Lirr Insurance 2017-2026

What is the Lirr Insurance

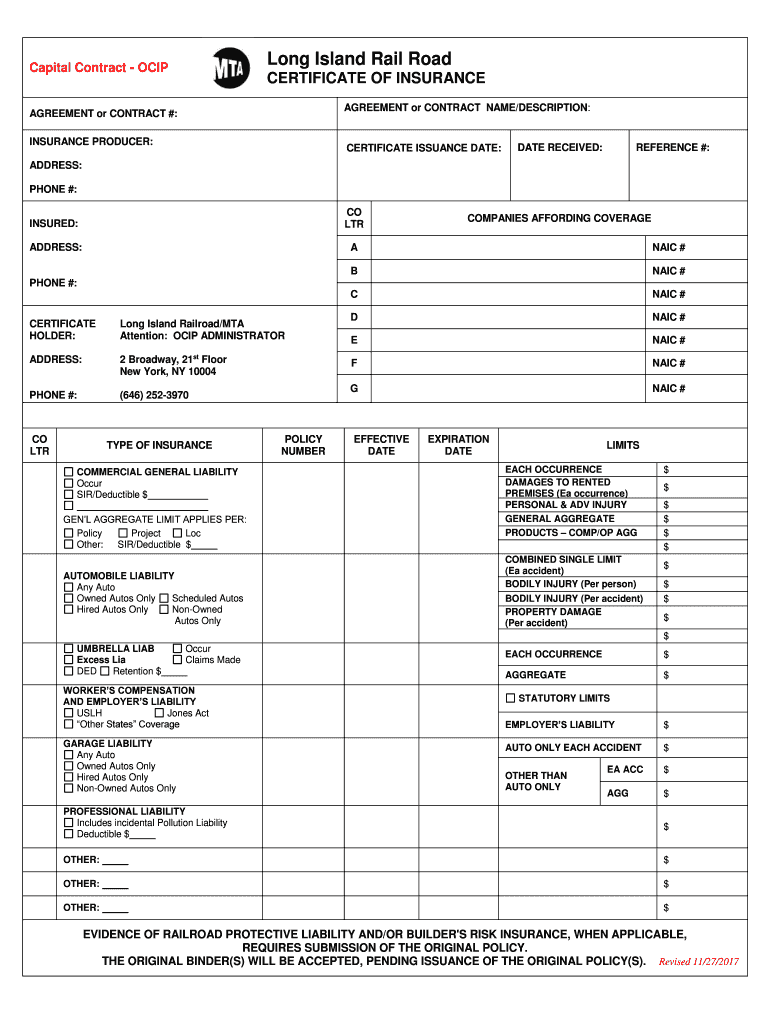

The Lirr insurance is a specific type of coverage designed for employees of the Long Island Rail Road (LIRR). It provides essential protection for workers against various risks associated with their employment. This insurance typically includes benefits such as health coverage, disability compensation, and liability protection. Understanding the scope and details of this insurance is crucial for LIRR employees to ensure they are adequately protected while performing their duties.

How to Obtain the Lirr Insurance

To obtain Lirr insurance, employees must follow a structured process that involves several steps. First, they should contact their human resources department to request information about the available insurance options. Next, employees need to complete the necessary application forms, which may require personal and employment details. After submitting the application, it is essential to review the terms and conditions of the policy to ensure it meets individual needs. Finally, employees should keep a copy of their insurance documents for future reference.

Steps to Complete the Lirr Insurance

Completing the Lirr insurance process involves several key steps. Start by gathering all required personal information and employment details, which may include your job title, work location, and any previous insurance history. Next, fill out the application form accurately, ensuring that all fields are completed. After submitting the application, monitor its status through the human resources department or the insurance provider. Once approved, carefully review the policy documents to understand your coverage and any obligations.

Legal Use of the Lirr Insurance

The legal use of Lirr insurance is governed by both federal and state regulations. Employees must adhere to the guidelines set forth by the insurance provider and comply with any applicable laws regarding employment benefits. This includes understanding the rights and responsibilities associated with the insurance, such as timely reporting of claims and maintaining eligibility requirements. Familiarizing oneself with these legal aspects helps ensure that employees can effectively utilize their insurance benefits when needed.

Key Elements of the Lirr Insurance

Key elements of Lirr insurance include coverage types, eligibility criteria, and benefit limits. Coverage types typically encompass health insurance, disability benefits, and liability coverage. Eligibility criteria may vary based on employment status, length of service, and specific job roles. It is also important to be aware of the benefit limits, which define the maximum amount payable under the policy for various claims. Understanding these elements is essential for employees to maximize their insurance benefits.

Required Documents

When applying for Lirr insurance, several documents are typically required. These may include proof of employment, such as a pay stub or employment verification letter, personal identification, and any previous insurance documentation. Additionally, employees may need to provide medical records if applying for health-related coverage. Ensuring that all required documents are prepared and submitted can streamline the application process and reduce delays.

Form Submission Methods

Submitting the Lirr insurance application can be done through various methods, depending on the employer's policies. Common submission methods include online applications via the company's human resources portal, mailing physical copies of the application, or submitting in person at the HR department. Each method has its advantages, and employees should choose the one that best suits their needs and ensures timely processing of their application.

Quick guide on how to complete lirr insurance

Complete Lirr Insurance effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Lirr Insurance on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Lirr Insurance with ease

- Locate Lirr Insurance and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Lirr Insurance and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lirr insurance

Create this form in 5 minutes!

How to create an eSignature for the lirr insurance

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is LIRR insurance?

LIRR insurance refers to insurance options available for riders using the Long Island Rail Road. It typically provides coverage against lost tickets, travel inconveniences, and more. Understanding LIRR insurance can help you choose the right plan to ensure a worry-free commute.

-

How can airSlate SignNow help with LIRR insurance documentation?

With airSlate SignNow, you can easily manage and eSign all necessary documentation related to your LIRR insurance. Our platform streamlines the process, ensuring quick submissions and approvals. This not only saves time but reduces paperwork, making it easier for you to focus on your travel plans.

-

What are the pricing options for LIRR insurance?

The pricing for LIRR insurance varies based on coverage options and duration of the policy. By comparing different plans, you can find the most cost-effective insurance that suits your travel needs. Using airSlate SignNow allows you to quickly evaluate and eSign different insurance options efficiently.

-

What features should I look for in LIRR insurance?

When selecting LIRR insurance, look for features such as trip cancellation coverage, lost ticket reimbursement, and emergency assistance. A comprehensive policy will provide peace of mind during your travels. airSlate SignNow can help you manage the associated paperwork seamlessly.

-

What are the main benefits of having LIRR insurance?

Having LIRR insurance offers financial protection against unforeseen travel issues such as delays or cancellations. It ensures that unexpected expenses don't disrupt your journey. Leveraging tools like airSlate SignNow can simplify the process of acquiring and managing your insurance documents.

-

Can I integrate airSlate SignNow with my existing insurance management tools?

Yes, airSlate SignNow can integrate with various insurance management tools, enhancing your workflow when dealing with LIRR insurance. This integration allows you to manage your policies, claims, and documentation from a single platform. This efficiency ensures that you are always prepared for your travels.

-

How quickly can I get LIRR insurance coverage?

Many insurance providers offer instant coverage options for LIRR insurance, especially when applied through online platforms. With airSlate SignNow, you can expedite the signing process, ensuring that your policy is in place before your trip. Quick access to your insurance documents prepares you for any travel uncertainties.

Get more for Lirr Insurance

- 10066 form

- Faa weight and balance form

- How to fill the complete airman file form

- Recruiting form 2010docx quothochschulen in der entwicklungspolitikquot

- Bfs rp p 51 real property assessment division form

- Online jsa template form

- Snow load design criteria request klamath county klamathcounty form

- Appendix e pesticide use proposal form fs 2100 2

Find out other Lirr Insurance

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online