Irs E File Login 2004-2026

What is the IRS e-file login?

The IRS e-file login is a secure online portal that allows taxpayers to electronically file their tax returns with the Internal Revenue Service (IRS). This system is designed to streamline the filing process, making it easier for individuals and businesses to submit their tax information quickly and efficiently. By using the e-file login, users can access their tax accounts, check the status of their returns, and make necessary adjustments as needed.

How to use the IRS e-file login

To use the IRS e-file login, follow these steps:

- Visit the official IRS website.

- Locate the e-file section and click on the login option.

- Enter your user ID and password. If you do not have an account, you will need to create one.

- Once logged in, you can access various services, including filing your tax return and checking your refund status.

Required documents for IRS e-file login

Before logging into the IRS e-file system, ensure you have the following documents ready:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- W-2 forms from your employers.

- 1099 forms for any additional income.

- Records of any deductions or credits you plan to claim.

Filing deadlines and important dates

Understanding filing deadlines is crucial for compliance. The typical deadline for filing individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extension options available, which typically allow for an additional six months to file, but not to pay any taxes owed.

Eligibility criteria for IRS e-file

Most taxpayers are eligible to use the IRS e-file system. However, there are specific criteria to consider:

- Taxpayers must have a valid Social Security number or ITIN.

- Individuals must be filing a federal tax return.

- Some forms may not be eligible for e-filing, so it is essential to check the IRS guidelines for specific forms.

Penalties for non-compliance

Failing to comply with IRS e-filing requirements can result in various penalties. These may include:

- Late filing penalties, which can accumulate daily until the return is filed.

- Failure to pay penalties if taxes owed are not paid by the due date.

- Interest on any unpaid taxes, which compounds over time.

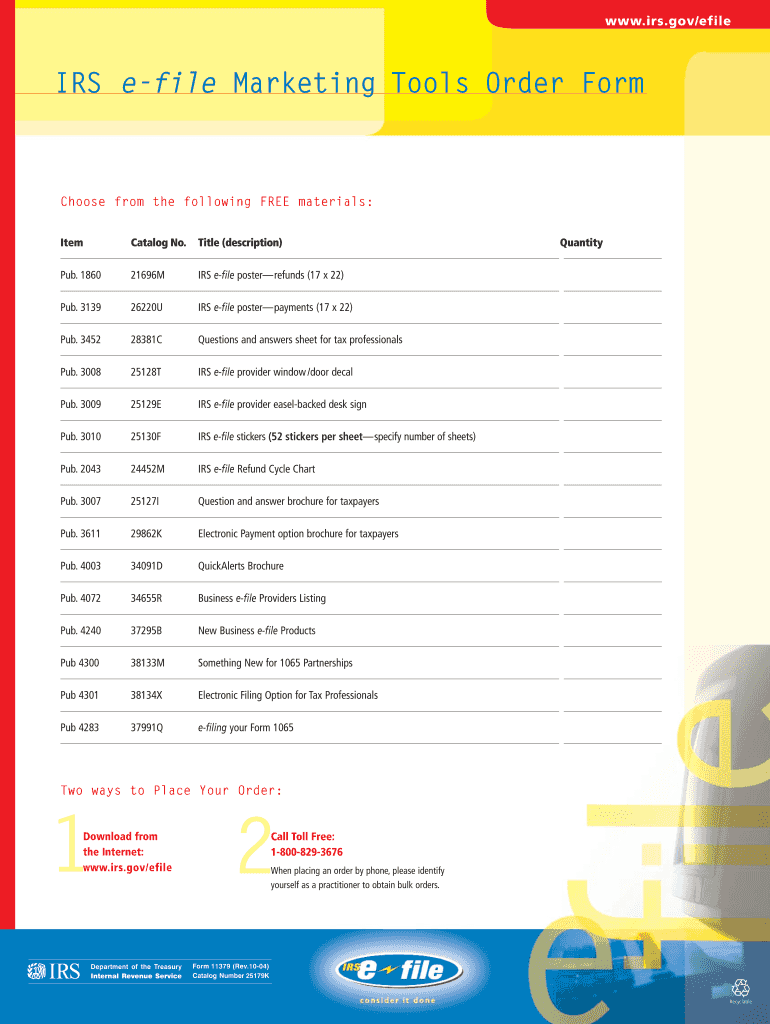

Quick guide on how to complete e file marketing tool kit form

Explore the most efficient method to complete and endorse your Irs E File Login

Are you still squandering time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior way to complete and endorse your Irs E File Login and comparable forms for public services. Our advanced electronic signature solution provides everything required to manage paperwork swiftly and in accordance with official standards - robust PDF editing, managing, securing, endorsing, and sharing features all conveniently available within an intuitive interface.

Only a few steps are necessary to finish filling out and endorsing your Irs E File Login:

- Upload the editable template to the editor with the Get Form button.

- Verify what details you need to input in your Irs E File Login.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your data.

- Modify the content using Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Blackout sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any preferred option.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Irs E File Login in the Documents folder within your profile, download it, or export it to your preferred cloud storage. Our solution also provides versatile file sharing options. There’s no need to print your forms when submitting them to the relevant public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the e file marketing tool kit form

How to make an electronic signature for the E File Marketing Tool Kit Form online

How to make an eSignature for the E File Marketing Tool Kit Form in Chrome

How to make an eSignature for putting it on the E File Marketing Tool Kit Form in Gmail

How to generate an electronic signature for the E File Marketing Tool Kit Form right from your mobile device

How to create an electronic signature for the E File Marketing Tool Kit Form on iOS devices

How to create an electronic signature for the E File Marketing Tool Kit Form on Android OS

People also ask

-

What is the Irs E File Login process for airSlate SignNow?

The Irs E File Login process with airSlate SignNow is designed to be user-friendly and straightforward. Users can easily create an account and log in using their credentials to access e-filing services. Once logged in, you can prepare, sign, and submit your documents with the IRS seamlessly.

-

How much does airSlate SignNow cost for Irs E File Login services?

AirSlate SignNow offers competitive pricing plans tailored to meet various business needs. Pricing for Irs E File Login services varies depending on the plan you choose, with options for individual users and teams. You can find detailed pricing information on our website to select the best plan for your e-filing requirements.

-

What features does airSlate SignNow offer for Irs E File Login?

AirSlate SignNow provides a range of features that enhance the Irs E File Login experience. This includes secure document storage, customizable templates, and automated workflows. Additionally, our platform supports multiple file formats and integrates seamlessly with other applications to streamline your e-signing process.

-

Is airSlate SignNow compliant with IRS regulations for e-filing?

Yes, airSlate SignNow is fully compliant with IRS regulations for e-filing. Our platform ensures that all documents signed and submitted through the Irs E File Login process meet the necessary legal standards. This compliance guarantees the security and integrity of your sensitive tax information.

-

Can I integrate airSlate SignNow with other applications for my Irs E File Login?

Absolutely! AirSlate SignNow supports integrations with various applications to enhance your Irs E File Login experience. Whether you use accounting software or customer relationship management tools, our platform can connect seamlessly, allowing for a more efficient workflow.

-

What benefits does airSlate SignNow provide for users needing Irs E File Login?

Using airSlate SignNow for your Irs E File Login offers numerous benefits, including time savings and increased accuracy in document handling. The platform’s intuitive interface makes it easy to e-sign and manage documents, reducing the likelihood of errors. Additionally, our secure environment ensures that your data is protected.

-

How do I get support for my Irs E File Login issues with airSlate SignNow?

If you encounter any issues with your Irs E File Login on airSlate SignNow, our dedicated support team is here to help. We offer multiple support channels, including live chat, email, and a comprehensive help center. Our team is committed to providing timely assistance to ensure a smooth e-filing experience.

Get more for Irs E File Login

Find out other Irs E File Login

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation