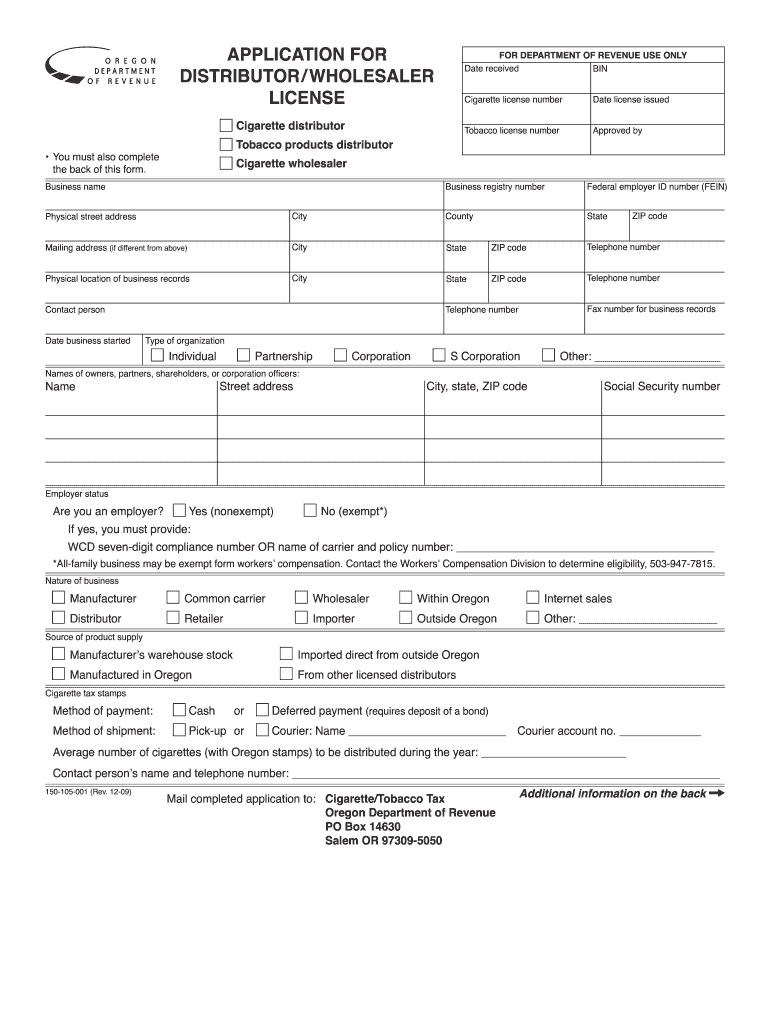

Oregon Form 150 105 001 2009

What is the Oregon Form 150 105 001

The Oregon Form 150 105 001 is a tax form used by individuals and businesses in the state of Oregon for specific tax reporting purposes. This form is essential for ensuring compliance with state tax regulations. It is primarily utilized for reporting income, deductions, and credits applicable to Oregon taxpayers. Understanding the purpose and requirements of this form is crucial for accurate tax filing and to avoid potential penalties.

How to use the Oregon Form 150 105 001

Using the Oregon Form 150 105 001 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it thoroughly for any errors. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the Oregon Form 150 105 001

Completing the Oregon Form 150 105 001 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and any other sources of income.

- List all applicable deductions and credits to reduce your taxable income.

- Double-check all entries for accuracy before signing the form.

- Submit the completed form by the designated deadline to avoid penalties.

Legal use of the Oregon Form 150 105 001

The legal use of the Oregon Form 150 105 001 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the required timeframe. Additionally, it is essential to ensure that all information provided is truthful and supported by appropriate documentation. Failure to comply with these legal requirements can result in penalties, including fines or additional taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form 150 105 001 are critical for maintaining compliance with state tax laws. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, it is important to verify specific dates each tax year, as they may vary. Taxpayers should also be aware of any extensions that may apply to their situation.

Form Submission Methods (Online / Mail / In-Person)

The Oregon Form 150 105 001 can be submitted through various methods to accommodate different taxpayer preferences. Options typically include:

- Online Submission: Many taxpayers prefer to file electronically through the Oregon Department of Revenue’s e-filing system.

- Mail: Completed forms can be mailed to the appropriate address provided by the state tax authority.

- In-Person: Taxpayers may also choose to submit the form in person at designated state tax offices.

Quick guide on how to complete oregon form 150 105 001

Prepare Oregon Form 150 105 001 easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Oregon Form 150 105 001 on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign Oregon Form 150 105 001 effortlessly

- Find Oregon Form 150 105 001 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Oregon Form 150 105 001 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon form 150 105 001

Create this form in 5 minutes!

How to create an eSignature for the oregon form 150 105 001

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Oregon Form 150 105 001?

The Oregon Form 150 105 001 is a specific tax form used for reporting state income tax in Oregon. It is essential for individuals and businesses to accurately complete this form to comply with state tax regulations. Utilizing airSlate SignNow can streamline the eSigning process for your Oregon Form 150 105 001, making submission easier.

-

How can airSlate SignNow help me with the Oregon Form 150 105 001?

airSlate SignNow provides an easy-to-use platform that allows you to send and eSign documents, including the Oregon Form 150 105 001. By utilizing our service, you can ensure that your forms are signed quickly and securely, which helps you meet deadlines without hassle.

-

What are the pricing options for airSlate SignNow when using the Oregon Form 150 105 001?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Users can choose from monthly or annual subscriptions, both designed to provide great value for efficiently managing forms like the Oregon Form 150 105 001. Explore our pricing page for more details.

-

Are there any features specific to signing the Oregon Form 150 105 001 with airSlate SignNow?

Yes, airSlate SignNow includes features like customizable templates and secure eSigning specifically for forms like the Oregon Form 150 105 001. You can easily track the signing status, receive notifications, and even integrate with other applications to enhance your workflow.

-

What benefits does airSlate SignNow provide for handling the Oregon Form 150 105 001?

Using airSlate SignNow for the Oregon Form 150 105 001 provides several benefits, including reduced paperwork, enhanced security, and faster processing times. By digitizing the signing process, businesses can save time and ensure that they are always in compliance with Oregon's tax requirements.

-

Can I integrate airSlate SignNow with other software to manage the Oregon Form 150 105 001?

Absolutely! airSlate SignNow offers seamless integrations with many popular software solutions, allowing you to manage the Oregon Form 150 105 001 in conjunction with your existing tools. This helps streamline your document workflows and keeps everything organized in one place.

-

Is it easy to share the Oregon Form 150 105 001 with clients using airSlate SignNow?

Yes, sharing the Oregon Form 150 105 001 with clients is simple and efficient through airSlate SignNow. Our platform allows you to send documents directly to your clients, ensuring they receive and can sign relevant forms quickly, thereby expediting your processes.

Get more for Oregon Form 150 105 001

- Personal recommendation essec business school essec form

- Dci 148 iowa form

- Unemployment application form pdf

- Nurse form 1 op nysed

- Ui 1 application for unemployment benefits rrb form

- Nelf fillable long form application

- American payroll association application for form

- Pg 101 emergency petition for appointment of a temporary guardian form

Find out other Oregon Form 150 105 001

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe