Bc Speculation Tax Form

What is the share purchase report?

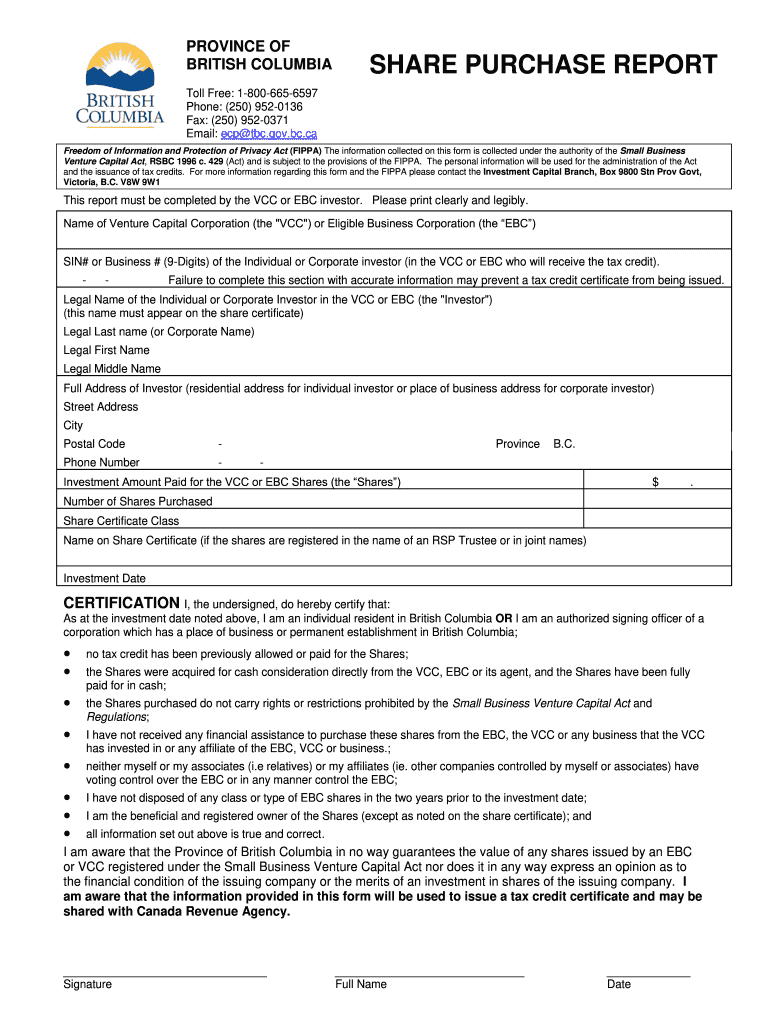

The share purchase report is a crucial document used in the context of stock transactions. It provides detailed information about the purchase of shares in a company, including the number of shares acquired, the purchase price, and the date of the transaction. This report serves as a formal record and is often required for legal compliance and tax purposes. It is essential for both buyers and sellers to maintain accurate records of these transactions to ensure transparency and accountability in financial dealings.

Key elements of the share purchase report

A well-structured share purchase report includes several key elements that contribute to its effectiveness. These elements typically comprise:

- Buyer Information: Details about the individual or entity purchasing the shares.

- Seller Information: Information regarding the seller of the shares.

- Transaction Details: The number of shares purchased, the purchase price per share, and the total transaction value.

- Date of Transaction: The specific date on which the purchase occurred.

- Payment Method: Information on how the payment was made, whether through bank transfer, check, or another method.

Steps to complete the share purchase report

Completing a share purchase report involves several straightforward steps. Following these steps can help ensure that the report is accurate and compliant with relevant regulations:

- Gather necessary information about the buyer and seller.

- Document the details of the transaction, including the number of shares and purchase price.

- Specify the date of the transaction clearly.

- Include payment method details to provide a complete financial picture.

- Review the report for accuracy before finalizing it.

Legal use of the share purchase report

The share purchase report holds legal significance as it serves as evidence of ownership transfer. For the report to be legally binding, it must be accurately filled out and signed by both parties involved in the transaction. It is advisable to retain copies of this report for future reference, especially for tax reporting and compliance purposes. Additionally, ensuring that the report adheres to state and federal regulations can help mitigate potential legal issues.

Required documents for the share purchase report

When preparing a share purchase report, certain documents may be required to support the information provided. These documents can include:

- Identification documents for both the buyer and seller.

- Previous share certificates, if applicable.

- Proof of payment, such as bank statements or transaction receipts.

- Any relevant agreements or contracts related to the share purchase.

Form submission methods

The share purchase report can be submitted through various methods, depending on the requirements of the involved parties and regulatory bodies. Common submission methods include:

- Online Submission: Many companies offer digital platforms for submitting share purchase reports electronically.

- Mail: Physical copies of the report can be sent via postal service to the relevant parties or regulatory authorities.

- In-Person: In certain cases, submitting the report in person may be required, especially for significant transactions.

Quick guide on how to complete bc speculation tax

Complete Bc Speculation Tax effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Bc Speculation Tax on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Bc Speculation Tax without any hassle

- Find Bc Speculation Tax and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Bc Speculation Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bc speculation tax

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is a share purchase report?

A share purchase report is a detailed document that outlines the terms and conditions of a share acquisition. It includes information such as the number of shares purchased, the purchase price, and the parties involved. Utilizing airSlate SignNow can streamline the creation and signing process of this important document.

-

How does airSlate SignNow help with share purchase reports?

airSlate SignNow provides a user-friendly platform that simplifies the drafting and eSigning of share purchase reports. With customizable templates and automated workflows, businesses can easily generate these reports and ensure quick approvals. This feature enhances efficiency, reducing the time and effort involved in document management.

-

What are the pricing options for using airSlate SignNow for share purchase reports?

airSlate SignNow offers a variety of pricing plans that cater to different business needs and sizes. The plans are cost-effective and designed to provide access to essential features for managing share purchase reports and other documents. You can choose from monthly or annual subscriptions, ensuring flexibility in budget and usage.

-

Can I integrate airSlate SignNow with other software for share purchase reports?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance the management of share purchase reports. Whether you're using CRM systems, cloud storage services, or collaboration tools, these integrations facilitate a smoother workflow and better accessibility. This ensures that all data related to your share purchase reports is synchronized across platforms.

-

What benefits does using airSlate SignNow offer for creating share purchase reports?

Using airSlate SignNow for creating share purchase reports offers several benefits, including increased efficiency, cost savings, and enhanced security. With eSigning capabilities, businesses can obtain signatures quickly without the need for physical documents. Furthermore, the platform ensures that your reports are stored securely and accessed easily whenever needed.

-

Does airSlate SignNow provide templates for share purchase reports?

Yes, airSlate SignNow offers customizable templates specifically designed for share purchase reports. These templates are pre-formatted to include all necessary sections, allowing businesses to quickly fill in required details and finalize the document. This saves time and ensures compliance with industry standards.

-

Is it possible to track the status of share purchase reports in airSlate SignNow?

Absolutely! airSlate SignNow includes features that allow users to track the status of their share purchase reports in real-time. This tracking capability ensures that you are notified once the document is viewed and signed, providing transparency throughout the entire process of documenting share transactions.

Get more for Bc Speculation Tax

- Field trip and in state travel permission form keller isd schools

- Will county illinois summons in forceible en detainer form

- Co summons form

- Verification of no income voni chasebrexton form

- Notice of confidential information within court filing eighteenth flcourts18

- Genetics the science of heredity chapter test genetics the dgs k12 il form

- Eye exam formpdf up140 jacksn k12 il

- Caprapbsohscninet form ca1 ni ca no rev 0511 1 audit hscbusiness hscni

Find out other Bc Speculation Tax

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template