Form 501 Vi 2017

What is the Form 501 Vi

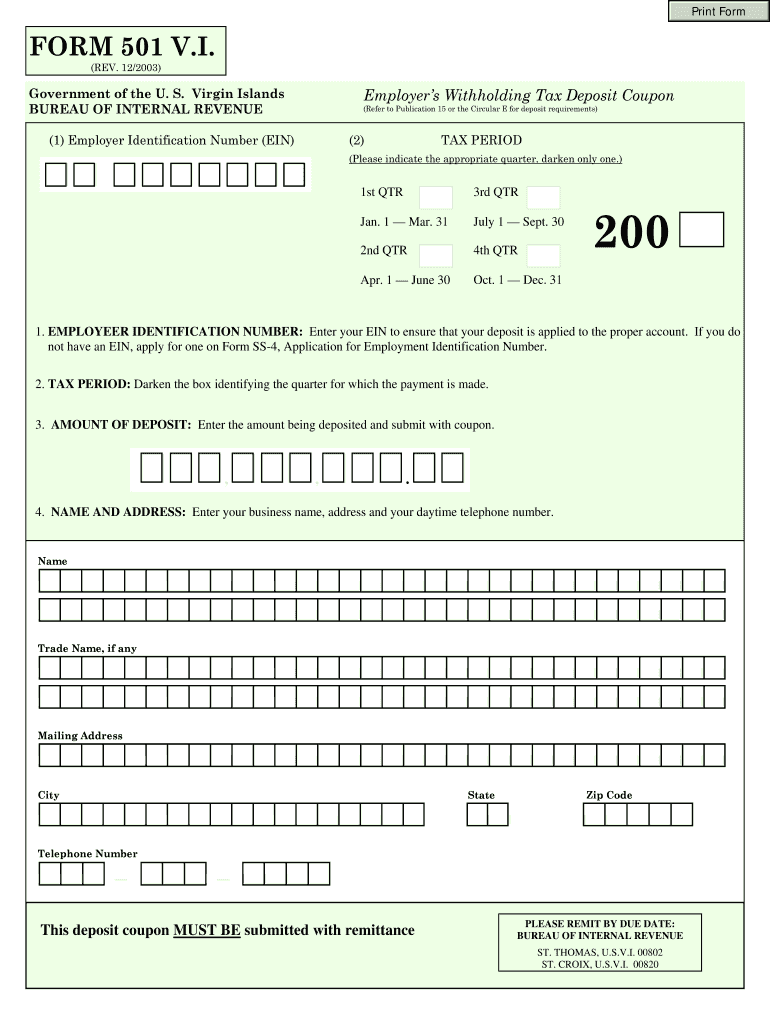

The Form 501 Vi is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required for various financial transactions or tax filings. Understanding its purpose is crucial for anyone involved in the reporting process.

How to use the Form 501 Vi

Using the Form 501 Vi involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required to fill out the form. Next, carefully follow the instructions provided on the form to enter your data correctly. It is important to review your entries for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Form 501 Vi

Completing the Form 501 Vi requires attention to detail. Here are the steps to follow:

- Collect all relevant financial documents, including income statements and expense records.

- Obtain the latest version of the Form 501 Vi from the IRS website or other official sources.

- Fill in your personal or business information as required, ensuring accuracy.

- Complete the financial sections by entering the necessary figures.

- Review the form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Form 501 Vi

The legal use of the Form 501 Vi is governed by IRS regulations. When filled out correctly, the form serves as a legally binding document that can be used in audits or legal proceedings. It is essential to ensure that all information provided is truthful and accurate to avoid penalties or legal issues. Compliance with IRS guidelines is critical for the form to maintain its legal standing.

Required Documents

To successfully complete the Form 501 Vi, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records related to the reporting period.

- Previous tax returns for reference.

- Any additional documentation specified in the form instructions.

Having these documents ready can streamline the process and help ensure accuracy.

Form Submission Methods

The Form 501 Vi can be submitted in various ways, depending on individual preferences and IRS requirements. The primary submission methods include:

- Electronic submission through authorized e-filing software.

- Mailing a paper copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Choosing the right method can impact processing times and should align with your specific needs.

Quick guide on how to complete form 501 vi 2003

Finish Form 501 Vi effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to craft, modify, and eSign your documents swiftly without interruptions. Manage Form 501 Vi on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Form 501 Vi seamlessly

- Find Form 501 Vi and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and eSign Form 501 Vi to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 501 vi 2003

Create this form in 5 minutes!

How to create an eSignature for the form 501 vi 2003

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is Form 501 Vi and how can airSlate SignNow assist with it?

Form 501 Vi is a crucial document for various administrative processes. airSlate SignNow provides an efficient platform for seamlessly signing and managing Form 501 Vi electronically, ensuring compliance and faster processing.

-

How does airSlate SignNow ensure the security of Form 501 Vi?

airSlate SignNow employs advanced encryption and security features to protect your documents, including Form 501 Vi. This ensures that all sensitive data is securely transmitted and stored, keeping your information safe from unauthorized access.

-

What are the pricing options for using airSlate SignNow for Form 501 Vi?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of individuals and businesses handling Form 501 Vi. With a range of subscription tiers, you can select a plan that suits your budget and document volume requirements.

-

Can airSlate SignNow help with workflow automation for Form 501 Vi?

Yes, airSlate SignNow allows businesses to automate workflows related to Form 501 Vi. By integrating automation features, you can streamline the signing process, reduce manual tasks, and improve overall efficiency in document management.

-

What integrations does airSlate SignNow support for managing Form 501 Vi?

airSlate SignNow supports multiple integrations with popular applications, making it easy to manage Form 501 Vi within your existing workflows. Integrations with CRM and project management tools simplify the document handling process, enhancing productivity.

-

Is it easy to track the status of Form 501 Vi documents in airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking features, allowing you to monitor the status of your Form 501 Vi documents. You’ll receive notifications at each stage, ensuring you're always updated on the progress of your eSignatures.

-

What benefits does airSlate SignNow provide for businesses dealing with Form 501 Vi?

Using airSlate SignNow for Form 501 Vi brings numerous benefits, including reduced turnaround times, improved accuracy, and lower costs associated with paper-based processes. This electronic solution enhances collaboration and ensures compliance with legal requirements.

Get more for Form 501 Vi

- Bureti tti admission form pdf

- Please wait if this message is not eventually r 578433907 form

- Service for service contract template form

- Service for it contract template form

- Service invoice contract template form

- Service hvac contract template form

- Service level contract template form

- Service maintenance contract template form

Find out other Form 501 Vi

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word