Pinal County Property Tax Lookup Form

What is the Pinal County Property Tax Lookup

The Pinal County Property Tax Lookup is a tool designed to help residents and property owners in Pinal County, Arizona, access detailed information about property taxes associated with specific parcels. This lookup provides essential data, including property assessments, tax rates, and payment history. Users can search for properties by parcel number, address, or owner name, allowing for efficient access to property records and tax obligations.

How to Use the Pinal County Property Tax Lookup

Using the Pinal County Property Tax Lookup is straightforward. Begin by visiting the official Pinal County Assessor's website. Enter the required search criteria, such as the parcel number or property address, into the designated fields. Once the search is initiated, the system will display relevant property information, including the assessed value, tax rate, and payment status. This tool is user-friendly and designed to provide quick access to property tax information.

Steps to Complete the Pinal County Property Tax Lookup

To effectively complete the Pinal County Property Tax Lookup, follow these steps:

- Access the Pinal County Assessor's website.

- Locate the property tax lookup tool on the homepage.

- Input the parcel number, property address, or owner name in the search fields.

- Click the search button to retrieve property details.

- Review the displayed information, including tax assessments and payment history.

Key Elements of the Pinal County Property Tax Lookup

The Pinal County Property Tax Lookup includes several key elements that are crucial for understanding property tax obligations. These elements typically encompass:

- Parcel Information: Details about the specific property, including its location and size.

- Assessed Value: The value determined by the assessor, which is used to calculate property taxes.

- Tax Rate: The current rate applied to the assessed value for tax calculation.

- Payment History: Records of past payments, including any outstanding balances.

Legal Use of the Pinal County Property Tax Lookup

The Pinal County Property Tax Lookup is legally recognized as a valid source of property information. It can be used by property owners to verify their tax obligations, assess property values for financial decisions, and ensure compliance with local tax laws. Additionally, real estate professionals may utilize this tool to assist clients in understanding property tax implications during transactions.

Examples of Using the Pinal County Property Tax Lookup

There are various scenarios in which the Pinal County Property Tax Lookup can be beneficial:

- A homeowner checking their property tax assessment to prepare for tax payments.

- A prospective buyer researching property taxes before purchasing a home.

- A real estate agent using the lookup to provide clients with accurate property tax information.

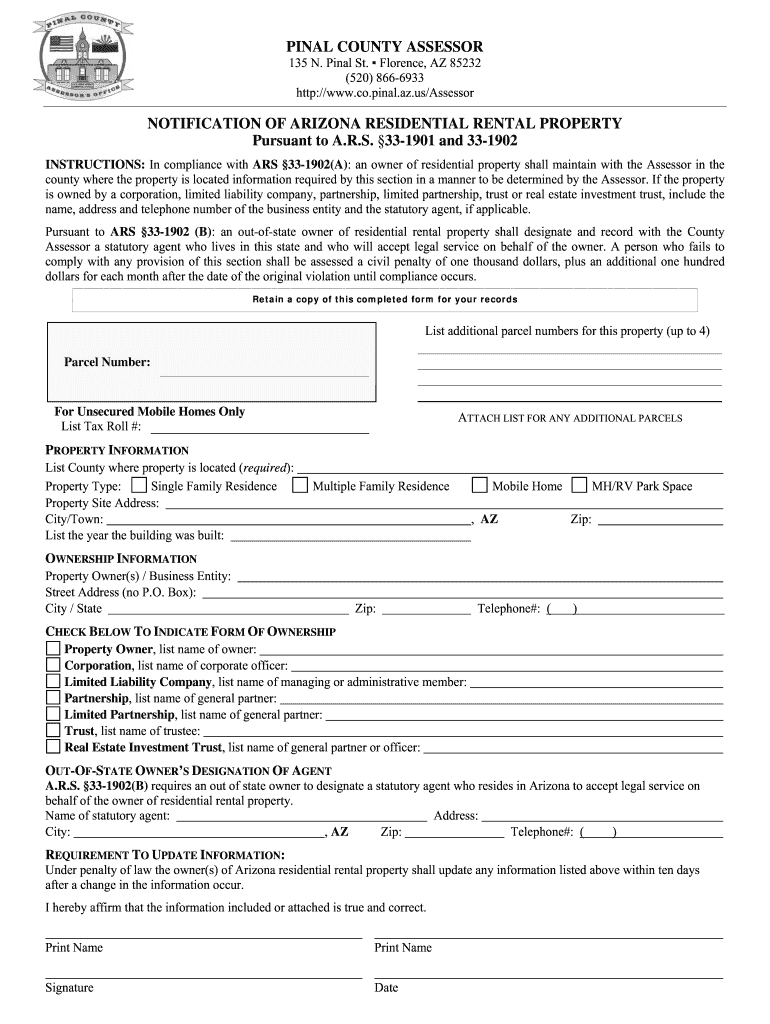

Quick guide on how to complete pinal county property registration form

Thoroughly Review Your Documents with Pinal County Property Tax Lookup

Negotiating agreements, managing listings, organizing calls, and conducting viewings—realtors and real estate professionals shift between numerous duties each day. Many of these tasks involve extensive paperwork, such as Pinal County Property Tax Lookup, that must be filled out quickly and accurately.

airSlate SignNow is a comprehensive solution that allows real estate experts to reduce the paperwork load and concentrate more on their clients’ goals throughout the entire negotiation process, helping them secure the most favorable terms in the transaction.

Instructions to complete Pinal County Property Tax Lookup using airSlate SignNow:

- Access the Pinal County Property Tax Lookup page or utilize our library’s search capabilities to locate the document you require.

- Click on Get form—you will be redirected to the editor right away.

- Begin filling in the form by selecting fillable fields and entering your information into them.

- Add new text and modify its settings if needed.

- Select the Sign option in the upper toolbar to create your signature.

- Explore additional features used to annotate and enhance your form, such as drawing, highlighting, adding shapes, and more.

- Go to the note tab and include comments regarding your document.

- Conclude the process by downloading, sharing, or emailing your form to your designated users or entities.

Eliminate paper entirely and optimize the homebuying process with our user-friendly and powerful solution. Experience enhanced convenience when signing Pinal County Property Tax Lookup and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the ICSI registration form?

Online Registration for CS Foundation | Executive | ProfessionalCheck this site

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

Create this form in 5 minutes!

How to create an eSignature for the pinal county property registration form

How to create an eSignature for the Pinal County Property Registration Form online

How to generate an eSignature for the Pinal County Property Registration Form in Chrome

How to generate an electronic signature for putting it on the Pinal County Property Registration Form in Gmail

How to make an eSignature for the Pinal County Property Registration Form straight from your smartphone

How to create an eSignature for the Pinal County Property Registration Form on iOS

How to make an eSignature for the Pinal County Property Registration Form on Android OS

People also ask

-

What is the Pinal County Property Tax Lookup feature in airSlate SignNow?

The Pinal County Property Tax Lookup feature in airSlate SignNow allows users to quickly and easily access property tax information for properties located in Pinal County. This feature helps streamline the process of obtaining necessary tax documents, making it simple for both property owners and real estate professionals to stay informed.

-

How can I use airSlate SignNow for Pinal County Property Tax Lookup?

To use airSlate SignNow for Pinal County Property Tax Lookup, simply log in to your account and navigate to the property tax lookup section. From there, you can enter the property details to retrieve tax information, allowing for efficient document management and e-signatures related to property transactions.

-

Is there a cost associated with using the Pinal County Property Tax Lookup?

airSlate SignNow offers a range of pricing plans, and the Pinal County Property Tax Lookup feature is included in these plans. Users benefit from a cost-effective solution that provides essential tools for managing property documents, making it a valuable investment for businesses and individuals alike.

-

What are the benefits of using airSlate SignNow for property tax management?

Using airSlate SignNow for property tax management, including the Pinal County Property Tax Lookup, offers numerous benefits. It enhances efficiency by simplifying document handling, reduces the time spent on paperwork, and provides a secure platform for e-signatures, ensuring that all property transactions are managed smoothly.

-

Can I integrate airSlate SignNow with other software for Pinal County Property Tax Lookup?

Yes, airSlate SignNow supports various integrations with other software tools, enhancing your experience with the Pinal County Property Tax Lookup. By connecting with CRM systems, accounting software, and document management platforms, users can streamline their workflows and improve productivity.

-

Are there any specific features in airSlate SignNow that support Pinal County Property Tax Lookup?

airSlate SignNow includes several features that support the Pinal County Property Tax Lookup, such as customizable templates and automated workflows. These features allow users to create tailored documents for tax purposes quickly and efficiently, ensuring all necessary information is readily available and organized.

-

How secure is the information accessed through Pinal County Property Tax Lookup in airSlate SignNow?

The security of your information is a top priority with airSlate SignNow. When using the Pinal County Property Tax Lookup, you can trust that all data is encrypted and protected, ensuring that sensitive property tax information remains confidential and secure throughout the document signing process.

Get more for Pinal County Property Tax Lookup

Find out other Pinal County Property Tax Lookup

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free