Utah Claim for Refund of Fees or Sales Tax for Motor Vehicles, TC 55A 2017

What is the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A

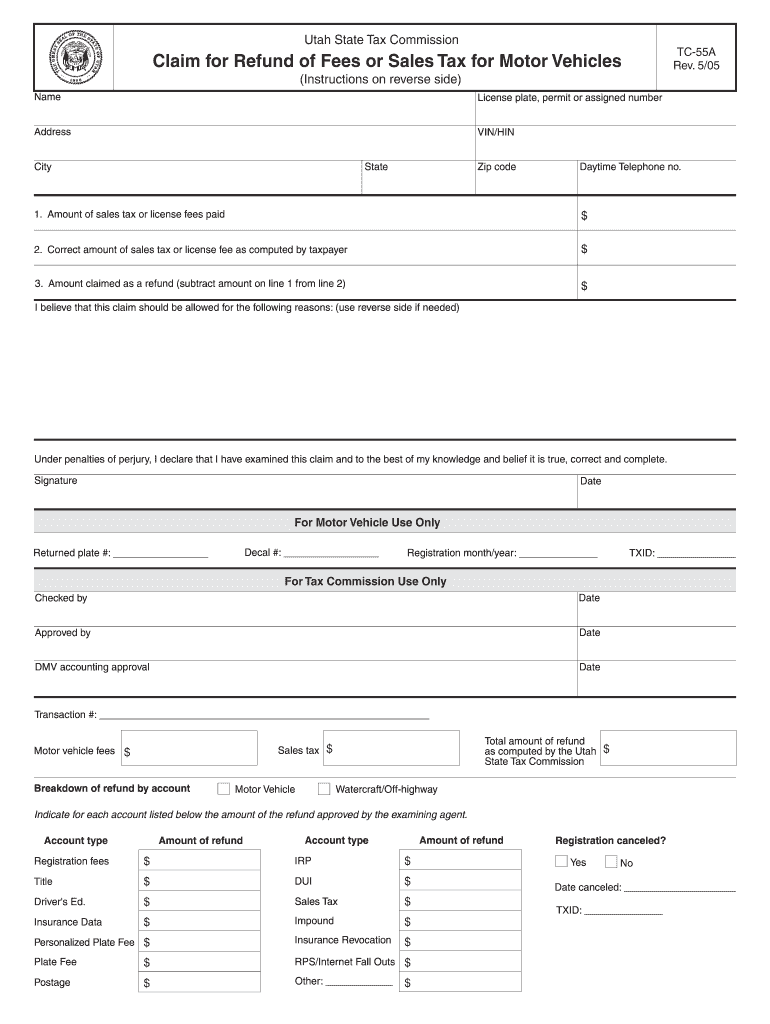

The Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A, is a specific form used by individuals or businesses to request a refund for fees or sales tax paid on motor vehicles in the state of Utah. This form is essential for taxpayers who believe they have overpaid taxes or fees related to vehicle purchases or registrations. By submitting this claim, individuals can seek reimbursement from the state for amounts that were incorrectly charged or assessed.

How to use the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A

To use the TC 55A form effectively, start by gathering all necessary documentation that supports your claim. This may include receipts, proof of payment, and any relevant correspondence with tax authorities. Next, fill out the form accurately, ensuring that all personal and vehicle information is correct. After completing the form, submit it according to the instructions provided, either online or via mail. Keeping a copy of the submitted form and any supporting documents is advisable for your records.

Steps to complete the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A

Completing the TC 55A form involves several key steps:

- Gather supporting documents, including receipts and proof of payment.

- Access the TC 55A form from the official Utah state tax website or relevant sources.

- Fill out the form with accurate information, including your name, address, and vehicle details.

- Clearly state the reason for your refund request, citing any specific errors or overcharges.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either electronically or by mailing it to the appropriate address.

