Vt Fpr C 101 Form

What is the VT FPR C 101?

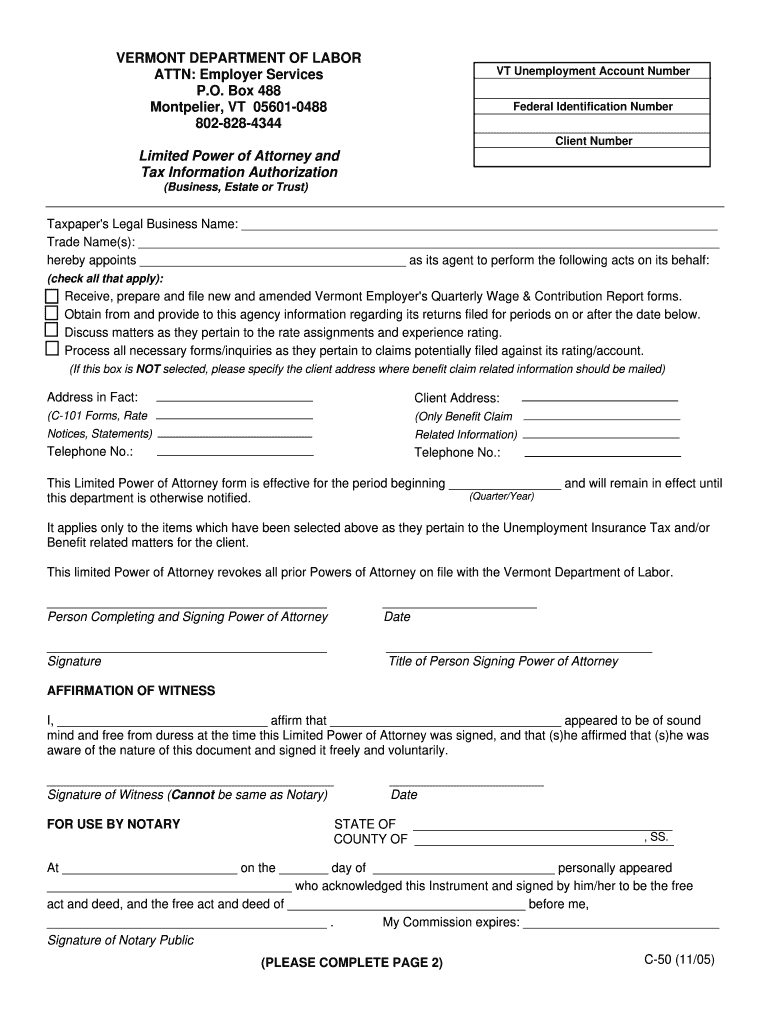

The VT FPR C 101 is a specific form used in Vermont for tax-related purposes. It is designed to collect essential information regarding the financial activities of individuals and businesses within the state. This form plays a vital role in ensuring that taxpayers comply with state tax regulations and accurately report their income and deductions. Understanding the purpose and requirements of the VT FPR C 101 is crucial for anyone filing taxes in Vermont.

How to Use the VT FPR C 101

Using the VT FPR C 101 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted online, by mail, or in person, depending on the preferred method of filing.

Steps to Complete the VT FPR C 101

Completing the VT FPR C 101 requires a systematic approach:

- Gather all necessary documentation, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with personal information such as name, address, and Social Security number.

- Input income details, including wages, interest, and any other sources of income.

- List applicable deductions and credits to ensure a lower taxable income.

- Double-check all entries for accuracy and completeness.

- Submit the form through the chosen method, ensuring it is sent before the filing deadline.

Legal Use of the VT FPR C 101

The VT FPR C 101 is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to understand that providing false information on this form can lead to penalties, including fines or audits. Compliance with the legal requirements surrounding the use of this form helps maintain transparency and accountability in the state's tax system.

Required Documents

To successfully complete the VT FPR C 101, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical bills or educational expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods

The VT FPR C 101 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Vermont Department of Taxes website

- Mailing the completed form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method depends on personal preference and the urgency of the filing.

Quick guide on how to complete vt fpr c 101

Complete Vt Fpr C 101 seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to easily locate the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without interruptions. Manage Vt Fpr C 101 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Vt Fpr C 101 effortlessly

- Obtain Vt Fpr C 101 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Vt Fpr C 101 and ensure outstanding communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vt fpr c 101

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the vt form c 101, and how can airSlate SignNow help?

The vt form c 101 is a vital document used for various compliance purposes. AirSlate SignNow streamlines the process of filling out and signing this form, ensuring it meets all legal standards while providing an easy-to-use interface for users.

-

Is airSlate SignNow suitable for handling vt form c 101?

Yes, airSlate SignNow is specifically designed to handle various types of documents, including the vt form c 101. With features like e-signatures and templates, it simplifies the management and processing of this form.

-

What are the pricing options for using airSlate SignNow with vt form c 101?

AirSlate SignNow offers several pricing plans tailored to different business needs. Each plan includes features that support the processing of the vt form c 101, making it a cost-effective solution for all organizations.

-

Can I integrate airSlate SignNow with other software when using vt form c 101?

Absolutely! AirSlate SignNow supports integrations with various software tools, enhancing the workflow for managing the vt form c 101. This capability allows users to connect with CRM, project management, and other business applications seamlessly.

-

What features does airSlate SignNow provide for the vt form c 101?

AirSlate SignNow offers numerous features, including customizable templates, automated workflows, and secure e-signature capabilities for the vt form c 101. These tools help accelerate document processing while ensuring compliance.

-

How does airSlate SignNow enhance security for the vt form c 101?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the vt form c 101. The platform employs encryption and secure access measures to protect user data and maintain confidentiality.

-

Can I track the status of my vt form c 101 with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their vt form c 101 in real time. This feature helps keep all stakeholders informed on the progress of the document, ensuring transparency and accountability.

Get more for Vt Fpr C 101

Find out other Vt Fpr C 101

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast