Risk Supplemental Form

What is a builder's risk policy?

A builder's risk policy is a specialized type of insurance designed to protect buildings under construction. This coverage typically includes protection against risks such as fire, theft, vandalism, and certain weather-related damages. It is essential for contractors, builders, and property owners to understand that this policy is specifically tailored for the construction phase and does not cover completed structures. The policy can be customized to fit the unique needs of a project, providing peace of mind during the construction process.

Key elements of a builder's risk policy

Understanding the key elements of a builder's risk policy can help ensure adequate coverage. Important components often include:

- Coverage limits: The maximum amount the insurer will pay for a covered loss.

- Deductibles: The amount the policyholder must pay out of pocket before the insurance kicks in.

- Covered perils: Specific risks that the policy will cover, such as fire, theft, and certain weather events.

- Exclusions: Risks not covered by the policy, which may include damage due to poor workmanship or design flaws.

- Duration: Coverage typically lasts until the construction is complete or the property is occupied.

How to obtain a builder's risk policy

Obtaining a builder's risk policy involves several steps. First, it is important to assess the specific needs of the construction project. This includes determining the value of the property, the duration of the construction, and any unique risks associated with the project. Next, potential policyholders should consult with an insurance agent or broker who specializes in builder's risk insurance. They can provide guidance on selecting the right coverage and help navigate the application process. Finally, after reviewing quotes and policy options, the builder can purchase the policy that best fits their needs.

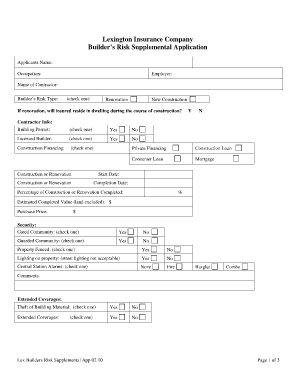

Steps to complete the builder's risk application

Completing the builder's risk application requires careful attention to detail. Here are the general steps involved:

- Gather project details: Collect information about the construction site, project value, and timeline.

- Identify coverage needs: Determine the specific risks to insure against and any additional coverage options required.

- Fill out the application: Provide accurate information on the application form, including all relevant details about the project and stakeholders.

- Review terms: Understand the policy terms, including coverage limits and exclusions, before submission.

- Submit the application: Send the completed application to the chosen insurance provider for review and approval.

Legal use of a builder's risk policy

The legal use of a builder's risk policy is crucial for ensuring compliance with local regulations and protecting all parties involved in a construction project. It is important to note that this insurance should be in place before construction begins to avoid potential legal issues. Additionally, having a builder's risk policy can help fulfill contractual obligations with lenders, investors, and property owners. Understanding the legal implications of the policy can safeguard against disputes and provide a clear framework for addressing risks during the construction process.

State-specific rules for builder's risk insurance

Builder's risk insurance regulations can vary significantly by state. It is essential for contractors and property owners to familiarize themselves with local laws and requirements. Some states may mandate specific coverage levels or have unique exclusions that impact policy terms. Additionally, certain jurisdictions might require builders to carry liability insurance alongside their builder's risk policy. Consulting with a local insurance expert can provide insights into state-specific rules and ensure compliance with all legal obligations.

Quick guide on how to complete risk supplemental

Complete Risk Supplemental seamlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely retain it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files swiftly without delays. Manage Risk Supplemental on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to edit and eSign Risk Supplemental effortlessly

- Find Risk Supplemental and click Get Form to begin.

- Leverage the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign function, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign Risk Supplemental while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the risk supplemental

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is a builders risk policy?

A builders risk policy is a specialized insurance designed to cover buildings under construction or renovation. It protects the structure from risks such as fire, theft, and weather-related damages. Understanding what is a builders risk policy is essential for contractors and property owners to safeguard their investments during building projects.

-

Who needs a builders risk policy?

Anyone involved in construction, including builders, contractors, and property owners, can benefit from a builders risk policy. This type of coverage is particularly critical for new builds, major renovations, or additions. Knowing what is a builders risk policy helps stakeholders ensure adequate protection against unexpected events.

-

What does a builders risk policy typically cover?

A builders risk policy typically covers damage to the structure itself, materials on-site, and fixtures that are being installed. It generally includes protection against risks like fire, water damage, and vandalism. Understanding what is a builders risk policy allows property owners to identify necessary exclusions and enhancements for their coverage.

-

How much does a builders risk policy cost?

The cost of a builders risk policy depends on various factors, including the project's size, location, and duration. On average, premiums might range from 1% to 3% of the total construction cost. It's vital to evaluate what is a builders risk policy and its pricing structure to select the most suitable option for your needs.

-

Can I customize my builders risk policy?

Yes, many insurance providers allow for customization of builders risk policies. You can often add coverage for specific risks or increase limits based on project requirements. Understanding what is a builders risk policy will help you choose the appropriate endorsements to tailor your coverage effectively.

-

How long does builders risk insurance last?

A builders risk insurance policy typically lasts until the construction project is completed or a specified period ends. This duration can range from a few months to a year, depending on the nature of the project. It's important to know what is a builders risk policy and its timeline to ensure continuous protection.

-

What happens if a claim is filed against my builders risk policy?

If a claim is filed, the insurance company will review the circumstances and coverage terms outlined in your builders risk policy. They will assess the damages and determine compensation based on the policy limits and deductibles. To navigate this process effectively, understand what is a builders risk policy and how it applies to your situation.

Get more for Risk Supplemental

- Small business self certification statement form

- Rpie 2011 b form

- Public improvement lien form california

- Tribal higher education scholarship program tsp application online form

- Private money lender handbook pdf form

- Merp survey facility questionnaire form

- Form cms2567

- Pa medical command authorization form

Find out other Risk Supplemental

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now