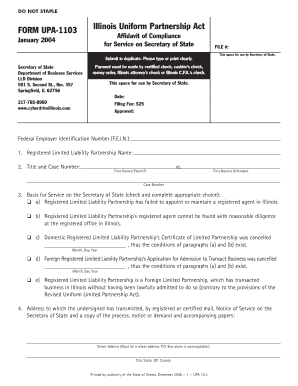

Illinois Uniform Partnership

What is the Illinois Uniform Partnership?

The Illinois Uniform Partnership Act provides a legal framework for partnerships operating within the state. It outlines the rights and responsibilities of partners, governing how partnerships are formed, managed, and dissolved. This act is essential for ensuring that partnerships function smoothly and fairly, providing clarity on issues such as profit sharing, liability, and decision-making processes. Understanding the Illinois Uniform Partnership is crucial for anyone involved in a partnership to ensure compliance with state laws and to protect their interests.

Key Elements of the Illinois Uniform Partnership

Several key elements define the Illinois Uniform Partnership Act, including:

- Formation: Partnerships can be formed through a verbal or written agreement, but a written document is advisable for clarity.

- Liability: Partners typically share liability for the debts and obligations of the partnership, which can impact personal assets.

- Management: Each partner has an equal right to participate in the management of the partnership unless otherwise agreed upon.

- Profit Sharing: Profits are generally shared equally among partners unless a different arrangement is specified in the partnership agreement.

Steps to Complete the Illinois Uniform Partnership

Completing the Illinois Uniform Partnership involves several important steps:

- Draft a Partnership Agreement: Outline the terms of the partnership, including roles, responsibilities, and profit-sharing.

- Obtain Necessary Licenses: Ensure that your partnership complies with local business licensing requirements.

- Register the Partnership: File the partnership agreement with the appropriate state authorities, if required.

- Open a Business Bank Account: Keep personal and business finances separate by establishing a dedicated account for partnership transactions.

Legal Use of the Illinois Uniform Partnership

To legally utilize the Illinois Uniform Partnership Act, partners must adhere to the stipulations outlined in the act. This includes maintaining accurate records, fulfilling tax obligations, and ensuring compliance with local regulations. A well-drafted partnership agreement can help prevent disputes and clarify each partner's rights and responsibilities. Furthermore, partners should regularly review and update their agreements to reflect any changes in the partnership structure or business operations.

Form Submission Methods

When submitting documents related to the Illinois Uniform Partnership, partners have several options:

- Online Submission: Many forms can be submitted electronically through state business portals.

- Mail: Partners may choose to send completed forms via postal mail to the relevant state office.

- In-Person Submission: For those who prefer direct interaction, forms can be submitted in person at designated state offices.

Eligibility Criteria

To establish a partnership under the Illinois Uniform Partnership Act, the following eligibility criteria must be met:

- At least two individuals or entities must agree to form a partnership.

- Partners must have the legal capacity to enter into contracts.

- The partnership must be formed for a lawful purpose.

Quick guide on how to complete illinois uniform partnership

Effortlessly Prepare Illinois Uniform Partnership on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents promptly without any delays. Manage Illinois Uniform Partnership on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Steps to Edit and eSign Illinois Uniform Partnership with Ease

- Find Illinois Uniform Partnership and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details thoroughly and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Illinois Uniform Partnership and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois uniform partnership

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Illinois Uniform Partnership Act?

The Illinois Uniform Partnership Act provides the legal framework for forming and operating partnerships in Illinois. It outlines the rights and responsibilities of partners and establishes guidelines for dissolution and disputes. Understanding this act is essential for anyone looking to form a partnership in Illinois.

-

How can airSlate SignNow help with compliance to the Illinois Uniform Partnership Act?

airSlate SignNow streamlines the document signing process, ensuring that all partnership agreements comply with the Illinois Uniform Partnership Act. With features like templates and secure eSignatures, users can easily create, share, and sign essential documents. This simplifies compliance for businesses forming partnerships in Illinois.

-

What are the benefits of using airSlate SignNow for partnership agreements under the Illinois Uniform Partnership Act?

Using airSlate SignNow for partnership agreements enhances efficiency and reduces paperwork. It allows for quick and legally binding eSignatures, which are critical for complying with the Illinois Uniform Partnership Act. Additionally, this tool minimizes errors and helps maintain organized documentation throughout the partnership's lifecycle.

-

Is airSlate SignNow a cost-effective solution for businesses adjusting to the Illinois Uniform Partnership Act?

Yes, airSlate SignNow offers a cost-effective solution for businesses navigating the requirements of the Illinois Uniform Partnership Act. With flexible pricing plans, it ensures that companies of all sizes can afford the necessary tools to draft and sign partnership agreements efficiently. This investment can lead to signNow time and cost savings.

-

What features does airSlate SignNow offer that are relevant to the Illinois Uniform Partnership Act?

airSlate SignNow includes essential features such as customizable templates, secure eSignature capabilities, and instant document sharing. These features are crucial for creating partnership agreements that are compliant with the Illinois Uniform Partnership Act. Users can efficiently manage multiple documents and ensure all parties are aligned on terms and conditions.

-

Can airSlate SignNow integrate with other tools for management of partnership documents under the Illinois Uniform Partnership Act?

Yes, airSlate SignNow integrates seamlessly with various business management tools, enhancing the management of partnership documents in line with the Illinois Uniform Partnership Act. This allows users to connect with accounting, CRM, and project management platforms for streamlined workflows. These integrations improve collaboration and document handling across teams.

-

How secure is airSlate SignNow when handling partnership documents related to the Illinois Uniform Partnership Act?

airSlate SignNow prioritizes security when handling sensitive partnership documents. With encryption, secure access controls, and compliance with industry regulations, it ensures that all documents related to the Illinois Uniform Partnership Act are protected from unauthorized access. Businesses can trust that their information is safe within the platform.

Get more for Illinois Uniform Partnership

Find out other Illinois Uniform Partnership

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien