at 115 Form 2015

What is the At 115 Form

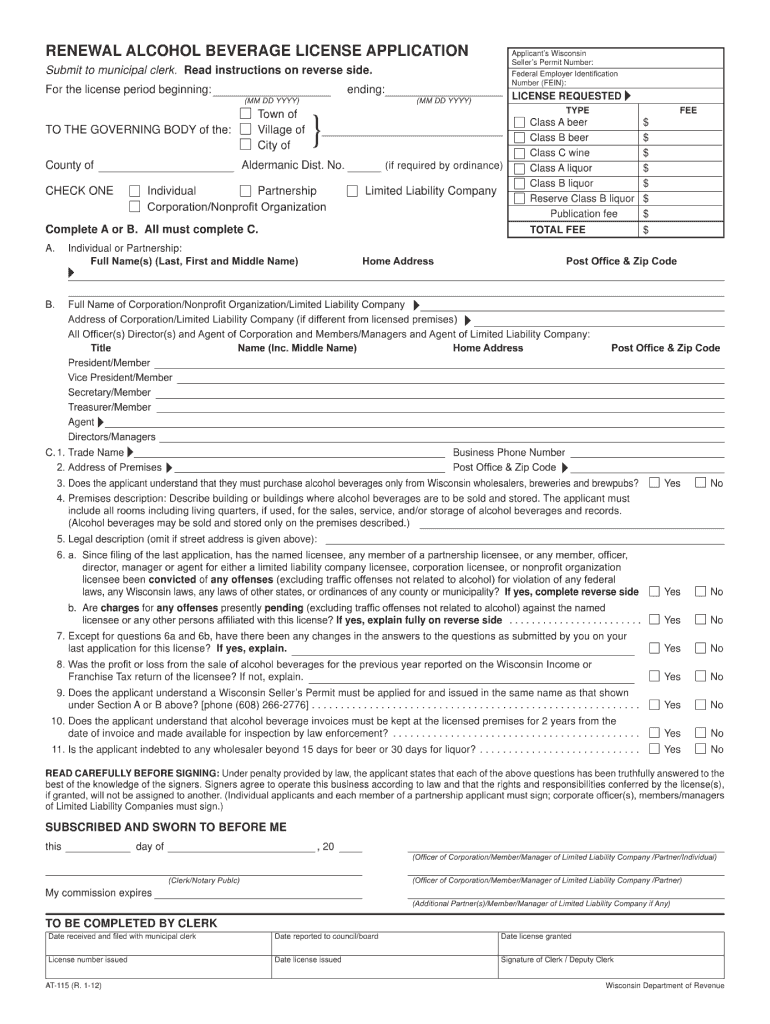

The At 115 Form is a specific document used primarily for tax-related purposes in the United States. It serves as a declaration for various financial activities and is often required by state tax authorities. This form helps individuals and businesses report their income and expenses accurately, ensuring compliance with tax regulations. Understanding the purpose and requirements of the At 115 Form is essential for proper tax filing and avoiding potential penalties.

How to use the At 115 Form

Using the At 115 Form involves several straightforward steps. First, gather all necessary financial documents, such as income statements and expense receipts. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to double-check for any errors before submission, as inaccuracies can lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the state tax authority.

Steps to complete the At 115 Form

Completing the At 115 Form requires attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, including income statements and expense records.

- Review the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all sections are completed.

- Double-check your entries for any mistakes or omissions.

- Submit the form as directed, either online or by mail.

Legal use of the At 115 Form

The At 115 Form must be used in accordance with state and federal tax laws. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies could result in legal consequences, including fines or audits. The form is legally binding once submitted, and it is important to keep a copy for personal records. Compliance with all relevant regulations is crucial to avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the At 115 Form can vary by state and year. Generally, it is advisable to submit the form before the tax deadline to avoid penalties. Important dates to keep in mind include:

- Annual tax filing deadline, typically April 15 for individuals.

- State-specific deadlines that may differ from federal deadlines.

- Extensions that may be available for filing, if applicable.

Who Issues the Form

The At 115 Form is issued by state tax authorities in the United States. Each state may have its own version of the form, tailored to meet specific tax regulations and requirements. It is important to obtain the correct version of the form from the appropriate state agency to ensure compliance and accurate reporting of financial information.

Quick guide on how to complete at 115 2012 form

Prepare At 115 Form effortlessly on any device

Web-based document management has grown in popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without holdups. Manage At 115 Form on any device using airSlate SignNow's Android or iOS applications and enhance any documentation process today.

How to modify and eSign At 115 Form with ease

- Acquire At 115 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional written signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Alter and eSign At 115 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the at 115 2012 form

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the At 115 Form?

The At 115 Form is a customizable document template that allows users to simplify the signing and management of important paperwork. With airSlate SignNow, you can create, send, and eSign the At 115 Form effortlessly. This feature ensures that your documents are processed promptly and securely, improving overall efficiency.

-

How much does it cost to use the At 115 Form?

Pricing for using the At 115 Form through airSlate SignNow varies based on the chosen subscription plan. We offer affordable plans tailored for individuals, small businesses, and enterprises, ensuring you get the best value for your needs. Check our website for detailed pricing information and promotions for new customers.

-

What are the key features of the At 115 Form?

Key features of the At 115 Form include easy document customization, secure electronic signatures, automated workflows, and real-time tracking. These features enhance convenience and streamline the signing process, making it easier for users to manage their documents effectively. Additionally, airSlate SignNow enables integration with other applications to further enhance functionality.

-

How can the At 115 Form benefit my business?

Using the At 115 Form can signNowly reduce the time and costs associated with managing paper documents. By utilizing airSlate SignNow's electronic signature capabilities, businesses can accelerate the approval process and improve collaboration. This leads to increased productivity and a more organized workflow.

-

Is the At 115 Form customizable?

Yes, the At 115 Form is fully customizable to fit your specific needs. With airSlate SignNow, you can add fields, adjust formatting, and include company branding to ensure that all documents align with your brand identity. This level of customization enhances professionalism and user experience.

-

Can I integrate the At 115 Form with other software?

Absolutely! airSlate SignNow allows you to integrate the At 115 Form with a variety of third-party applications like CRMs, project management tools, and cloud storage services. This integration capability streamlines your workflows and allows for seamless document management across platforms.

-

What makes airSlate SignNow the best choice for the At 115 Form?

airSlate SignNow stands out as the best choice for the At 115 Form due to its user-friendly interface, robust security features, and comprehensive customer support. Our platform is designed to meet the needs of businesses of all sizes, ensuring that managing eSignatures is straightforward and secure. Trust airSlate SignNow to enhance your document workflow.

Get more for At 115 Form

- Tx custody form

- Buyer seller agreement form

- California notice of cessation construction liens individual ca civil code section 8188 form

- Sale land agreement form for hawaii

- Montana contract for deed from pdf filler form

- Bank resolution form

- Massachusetts lead based paint disclosure for sales transaction form

- Hospital form

Find out other At 115 Form

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU