W 4 Form Federal 2023-2026

What is the W-4 Form Federal

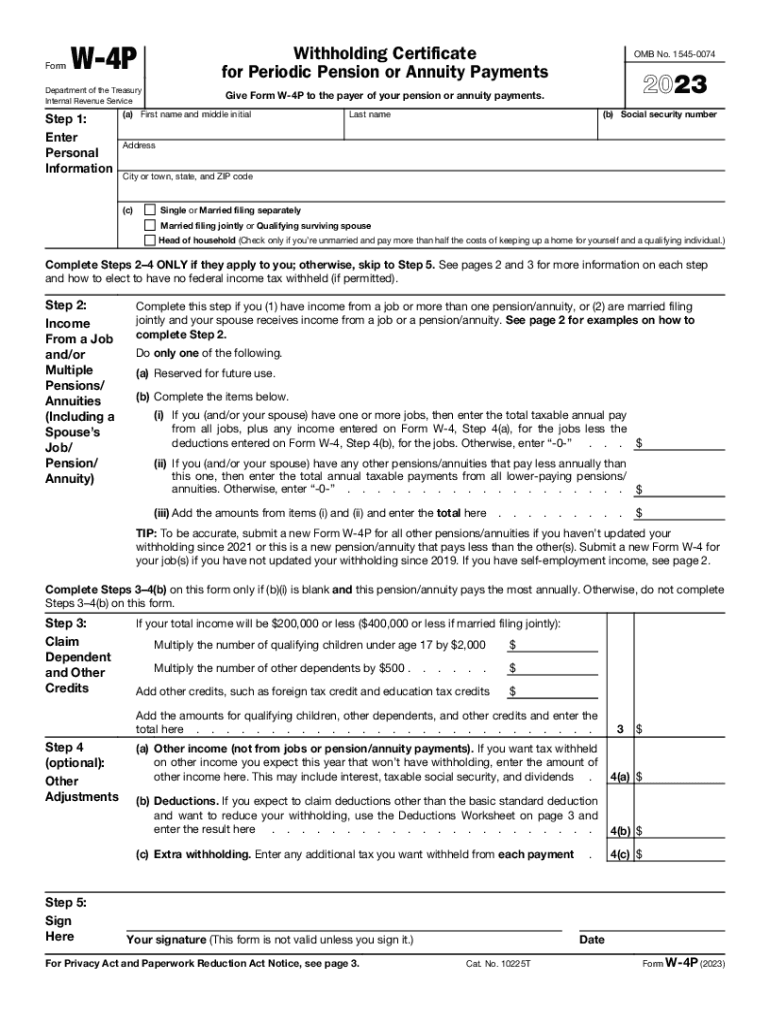

The W-4 form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing the W-4, employees can ensure that they are not overpaying or underpaying their taxes throughout the year.

How to use the W-4 Form Federal

Using the W-4 form involves several steps. First, employees must obtain the form from their employer or download it from the IRS website. Next, they should fill out the form with their personal information, including filing status, number of dependents, and any additional income or deductions. Once completed, the form should be submitted to the employer, who will then adjust the tax withholding accordingly. It is advisable to review and update the W-4 whenever there are significant life changes, such as marriage or the birth of a child.

Steps to complete the W-4 Form Federal

Completing the W-4 form requires careful attention to detail. Here are the steps:

- Enter your personal information, including name, address, Social Security number, and filing status.

- Indicate the number of dependents you are claiming.

- Consider any additional income or deductions that may affect your withholding.

- Sign and date the form to certify that the information provided is accurate.

After filling out the form, submit it to your employer's payroll department for processing.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the W-4 form. Employees are encouraged to use the IRS Tax Withholding Estimator to determine the correct amount of withholding based on their individual tax situations. The IRS also advises reviewing the form at least annually or whenever there are major life changes that could impact tax liability. It is important to ensure that the information on the W-4 is accurate to avoid potential penalties from under-withholding.

Filing Deadlines / Important Dates

While there is no formal deadline for submitting the W-4 form, it is essential to provide it to your employer as soon as possible, especially when starting a new job or experiencing a significant life change. Employers are required to implement the changes to withholding on the next payroll cycle after receiving the updated W-4. Additionally, employees should be aware of the annual tax filing deadline, typically April 15, to ensure that their withholding aligns with their overall tax obligations.

Penalties for Non-Compliance

Failure to submit an accurate W-4 form can lead to penalties for both employees and employers. If an employee under-withholds taxes, they may face a tax bill at the end of the year, potentially including interest and penalties. Employers who do not withhold the correct amount based on the W-4 may also be subject to penalties. It is crucial for both parties to ensure compliance with IRS regulations to avoid financial repercussions.

Quick guide on how to complete w 4 form federal

Effortlessly Prepare W 4 Form Federal on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the desired form and securely preserve it digitally. airSlate SignNow equips you with all the resources required to create, revise, and electronically sign your documents promptly without delays. Manage W 4 Form Federal on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Alter and Electronically Sign W 4 Form Federal Effortlessly

- Locate W 4 Form Federal and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive details using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form searching, or mistakes that require new printed copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign W 4 Form Federal and maintain effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4 form federal

Create this form in 5 minutes!

How to create an eSignature for the w 4 form federal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4p approach in airSlate SignNow?

The 4p approach in airSlate SignNow focuses on Price, Product, Promotion, and Place to ensure your document signing process is efficient. By understanding these four elements, you can maximize the effectiveness of your eSigning solution. Our team is dedicated to helping businesses implement the 4p strategy for seamless operations.

-

How does airSlate SignNow's pricing structure work for the 4p model?

AirSlate SignNow offers competitive pricing that aligns with the 4p model, ensuring that you get value for your money. We provide various pricing plans tailored to different needs and business sizes. This way, companies can choose an option that best fits their budget while enjoying all the features integrated into the 4p framework.

-

What essential features does airSlate SignNow integrate into the 4p strategy?

AirSlate SignNow incorporates essential features like electronic signatures, document templates, and customizable workflows, all aligned with the 4p strategy. These features enhance convenience and efficiency in document management. By embracing the 4p framework, users can streamline processes and achieve optimal results.

-

What benefits can businesses expect from implementing the 4p model with airSlate SignNow?

Implementing the 4p model with airSlate SignNow provides businesses with signNow efficiency gains and cost savings. It simplifies the eSigning process, making document handling quicker and easier. Overall, a focus on the 4p elements ensures that your business operates more smoothly and responsibly.

-

How can airSlate SignNow integrate with other platforms following the 4p principles?

AirSlate SignNow can seamlessly integrate with various platforms while adhering to the 4p principles. Integrations enhance your document workflows by connecting with tools like CRM and productivity software. This adaptability allows businesses to work more efficiently under the 4p framework.

-

Is airSlate SignNow suitable for businesses of all sizes based on the 4p approach?

Yes, airSlate SignNow is designed to cater to businesses of all sizes in accordance with the 4p approach. Whether you're a small startup or a large enterprise, you can easily customize and scale our solution to meet your requirements. The flexibility of airSlate SignNow makes it an ideal choice for diverse organizational needs.

-

What types of documents can be signed using the 4p strategy with airSlate SignNow?

Using airSlate SignNow under the 4p strategy, users can sign various document types, including contracts, agreements, and multi-page forms. The platform supports an array of document formats to ensure versatility. This feature allows businesses to manage their documentation needs effectively and securely.

Get more for W 4 Form Federal

- Lapm chapter 10 exhibit 10 h1 h3 cost proposal form

- Floor installation contract template form

- Floral contract template form

- Floor installation floor contract template form

- Floral design contract template form

- Floral wedding contract template form

- Florist contract template form

- Florist for wedding contract template form

Find out other W 4 Form Federal

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure