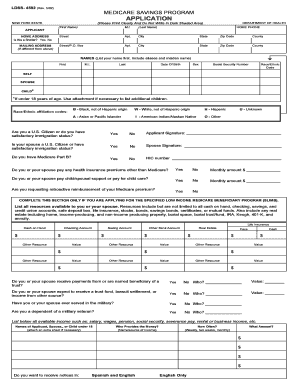

New York Medicare Savings Program Application Form

What is the New York Medicare Savings Program Application

The New York Medicare Savings Program Application, often referred to as the ldss4592 medicare savings, is a crucial document for individuals seeking assistance with their Medicare costs. This program helps eligible individuals pay for premiums, deductibles, and co-payments associated with Medicare. By completing this application, applicants can gain access to financial support that alleviates some of the burdens of healthcare expenses. Understanding the purpose and benefits of this application is essential for anyone looking to enhance their Medicare coverage.

Eligibility Criteria

To qualify for the New York Medicare Savings Program, applicants must meet specific eligibility requirements. These criteria typically include age, income level, and residency status. Generally, individuals must be at least sixty-five years old or have a qualifying disability. Additionally, their income must fall below certain thresholds set by the state. It is important to review these criteria carefully to determine if you meet the qualifications before submitting the ldss4592 medicare savings application.

Steps to Complete the New York Medicare Savings Program Application

Completing the New York Medicare Savings Program Application involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including Social Security numbers, income details, and Medicare information. Next, fill out the ldss4592 medicare savings form accurately, ensuring all sections are completed. After filling out the application, review it for any errors or omissions. Finally, submit the application via the preferred method, whether online, by mail, or in person, to ensure timely processing.

Form Submission Methods (Online / Mail / In-Person)

The New York Medicare Savings Program Application can be submitted through various methods, providing flexibility for applicants. Individuals can complete the form online through designated state portals, which often streamline the process. Alternatively, applicants may choose to mail the completed application to the appropriate state office. For those who prefer a more personal approach, in-person submissions are also accepted at local offices. Each method has its advantages, so applicants should choose the one that best fits their needs.

Required Documents

When submitting the New York Medicare Savings Program Application, certain documents are required to support the application. Typically, applicants need to provide proof of income, such as pay stubs or tax returns, along with documentation of Medicare enrollment. Additionally, identification documents, such as a driver's license or state ID, may be necessary. Ensuring all required documents are included can help prevent delays in processing the application.

Legal Use of the New York Medicare Savings Program Application

The ldss4592 medicare savings application is legally recognized when completed and submitted according to state regulations. It is essential for applicants to understand that the information provided must be accurate and truthful, as any discrepancies could lead to penalties or denial of benefits. Utilizing a reliable platform for filling out and submitting the application can enhance the legal validity of the document, ensuring compliance with all necessary legal frameworks.

Quick guide on how to complete new york medicare savings program application

Complete New York Medicare Savings Program Application effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without interruptions. Handle New York Medicare Savings Program Application on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign New York Medicare Savings Program Application without hassle

- Locate New York Medicare Savings Program Application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you prefer. Modify and eSign New York Medicare Savings Program Application and ensure excellent communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york medicare savings program application

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

How much savings can you have to qualify for Medicare?

The state of California has made it easier for Californians to apply for help paying Medicare costs. On January 1, 2024 the asset test to qualify for a Medicare Savings Program was eliminated. This means individuals can have any amount of assets and still qualify for a Medicare Savings Program.

-

What is income threshold for QMB plus in NYS?

Qualified Medicare Beneficiary Program (QMB) Income at or Below 138% FPL+ $20 Single: $1,732 per month $1,752 Couple: $2,351 per month $2,371

-

What is the Medicare Savings Program in NY?

The Medicare Savings Program (MSP) is a Medicaid-administered program available to Medicare consumers with limited income. If you qualify, this program will pay your Medicare Part B premium. Depending upon the sub-program for which you are eligible, it may also pay for other cost-sharing expenses as listed below.

-

What is the income limit for 2024 for QMB?

Medicare Savings Programs (MSPs) — Qualification at a Glance – 2024 Program/BenefitsIncome Limits Qualified Medicare Beneficiary (QMB) Premiums for Parts A & B Deductibles for Parts A & B Coinsurance for Parts A & B Single: $1,255/mo., $15,060/yr.* Couple: $1,704/mo., $20,440/yr.*4 more rows

-

Does social security count as income for QMB?

But Social Security benefits do count as income for QMB, including disability and retirement benefits. If, after applying the SSI rules, the figure you arrive at is anywhere close to the QMB limit (in 2024, $1,275 in monthly countable income for an individual, $1,724 for a couple), it's worth applying for it.

-

What are the three types of Medicare savings programs?

QMB, SLMB, AND QI PROGRAMS The Qualified Medicare Beneficiary program (QMB), Specified Low-Income Medicare Beneficiary program (SLMB), and Qualified Individual program (QI), help Medicare beneficiaries of modest means pay all or some of Medicare's cost sharing amounts (ie. premiums, deductibles and copayments).

-

What is the income limit for the Medicare savings program in NY?

New York, NY—Starting January 1, 2023, eligibility for the Medicare Savings Program (MSP) expanded in New York to individuals with Medicare who have an income up to $2,107 per month and couples with monthly incomes up to $2,839. There are no asset limits for the MSP in New York.

-

How much money can you have in savings and still get Medicare?

eligibility for Medi-Cal. For new Medi-Cal applications only, current asset limits are $130,000 for one person and $65,000 for each additional household member, up to 10. Starting on January 1, 2024, Medi-Cal applications will no longer ask for asset information.

Get more for New York Medicare Savings Program Application

- Membership application snohomish county fire form

- Twitter com gigharborfire statusgigharborfire on twitter quota rare opportunity hiring a form

- Kittitas valley fire ampamp rescuefire ampamp rescue department form

- Police department buckley wa form

- Nonprofit jobs in united states aicpa global form

- An affirmative actionequal opportunity employer form

- Youngsville fire department youngsville fire department form

- North carolina membership form

Find out other New York Medicare Savings Program Application

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself