Office of Student Financial Aid Nau 2013

What is the Office Of Student Financial Aid Nau

The Office of Student Financial Aid at Northern Arizona University (NAU) is dedicated to assisting students in navigating their financial aid options. This office provides information on various types of financial aid, including grants, scholarships, work-study programs, and loans. Their mission is to ensure that students have access to the financial resources necessary to pursue their education without undue financial burden. The office also plays a crucial role in educating students about the financial aid process, eligibility criteria, and the importance of meeting deadlines.

How to use the Office Of Student Financial Aid Nau

Utilizing the Office of Student Financial Aid at NAU involves several steps. First, students should visit the office's website to access resources and information about available financial aid options. Next, students can complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for federal aid. The office offers guidance on filling out the FAFSA and provides support for understanding the financial aid package offered. Additionally, students can schedule appointments with financial aid advisors for personalized assistance and clarification on any financial aid questions.

Steps to complete the Office Of Student Financial Aid Nau

Completing the financial aid process at NAU involves a series of steps:

- Visit the Office of Student Financial Aid website to gather information on available aid.

- Complete the FAFSA to assess eligibility for federal and state aid.

- Review the financial aid offer from NAU, which includes grants, loans, and work-study opportunities.

- Accept or decline the offered aid through the student portal.

- Complete any additional documentation required by the financial aid office.

- Maintain communication with the office to ensure all requirements are met and to address any questions.

Legal use of the Office Of Student Financial Aid Nau

The use of financial aid resources at NAU is governed by federal and state regulations. Students must comply with the eligibility requirements set forth by the U.S. Department of Education, which include maintaining satisfactory academic progress and adhering to financial aid policies. Misuse of financial aid funds can lead to penalties, including repayment of funds and loss of future aid eligibility. It is crucial for students to understand their responsibilities and rights regarding financial aid to ensure compliance with all legal standards.

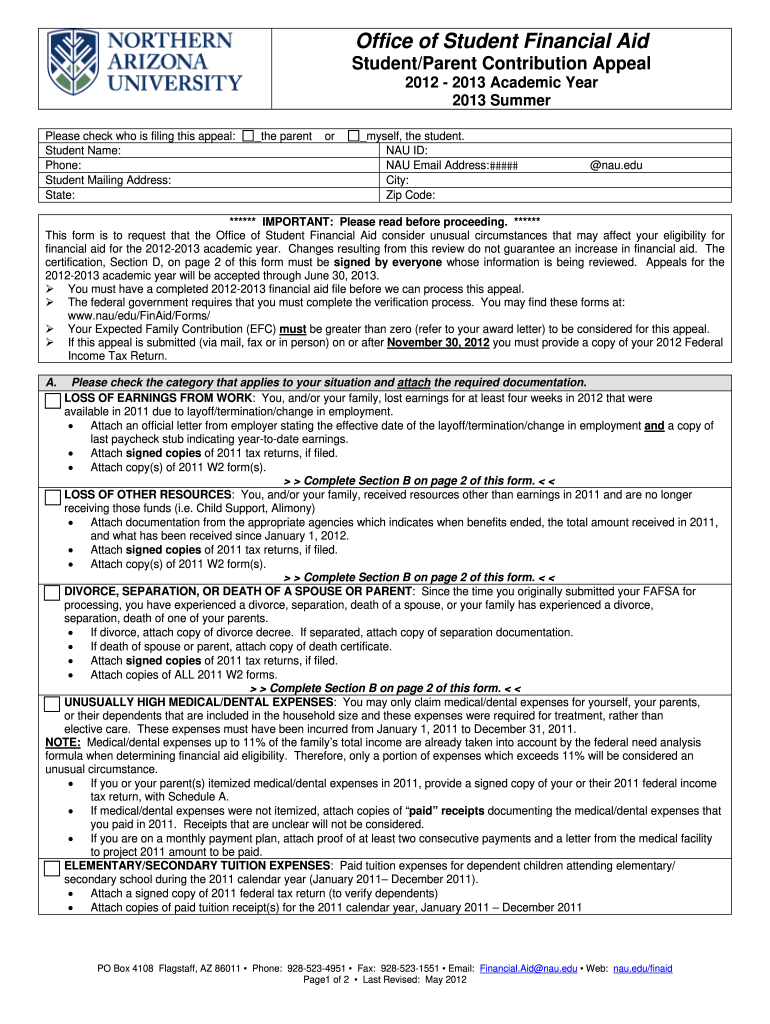

Required Documents

To apply for financial aid through the Office of Student Financial Aid at NAU, students typically need to provide several key documents:

- Completed FAFSA form.

- Tax returns and W-2 forms from the previous year.

- Proof of enrollment or acceptance at NAU.

- Any additional documentation requested by the financial aid office, such as verification forms.

Eligibility Criteria

Eligibility for financial aid through the Office of Student Financial Aid at NAU is determined based on several factors:

- Enrollment status (full-time or part-time).

- Financial need as determined by the FAFSA.

- Academic progress and GPA requirements.

- Citizenship status and residency requirements.

Quick guide on how to complete office of student financial aid nau

The simplest method to obtain and endorse Office Of Student Financial Aid Nau

Across the entirety of your business, unproductive workflows surrounding paper approval can consume a signNow amount of work hours. Endorsing documents like Office Of Student Financial Aid Nau is an inherent aspect of operations in any sector, which is why the effectiveness of each contract's lifecycle signNowly impacts the overall productivity of the company. With airSlate SignNow, endorsing your Office Of Student Financial Aid Nau is as straightforward and quick as it can be. You will discover on this platform the most recent version of nearly any document. Even better, you can endorse it immediately without needing to install external software on your computer or printing anything out in physical form.

Steps to obtain and endorse your Office Of Student Financial Aid Nau

- Browse through our library by category or use the search function to find the document you require.

- View the document preview by clicking on Learn more to confirm it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your document and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Office Of Student Financial Aid Nau.

- Select the signing option that is most suitable for you: Draw, Create initials, or include an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can find, complete, edit, and even send your Office Of Student Financial Aid Nau in a single tab with ease. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct office of student financial aid nau

FAQs

-

What can I do when a divorced parent refuses to fill out a college financial aid form?

Anything that does not involve going to university and paying for it with loans/grants.Join the service.Get a full time job and take a class at a time and pay with cash.Find an employer that will pay for your schooling.Get married so you can be considered an independent student 9but not from your husband).Jus t get a job. By the time the government lets you file as an independent student(age 24) you may have found an even better pattern that doesn’t involve college at all.

-

How can I apply to financial aid as an international student as I'm wanting to apply to UNC and they ask you to fill the form in the common app?

Which form? There is no financial form in the Common App. Common App is an application form for college admissions. There is a question whether you are going to apply for financial aid, but that’s it.For international admissions to UNC, read the information here: International Students.Paying for Carolina:International students are not eligible to receive need-based financial aid and should be prepared to pay the full cost of attendance for non-resident students. If you are admitted, we’ll ask you to provide documentation that you have sufficient funds to cover the total cost of attendance for one academic year. For 2017-2018, the cost is $53,100.We consider all students, including international students, for a limited number of merit-based scholarships. There is no separate application for these scholarships—just by applying for admission, you’ll automatically be considered for these opportunities. Because these are quite limited in number, we encourage all students to be prepared to pay the full cost of attendance.Since international students are ineligible for financial aid at UNC, there is no application for it. No separate application is needed for merit scholarships, since applicants are considered based on their qualifications presented in the Common App.

-

Do I have to fill out both the FAFSA (since I'm a US citizen living abroad) and a CSS profile form to get financial aid for colleges?

There’s nothing about the FAFSA that is exclusive or required for US citizens living abroad. The FAFSA is simply the most commonly used application form for student aid applications GENERALLY, and almost every college and university asks for it rather than go to the trouble of inventing their own - even though, in fact, many of them DO have their own application, and STILL want to see a FAFSA.What you actually should do, is go to the website OF THE COLLEGES you are interested in, and check the parts where financial aid is discussed, and see what they want to see.Probably 90% or more will want a FAFSA, maybe 10% will want their own form IN ADDITION to the FAFSA, and a certain number will also want to see the CSS profile.So fill out the FAFSA online. There is part of it which asks for the codes (every college has one) for the colleges you want to have them send the form to. You can send a FAFSA to TEN colleges when you fill out the FAFSA in the first place - AND, you can go back later, and add more colleges.Fill out the FAFSA. The one for fall semester 2018- spring 2019 is available to be filled out beginning, I believe, around October 2017. Most colleges want to have that in their possession by January 2018.Unless, of course, you are independently wealthy, and can afford to pay for college by yourself.Other notes:you fill out the FAFSA every year for the next college year.you can link to the IRS website to pre-fill in a lot of the information the FAFSA asks for (this saves time).you need your own tax return data (if you have such a thing yet) and your parents’ information also.It looks intimidating, but it really isn’t terribly difficult - I would suggest going through the FAFSA website and reading most of the information there before you start, because there are various documents and numbers you will need to have to fill out the form, and it is easier if you have collected all that stuff before you sit down to fill the form out.By the way - I see this idea often and it is wrong - ‘FAFSA’ does NOT give anybody any money. It is an APPLICATION FOR AID. The college you apply to and get accepted at will look at your application, your FAFSA form, all the other required forms you supply to them, and THEN the Financial Aid office will decide a) whether to offer you an aid package and b) what that aid package will contain.It could be a mix of scholarships (great!), grants (wonderful!), student loans of various kinds (read the fine print) and perhaps an offer of work-study. You can accept or refuse any of those, individually.Good luck!

-

If you are disowned by your family before college at age 18, how would you fill out the financial aid form?

I’m not sure what ‘disowned’ means, is this a legal situation where you are emancipated or are you just out of the house and not supported?If you are just on your own and not supported you are out of luck. It isn’t any different than any other kid. Until you are 24, you are not independent for aid and have to file FAFSA with your information and your parent financial information. This does not require your parents to pay anything. But it is used for the aid calculations.There are a limited set of circumstances where you can file with just your information only. This is called being an Independent Student for aid and it is not based on your parents supporting you are not. It is based on these criteria:https://studentaid.ed.gov/sa/faf...Now if your parents refuse to provide information you are still out of luck. You may file a FAFSA with only your information but aid will be limited. The most you will get is a federal loan starting at $5,500 for freshman year. You will have to contact the financial aid office at the colleges where you are accepted in order to get the override instructions. You won’t get any Pell Grant or college aid in this case.

-

Student Loans and Debt: How do I convince the financial aid office to increase my COA?

Create a budget, showing your typical monthly expenses. Highlight dependent care expenses and private K-12 tuition for your children. Also any unusually high unreimbursed medical or dental expenses. Colleges won't subsidize lifestyle choices. They also won't cover the monthly payments on any form of debt, such as credit cards, auto loans or mortgages.They will, however, cover the incremental use of a car that is associated with enrolling in college. Show the mileage between where you live and the college's location, and they'll provide an allowance based on the IRS mileage rates (55.5 cents per mile currently). Colleges are wary of increasing the cost of attendance too much, because COA increases usually translate into additional debt. If you borrow too much for living expenses, you'll graduate with too much debt. Your total student loan debt at graduation should be less than your expected annual starting salary and ideally a lot less. If your debt is less than your annual income, you'll be able to repay the student loans in about 10 years. If your debt will exceed your annual income, you'll struggle to repay the loans and will need an alternate repayment plan, such as extended repayment or income-based repayment in order to afford the monthly loan payments. This will mean that you'll be in repayment for 20 years or longer. That's even more problematic for a non-traditional student than a traditional student.

-

Student Financial Aid: How accurate does information have to be on the Collegeboard CSS Profile form?

Fudge? Not sure what you mean by that. Lie, low-ball, hide? Whatever the ruse, it sure doesn't make a lot of sense to do something like that. The numbers you enter will be verified against your tax returns when they're available and any irregularities, mistakes or outright lies will be caught and the awards, if any, adjusted with the correct, current figures. What is more, if they deem the misinformation intentional, you've pretty much blown your chances across the board. Bonehead move really.

-

How does the government aid office decide if a student should get a financial aid based on the information he/she provided on the FAFSA form?

It isn’t hard. But first you should know that the colleges administer the aid on behalf of the federal government.First, every student qualified to fill out FAFSA gets to take a federal student loan, if eligible. That is considered financial aid because no one else would lend to you and the rate and terms are favorable. You are limited in amount each year; for freshman year the amount is $5,500.When you file there will be a calculation on your income and assets and family size to calculate your EFC, Expected Family Contribution (there are a few other more minor factors.) If your EFC is 0, meaning you are low income you will get a Pell Grant for 5,815. If your EFC is not zero but still low you will get a partial Pell Grant. If you are not low enough income you can’t get this at all. There is no other grant available from the federal government for you. You will see your EFC when you file your Pell on your SAT (Student Aid Report.)When you get accepted to the college, the college may award you additional federal aid. They have a few other types of federal aid that is limited and not everyone can get itSEOG - another type of grant, usually for the lowest income students applying. You may get a couple thousand, availability is limited.Work/Study - a way to get a low hours job at school and earn a bit each month for your per expenses.Perkins Loan (if still in effect): additional loan at favorable rates.For any other aid, the federal government doesn’t decide it. Well, if there is state aid, then the state government has to decide it. Some states have aid, some don’t. They will also use the FAFSA numbers but may have their own formula. Any other aid has to come from the college. The college will apply its own institutional aid according to its own policies.

Create this form in 5 minutes!

How to create an eSignature for the office of student financial aid nau

How to create an electronic signature for the Office Of Student Financial Aid Nau online

How to create an eSignature for your Office Of Student Financial Aid Nau in Google Chrome

How to generate an electronic signature for putting it on the Office Of Student Financial Aid Nau in Gmail

How to make an eSignature for the Office Of Student Financial Aid Nau from your smart phone

How to create an electronic signature for the Office Of Student Financial Aid Nau on iOS devices

How to make an electronic signature for the Office Of Student Financial Aid Nau on Android OS

People also ask

-

What services does the Office Of Student Financial Aid Nau provide?

The Office Of Student Financial Aid Nau offers a range of services to help students access financial support for their education. This includes assistance with scholarships, grants, loans, and budgeting. Our team is dedicated to guiding students through the financial aid process to ensure they make informed decisions.

-

How can I apply for financial aid through the Office Of Student Financial Aid Nau?

To apply for financial aid, you need to complete the Free Application for Federal Student Aid (FAFSA). Once submitted, the Office Of Student Financial Aid Nau will review your application and determine your eligibility for various financial aid programs. Be sure to check the official deadlines to ensure your application is processed in time.

-

What kind of financial aid options are available at the Office Of Student Financial Aid Nau?

The Office Of Student Financial Aid Nau provides various financial aid options, including federal and state grants, scholarships, and work-study opportunities. Additionally, students may also be eligible for loans, which can be repaid after graduation. We strive to tailor financial aid packages to meet individual student needs and circumstances.

-

Are the services of the Office Of Student Financial Aid Nau free?

Yes, the services provided by the Office Of Student Financial Aid Nau are free of charge. Our mission is to support students in navigating their financial aid options without incurring additional costs. All you need to do is signNow out for guidance and support.

-

What are the benefits of working with the Office Of Student Financial Aid Nau?

Working with the Office Of Student Financial Aid Nau gives you access to expert advice and personalized financial aid plans. Our knowledgeable staff can help you maximize your financial aid opportunities and navigate complex processes, ultimately saving you time and stress while pursuing your education.

-

How does the Office Of Student Financial Aid Nau assist in loan management?

The Office Of Student Financial Aid Nau provides resources and guidance to help students understand their loan options and responsibilities. We offer workshops and one-on-one consultations to educate students about loan repayment plans, interest rates, and deferment options, ensuring you make informed financial decisions post-graduation.

-

Can I receive financial aid if I am a non-traditional student at the Office Of Student Financial Aid Nau?

Absolutely! The Office Of Student Financial Aid Nau is committed to assisting all students, including non-traditional students. Everyone's financial situation is unique, and we will work with you to find the financial aid options that best suit your circumstances and educational goals.

Get more for Office Of Student Financial Aid Nau

Find out other Office Of Student Financial Aid Nau

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney