Receipt Challan Form

What is the Receipt Challan

The receipt challan is a formal document used to acknowledge the receipt of payment for various fees, taxes, or services. It serves as proof of payment and is often required for record-keeping and compliance purposes. In the United States, receipt challans are commonly utilized in transactions involving government agencies, educational institutions, and other organizations. They ensure that both the payer and the receiving entity have a clear record of the transaction, which can be crucial for future reference or audits.

How to use the Receipt Challan

Using a receipt challan involves a few straightforward steps. First, ensure you have the correct form, which can often be downloaded online. Fill out the necessary details, including the amount paid, the purpose of the payment, and your personal information. After completing the form, submit it to the relevant authority, either electronically or in person, depending on the specific requirements. Retain a copy of the receipt challan for your records, as it may be needed for future reference or in case of disputes.

Steps to complete the Receipt Challan

Completing a receipt challan online typically requires the following steps:

- Access the official website or platform where the receipt challan is available.

- Select the appropriate form for your specific transaction.

- Fill in all required fields, including your name, address, and payment details.

- Review the information for accuracy before submitting.

- Submit the form electronically and save or print a copy for your records.

Legal use of the Receipt Challan

The legal use of a receipt challan is significant, as it serves as a binding document that confirms payment. To ensure its legality, it must be filled out correctly and submitted to the appropriate authority. The receipt challan must also comply with relevant regulations, such as those set forth by the IRS or state tax authorities. Maintaining a properly executed receipt challan can protect individuals and businesses from potential disputes regarding payment claims.

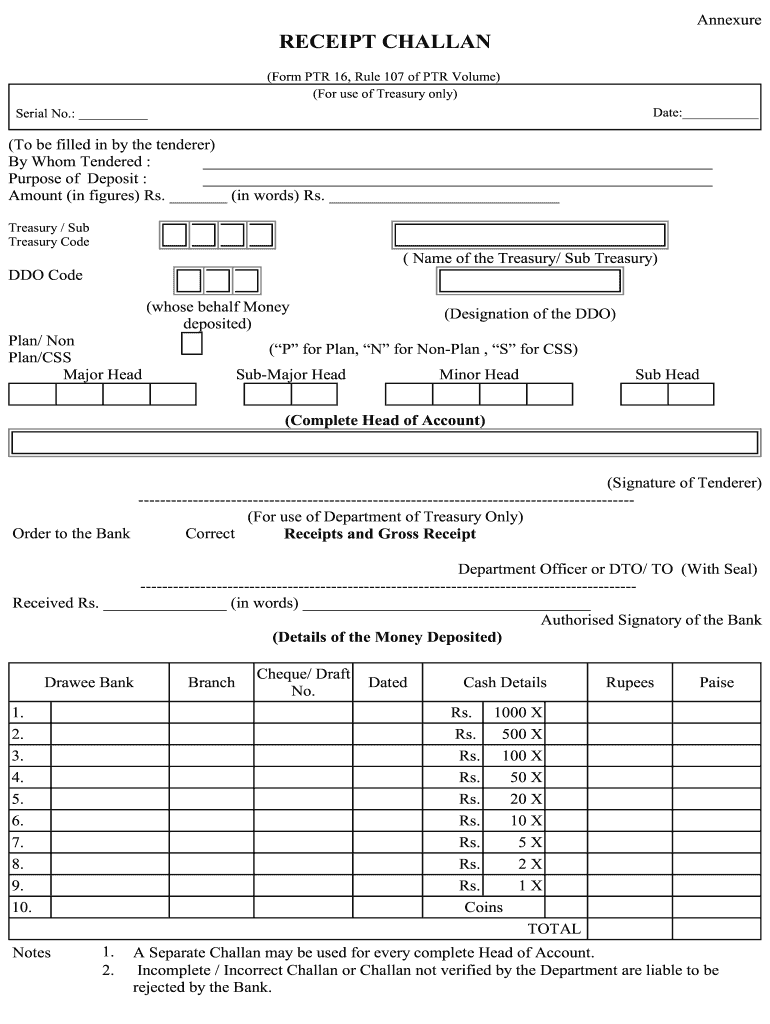

Key elements of the Receipt Challan

Key elements of a receipt challan include:

- Payer Information: Name, address, and contact details of the individual or entity making the payment.

- Recipient Information: Name and address of the organization or authority receiving the payment.

- Payment Details: Amount paid, payment method, and purpose of the payment.

- Date of Payment: The date on which the payment was made.

- Signature or Seal: An authorized signature or official seal may be required to validate the document.

Form Submission Methods (Online / Mail / In-Person)

Receipt challans can typically be submitted through various methods, depending on the requirements of the receiving authority. Common submission methods include:

- Online: Many organizations offer online submission options, allowing users to complete and submit the form digitally.

- Mail: For those who prefer traditional methods, mailing the completed form is often an option. Ensure to send it to the correct address and consider using a trackable service.

- In-Person: Some institutions may require or allow in-person submission, where you can deliver the form directly to the relevant office.

Quick guide on how to complete receipt challan

Complete Receipt Challan effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without delays. Manage Receipt Challan on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Receipt Challan with ease

- Find Receipt Challan and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this function.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Alter and eSign Receipt Challan and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the receipt challan

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a receipt challan online and how does it work?

A receipt challan online is a digital document used to acknowledge payment for services or goods. It facilitates swift transactions by allowing users to create, send, and manage these documents electronically, ensuring a seamless process that enhances efficiency and record-keeping.

-

How can I create a receipt challan online using airSlate SignNow?

Creating a receipt challan online with airSlate SignNow is simple. Users can select a template, fill in the necessary information, and customize the document before sending it for eSignature. Our platform streamlines this process, making it user-friendly and efficient.

-

What are the pricing options for using airSlate SignNow to generate receipt challans online?

airSlate SignNow offers various pricing plans to suit different business needs, including monthly and annual subscriptions. Each plan includes features that streamline the creation and management of receipt challans online. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing receipt challans online?

airSlate SignNow provides features such as customizable templates, automated workflows, real-time tracking, and secure eSignatures to manage receipt challans online. These features enhance the convenience and reliability of creating and sending documents, making the process more efficient.

-

Are receipt challans online legally binding when signed through airSlate SignNow?

Yes, receipt challans online signed through airSlate SignNow are legally binding. Our platform complies with eSignature laws, ensuring that electronically signed documents are valid and enforceable, just like traditional paper documents.

-

Can I integrate airSlate SignNow with other software tools for managing receipt challans online?

Absolutely! airSlate SignNow offers integration with various software tools and applications, allowing for a seamless workflow when managing receipt challans online. This compatibility ensures that you can easily connect with your existing systems and enhance overall productivity.

-

What are the benefits of using airSlate SignNow for receipt challans online?

Using airSlate SignNow for receipt challans online provides numerous benefits, including faster document turnaround times, reduced paperwork, and improved accuracy. Businesses can streamline their operations, save time, and ultimately enhance customer satisfaction with our efficient solution.

Get more for Receipt Challan

Find out other Receipt Challan

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later