501 Vi Tax Form 2017-2026

What is the 501 Vi Tax Form

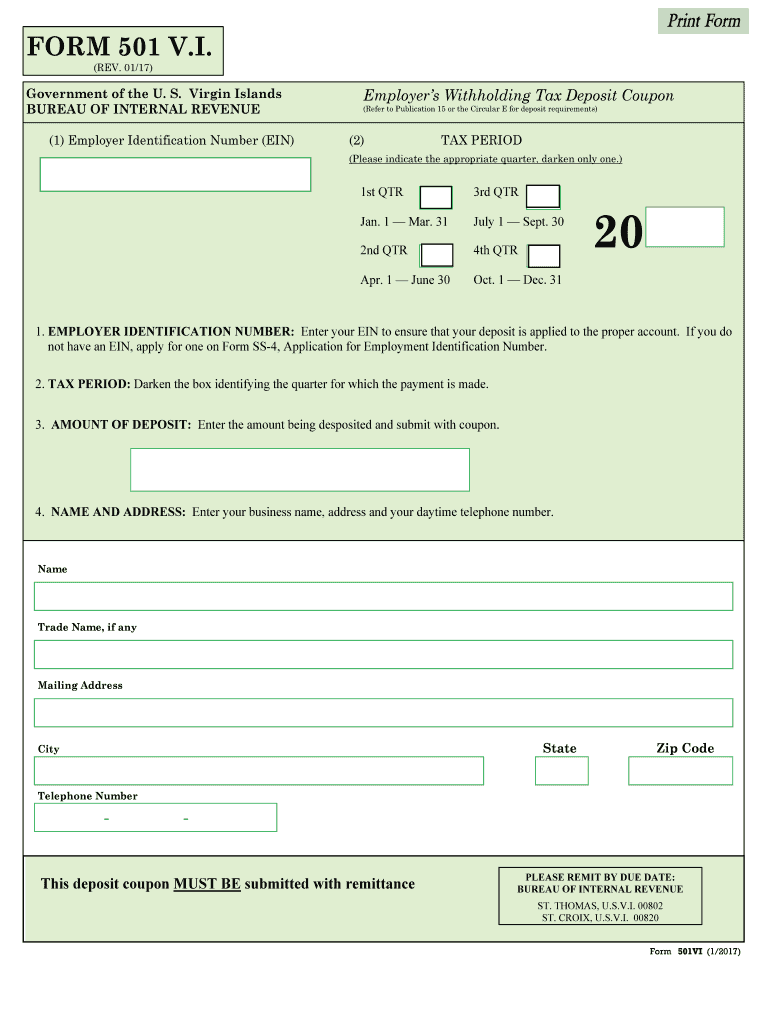

The 501 Vi tax form is a crucial document used by employers in the United States to report certain tax-related information. Specifically, it is utilized to document the withholding of taxes from employee wages. This form helps ensure that the correct amount of taxes is withheld and reported to the Internal Revenue Service (IRS). Understanding the purpose and function of the 501 Vi is essential for both employers and employees to maintain compliance with federal tax regulations.

How to use the 501 Vi Tax Form

Using the 501 Vi tax form involves several steps to ensure accurate completion and submission. Employers must first gather necessary information about their employees, including names, Social Security numbers, and the amount of wages paid. Once this information is collected, it can be entered into the appropriate sections of the form. After completing the form, employers should review it for accuracy before submitting it to the IRS, either electronically or by mail. Proper use of this form helps avoid penalties and ensures compliance with tax laws.

Steps to complete the 501 Vi Tax Form

Completing the 501 Vi tax form requires careful attention to detail. Follow these steps for proper completion:

- Gather employee information, including full names and Social Security numbers.

- Calculate the total wages paid to each employee during the reporting period.

- Determine the correct amount of tax to withhold based on applicable federal tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the 501 Vi Tax Form

The legal use of the 501 Vi tax form is governed by IRS regulations. It is essential for employers to understand that failure to file this form accurately or on time can result in penalties. The form must be filled out in compliance with federal tax laws, ensuring that all reported information is truthful and complete. Employers should also maintain records of submitted forms for a minimum of four years, as the IRS may request these documents for verification purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 501 Vi tax form are critical to avoid penalties. Employers are typically required to submit this form by the end of the tax year, which is December thirty-first. Additionally, any payments due for withheld taxes must be made on a quarterly basis, with specific deadlines for each quarter. Staying informed about these dates is essential for compliance and to avoid unnecessary fines.

Required Documents

To complete the 501 Vi tax form accurately, certain documents are required. Employers should have access to:

- Employee payroll records detailing wages and hours worked.

- Previous tax forms filed for the same employees to ensure consistency.

- IRS guidelines and publications related to tax withholding.

Having these documents readily available will streamline the process of completing the 501 Vi tax form and help ensure compliance with IRS regulations.

Quick guide on how to complete 501 vi tax form

Complete 501 Vi Tax Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the features you require to create, modify, and electronically sign your documents swiftly without delays. Handle 501 Vi Tax Form on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to modify and electronically sign 501 Vi Tax Form with ease

- Locate 501 Vi Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your PC.

Eliminate the concern of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from your device of choice. Modify and electronically sign 501 Vi Tax Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 501 vi tax form

Create this form in 5 minutes!

How to create an eSignature for the 501 vi tax form

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the vi 501 v i feature in airSlate SignNow?

The vi 501 v i feature in airSlate SignNow allows users to efficiently manage and eSign important documents. This functionality streamlines the signing process while ensuring compliance and security. With vi 501 v i, businesses can enhance their workflow and improve document accuracy.

-

How much does airSlate SignNow with the vi 501 v i feature cost?

Pricing for airSlate SignNow with the vi 501 v i feature is designed to be budget-friendly. We offer various subscription plans that cater to different business needs, ensuring you get the best value for your investment. Visit our pricing page to find a plan that includes the vi 501 v i feature at an affordable rate.

-

What are the main benefits of using the vi 501 v i feature?

By utilizing the vi 501 v i feature, businesses can signNowly reduce their document processing time, enhance collaboration, and eliminate paper waste. This feature not only boosts productivity but also fosters a more sustainable business model. Experience the comprehensive benefits of vi 501 v i with airSlate SignNow.

-

Are there any integrations available for the vi 501 v i feature?

Yes, airSlate SignNow's vi 501 v i feature integrates seamlessly with numerous applications, enhancing your existing workflow. Integrate with CRM systems, cloud storage platforms, and productivity tools for a holistic eSigning experience. Explore our integration options to maximize the effectiveness of the vi 501 v i functionality.

-

Is the vi 501 v i feature secure and compliant?

The vi 501 v i feature in airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption protocols and meets global security standards to protect your data. You can confidently use the vi 501 v i feature knowing that your documents are secure.

-

How can I get started with the vi 501 v i feature in airSlate SignNow?

Getting started with the vi 501 v i feature is simple. Sign up for a free trial on our website to explore its capabilities and see how it fits into your business processes. Our user-friendly interface makes onboarding easy, allowing you to leverage the vi 501 v i feature right away.

-

Can I customize the vi 501 v i feature according to my needs?

Absolutely! The vi 501 v i feature offers customization options that allow you to tailor it to your specific business requirements. Adjust templates, workflows, and branding to align with your organization’s needs while utilizing the powerful capabilities of airSlate SignNow.

Get more for 501 Vi Tax Form

Find out other 501 Vi Tax Form

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online