Wage Deduction Authorization for Federally Assisted Projects Form

What is the Wage Deduction Authorization For Federally Assisted Projects Form

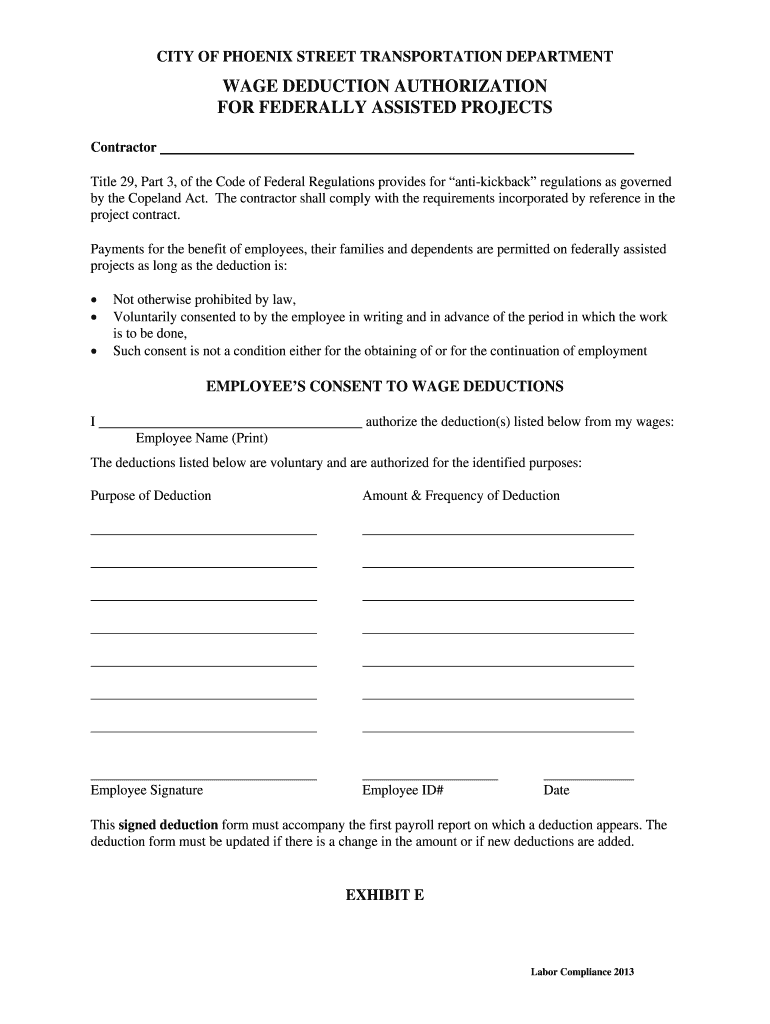

The wage deduction authorization for federally assisted projects form is a crucial document that allows employers to deduct a specified amount from an employee's wages for various purposes, such as loan repayments or contributions to benefit programs. This form ensures compliance with federal regulations while providing a clear record of the deductions authorized by employees. Understanding the purpose of this form is essential for both employers and employees involved in federally funded projects.

How to Use the Wage Deduction Authorization For Federally Assisted Projects Form

Using the wage deduction authorization for federally assisted projects form involves several straightforward steps. First, the employee must fill out the form accurately, specifying the amount to be deducted and the purpose of the deduction. Once completed, the employee should sign and date the form to authorize the deductions. The employer must then retain this document in their records to ensure compliance with federal guidelines and provide transparency regarding wage deductions.

Steps to Complete the Wage Deduction Authorization For Federally Assisted Projects Form

Completing the wage deduction authorization for federally assisted projects form requires careful attention to detail. Follow these steps:

- Obtain the form from your employer or relevant agency.

- Fill in your personal information, including your name, address, and employee ID.

- Specify the amount to be deducted from your wages and the reason for the deduction.

- Review the form for accuracy and completeness.

- Sign and date the form to authorize the deductions.

- Submit the completed form to your employer for processing.

Key Elements of the Wage Deduction Authorization For Federally Assisted Projects Form

Several key elements must be included in the wage deduction authorization for federally assisted projects form to ensure its validity. These elements include:

- Employee Information: Full name, address, and employee identification number.

- Deduction Amount: The specific amount to be deducted from wages.

- Purpose of Deduction: A clear explanation of why the deduction is being made.

- Employee Signature: The employee's signature is required to authorize the deduction.

- Date: The date when the form is signed.

Legal Use of the Wage Deduction Authorization For Federally Assisted Projects Form

The legal use of the wage deduction authorization for federally assisted projects form is governed by federal regulations that ensure employees are fully informed about any deductions from their wages. Employers must adhere to these regulations to avoid legal repercussions. Proper execution of the form not only protects the rights of employees but also provides employers with a documented basis for wage deductions, reinforcing compliance with labor laws.

Form Submission Methods (Online / Mail / In-Person)

Submitting the wage deduction authorization for federally assisted projects form can be done through various methods, depending on the employer's preferences. Common submission methods include:

- Online Submission: Many employers allow employees to submit forms electronically through secure portals.

- Mail: Employees may also choose to print the form and send it via postal mail to their employer's human resources department.

- In-Person: Delivering the form directly to the employer or HR department is another option, ensuring immediate processing.

Quick guide on how to complete wage deduction authorization for federally assisted projects form

Complete Wage Deduction Authorization For Federally Assisted Projects Form seamlessly on any device

Virtual document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Wage Deduction Authorization For Federally Assisted Projects Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Wage Deduction Authorization For Federally Assisted Projects Form effortlessly

- Obtain Wage Deduction Authorization For Federally Assisted Projects Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of the paperwork or redact sensitive information using tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature utilizing the Sign tool, which takes only seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for delivering your document, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misfiled documents, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Wage Deduction Authorization For Federally Assisted Projects Form to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage deduction authorization for federally assisted projects form

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a wage deduction authorization for federally assisted projects?

A wage deduction authorization for federally assisted projects allows employers to deduct specific amounts from employee wages to meet compliance with federal regulations. This ensures that funds are appropriately allocated for labor costs, and it can streamline budgeting for project managers.

-

How does airSlate SignNow facilitate wage deduction authorization for federally assisted projects?

airSlate SignNow simplifies the process of creating and sending wage deduction authorization forms for federally assisted projects. With its user-friendly interface, you can easily generate, send, and eSign documents, ensuring compliance and efficiency throughout the project lifecycle.

-

What pricing options are available for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Whether you are a small business or a large enterprise working on federally assisted projects, you can find a plan that fits your budget while providing the necessary features for wage deduction authorization.

-

Can I integrate airSlate SignNow with other tools for managing federally assisted projects?

Yes, airSlate SignNow supports integrations with various project management and accounting tools. This capability allows for seamless workflow between applications, ensuring that wage deduction authorization for federally assisted projects is executed smoothly alongside other administrative functions.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing offers numerous benefits, including enhanced security, compliance with regulations, and time-saving features. For wage deduction authorization for federally assisted projects, it ensures that documentation is handled securely and efficiently, reducing the risk of errors.

-

Is there a mobile app for airSlate SignNow to handle wage deduction authorization on-the-go?

Yes, airSlate SignNow provides a mobile app that allows users to manage their documents, including wage deduction authorization for federally assisted projects, from anywhere. This mobility ensures that you can always stay on top of your paperwork, even when away from the office.

-

How can I ensure compliance with wage deduction authorization requirements?

To ensure compliance with wage deduction authorization requirements, use templates provided by airSlate SignNow that are tailored for federally assisted projects. Additionally, the platform provides guidance on best practices and keeps you updated on any regulatory changes that may affect your processes.

Get more for Wage Deduction Authorization For Federally Assisted Projects Form

Find out other Wage Deduction Authorization For Federally Assisted Projects Form

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template