Required Documents

When filing the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A, certain documents are typically required to support your claim. These may include:

- Proof of purchase or payment, such as a receipt or invoice.

- Documentation showing the amount of sales tax or fees paid.

- Any correspondence with tax authorities related to the claim.

- Identification details, such as your driver's license number or Social Security number.

Eligibility Criteria

To be eligible to file the TC 55A form, you must meet specific criteria set by the state of Utah. Generally, the following conditions apply:

- You must be the registered owner of the vehicle for which you are claiming a refund.

- The refund request must be for fees or sales tax that were overpaid.

- The claim must be submitted within the designated timeframe established by state regulations.

Form Submission Methods (Online / Mail / In-Person)

The TC 55A form can be submitted through various methods, depending on your preference and the options available. These methods include:

- Online submission via the official Utah state tax website, if available.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, where applicable.

Quick guide on how to complete utah claim for refund of fees or sales tax for motor vehicles tc 55a

Effortlessly prepare Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A on any device

Online document organization has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Manage Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related procedure today.

The simplest way to modify and eSign Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A without difficulty

- Locate Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A and click on Get Form to begin.

- Utilize the tools we supply to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No need to worry about lost or misplaced files, tedious form navigation, or errors that require reprinting new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utah claim for refund of fees or sales tax for motor vehicles tc 55a

Create this form in 5 minutes!

How to create an eSignature for the utah claim for refund of fees or sales tax for motor vehicles tc 55a

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A?

The Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A, is a specific form used to request a refund for excess fees or sales tax paid on motor vehicles. This form is crucial for individuals or businesses looking to recover taxes they believe were incorrectly assessed. Understanding this process is key for anyone involved with vehicle purchases in Utah.

-

How can airSlate SignNow help with the TC 55A form?

airSlate SignNow offers an efficient platform to create, send, and eSign the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A. With user-friendly templates, you can easily fill out your application online and submit it directly, streamlining the entire refund process. This saves you time and reduces the complexity of paperwork.

-

Are there any fees associated with using airSlate SignNow for the TC 55A?

Using airSlate SignNow for submitting your Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A involves a subscription fee, which varies depending on the plan you choose. However, the cost is generally outweighed by the convenience and efficiency gained through our digital platform. This can lead to faster refunds and less hassle.

-

What features does airSlate SignNow offer for handling motor vehicle tax forms?

airSlate SignNow provides several features for handling the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A, including document templates, electronic signatures, and real-time tracking. These features ensure that your refund requests are processed efficiently and securely. Additionally, our integrations with other software enhance overall management capabilities.

-

Can I integrate airSlate SignNow with other applications to manage the TC 55A process?

Yes, airSlate SignNow can be integrated with a variety of applications to facilitate the management of the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A. This integration allows for smoother workflows, data transfer, and enhanced productivity, making it easier to manage your documentation process. Popular integrations include CRM systems and cloud storage platforms.

-

How does eSigning the TC 55A form work with airSlate SignNow?

With airSlate SignNow, eSigning the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A is straightforward. You simply create your document, add your signature fields, and send it to the necessary parties for their signatures. Once completed, you will receive a fully executed copy, ensuring that your claims are processed without delay.

-

What are the benefits of using airSlate SignNow for the TC 55A?

Using airSlate SignNow for the Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A provides numerous benefits, including enhanced efficiency, reduced paperwork, and a secure signing process. Our digital tools help simplify the filing process, ensuring that you have all documentation in order for a successful claim. Additionally, the ability to track submissions gives you peace of mind.

Get more for Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A

- Table 1 wisconsin department of health services wisconsin gov dhs wisconsin form

- W 4 form federal

- Self employed commission only contract template form

- Self employed courier contract template form

- Self employed contract template form

- Self employed delivery driver contract template form

- Self employed driver contract template form

- Self employed for service contract template form

Find out other Utah Claim For Refund Of Fees Or Sales Tax For Motor Vehicles, TC 55A

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF