptions. Manage Texas Fillable Tax Exemption Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Texas Fillable Tax Exemption Form effortlessly

- Obtain Texas Fillable Tax Exemption Form and click Get Form to begin.

- Use the available tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of sending your form, either by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Texas Fillable Tax Exemption Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas fillable tax exemption form 2004

Create this form in 5 minutes!

How to create an eSignature for the texas fillable tax exemption form 2004

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is a Texas Fillable Tax Exemption Form?

A Texas Fillable Tax Exemption Form is a standardized document used by Texas residents to claim exemptions from certain taxes. This fillable form allows you to input your information electronically, making the process more efficient. Utilizing airSlate SignNow, you can easily create, complete, and submit this form online.

-

How can I access the Texas Fillable Tax Exemption Form using airSlate SignNow?

You can access the Texas Fillable Tax Exemption Form on the airSlate SignNow platform by creating an account. Once logged in, search for the tax exemption form in the templates section, and you can start filling it out electronically. This feature streamlines the entire process, ensuring you meet tax filing deadlines.

-

What are the benefits of using the Texas Fillable Tax Exemption Form with airSlate SignNow?

Using the Texas Fillable Tax Exemption Form with airSlate SignNow provides multiple benefits, including the ability to eSign documents, track the status of your submissions, and reduce paperwork. This electronic solution simplifies the tax exemption process, ensuring compliance and saving valuable time and resources.

-

Is there a cost associated with using the Texas Fillable Tax Exemption Form on airSlate SignNow?

While airSlate SignNow offers various subscription plans, accessing the Texas Fillable Tax Exemption Form is included in these plans. You can choose a plan that best fits your needs, providing you with cost-effective access to a wide range of document management tools, including tax exemption forms.

-

What features does airSlate SignNow offer for filling out the Texas Fillable Tax Exemption Form?

airSlate SignNow provides features such as auto-fill options, customizable templates, and eSignature capabilities for the Texas Fillable Tax Exemption Form. These features enhance your experience by making it easier to complete forms accurately and quickly. Additionally, you can save and share your documents effortlessly.

-

Can I integrate the Texas Fillable Tax Exemption Form with other applications?

Yes, airSlate SignNow supports integrations with various applications, allowing you to connect your Texas Fillable Tax Exemption Form with tools you already use. This includes cloud storage services and CRM systems, enabling seamless data flow and enhanced productivity in managing tax-related documents.

-

How does airSlate SignNow ensure the security of my Texas Fillable Tax Exemption Form?

airSlate SignNow prioritizes the security of your documents, including the Texas Fillable Tax Exemption Form. The platform employs advanced encryption technology and secure cloud storage to protect your sensitive information. You can complete and submit your forms with peace of mind, knowing your data is safe.

Get more for Texas Fillable Tax Exemption Form

- 15 37 earnest money contract brazoria county texas form

- Landlords sworn motion for writ of possession form

- Ordernotice to withhold income for child support texas oag child portal cs oag state tx form

- Judicial district court county court at law form

- Fillable online amarillo municipal court community service form

- Amanda runte unit 20 lesson 99 report 99 73 wordpress com form

- Answering the call responding to a texas civil subpoena form

- Qty 1 afe h61 mannhummel direct replacement hydraulic filter form

Find out other Texas Fillable Tax Exemption Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT