Form Upwards Variation

What is the Form Upwards Variation

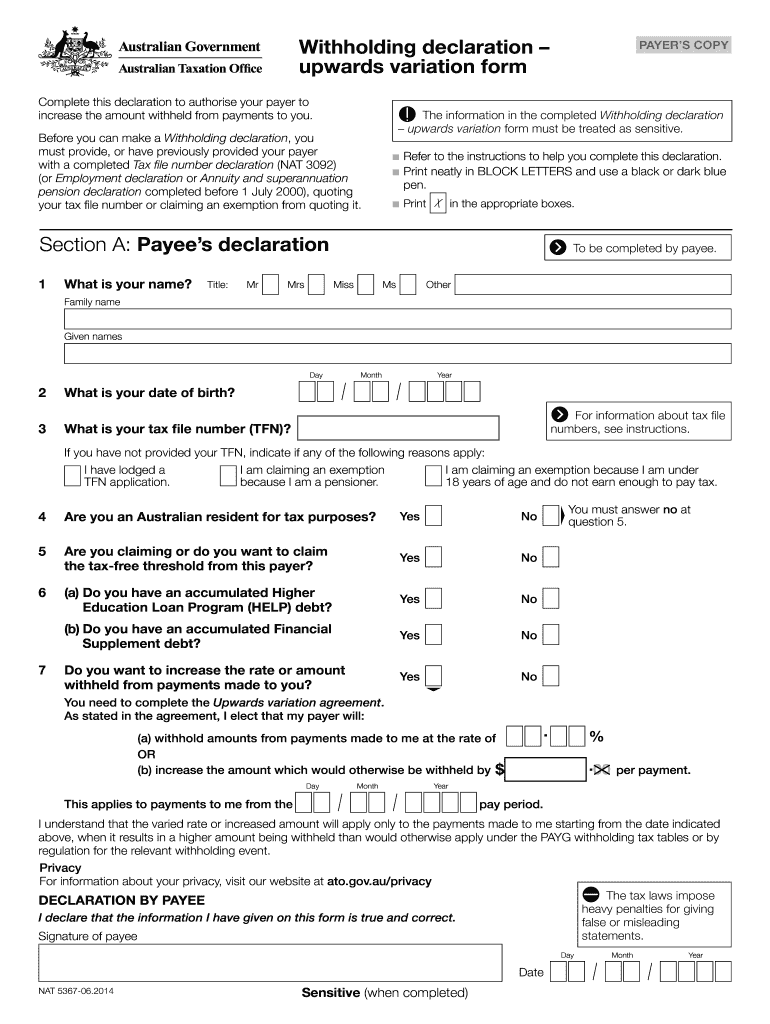

The upwards variation form is a specific document used to adjust withholding amounts for tax purposes. It is particularly relevant for individuals who want to modify their tax withholding based on changes in their financial situation or tax obligations. This form allows taxpayers to request an increase in their withholding to ensure they meet their tax liabilities effectively. Understanding the purpose and function of the upwards variation form is essential for proper tax management.

Steps to Complete the Form Upwards Variation

Completing the upwards variation form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your Social Security number and details of your current withholding. Next, fill out the form accurately, specifying the new withholding amount you are requesting. It is crucial to double-check all entries for correctness. Once completed, sign and date the form, ensuring that you meet any additional requirements stipulated by the issuing authority.

Legal Use of the Form Upwards Variation

The upwards variation form is legally binding when completed and submitted according to established guidelines. To ensure its validity, it must comply with relevant tax laws and regulations. This includes providing accurate information and obtaining necessary signatures. Utilizing a trusted eSignature solution can enhance the legal standing of the document, ensuring that it meets the requirements set forth by the IRS and other governing bodies.

Key Elements of the Form Upwards Variation

Several key elements must be included in the upwards variation form to ensure its effectiveness. These elements typically include:

- Your personal identification information, such as name and Social Security number.

- The current withholding amount and the proposed new amount.

- A clear declaration of the reason for the change in withholding.

- Your signature and the date of completion.

Ensuring that all these components are present will help facilitate a smooth processing of your request.

Form Submission Methods

The upwards variation form can be submitted through various methods, depending on the specific requirements of the tax authority. Common submission methods include:

- Online submission through a secure e-filing platform.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices or authorized locations.

Choosing the appropriate submission method is important for timely processing and compliance.

Examples of Using the Form Upwards Variation

There are several scenarios in which individuals might find the upwards variation form useful. For instance, a self-employed individual may experience an increase in income and wish to adjust their withholding to avoid underpayment penalties. Similarly, a retiree may need to increase their withholding due to changes in their pension or investment income. Understanding these examples can help taxpayers recognize when to utilize the upwards variation form effectively.

Quick guide on how to complete form upwards variation

Effortlessly Prepare Form Upwards Variation on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form Upwards Variation on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Adjust and Electronically Sign Form Upwards Variation with Ease

- Obtain Form Upwards Variation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive details with instruments that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow manages all your document-related needs with a few clicks from any preferred device. Edit and electronically sign Form Upwards Variation to ensure excellent communication at any phase of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form upwards variation

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the nat withholding declaration form, and why is it important?

The nat withholding declaration form is a crucial document used by businesses to manage withholding taxes for employees. It ensures that the correct amount of tax is withheld from an employee's paycheck based on their individual circumstances. Using this form helps companies stay compliant with tax regulations and avoid penalties.

-

How does airSlate SignNow help in managing the nat withholding declaration form?

airSlate SignNow offers an intuitive platform for businesses to create, send, and eSign the nat withholding declaration form electronically. This signNowly reduces paperwork, streamlines the process, and saves time. You can easily track the status of your forms and ensure they are completed promptly.

-

Is there a cost associated with using airSlate SignNow for the nat withholding declaration form?

Yes, airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. The cost varies depending on the features you choose, but it remains an affordable option for companies looking to simplify their document management process, including the nat withholding declaration form.

-

Can the nat withholding declaration form be customized in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the nat withholding declaration form to meet your business needs. You can add your branding, edit fields, and include specific instructions, making it easy for employees to fill out their information accurately.

-

What benefits does airSlate SignNow provide for the nat withholding declaration form?

Using airSlate SignNow for the nat withholding declaration form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. The electronic signing process minimizes the risk of lost documents and ensures all information is securely stored and easily accessible.

-

Are there integrations available for airSlate SignNow related to the nat withholding declaration form?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, allowing for smooth handling of the nat withholding declaration form alongside other documents. Popular integrations include CRM systems, cloud storage platforms, and project management tools, enhancing your overall workflow.

-

How secure is the airSlate SignNow platform when handling the nat withholding declaration form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption methods and secure cloud storage to ensure your nat withholding declaration forms and sensitive information are protected. Compliance with industry standards gives businesses peace of mind while managing their documents.

Get more for Form Upwards Variation

- Form 39 1 city of new york parks amp recreation contractoramp39s nycgovparks

- Whether one or more whose address is and whose address is landman form

- Simple ira employee application amp brochure alliancebernstein form

- Master land services contract american association of professional landman form

- Arpin statement of claim form

- Pretzelmaker application form

- Choctaw casino online application form

- Application for fire equipment permit floridaamp39s department of form

Find out other Form Upwards Variation

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed