Payroll Deduction Form

What is the Payroll Deduction Form

The payroll deduction form is a document used by employers to authorize the deduction of specific amounts from an employee's paycheck. This form is essential for various purposes, such as health insurance premiums, retirement contributions, loan repayments, and other voluntary deductions. By filling out this form, employees grant permission for their employer to withhold a designated amount from their salary, ensuring that payments are made on their behalf without the need for manual transactions.

Key Elements of the Payroll Deduction Form

A well-structured payroll deduction form typically includes several critical components to ensure clarity and compliance. These elements often consist of:

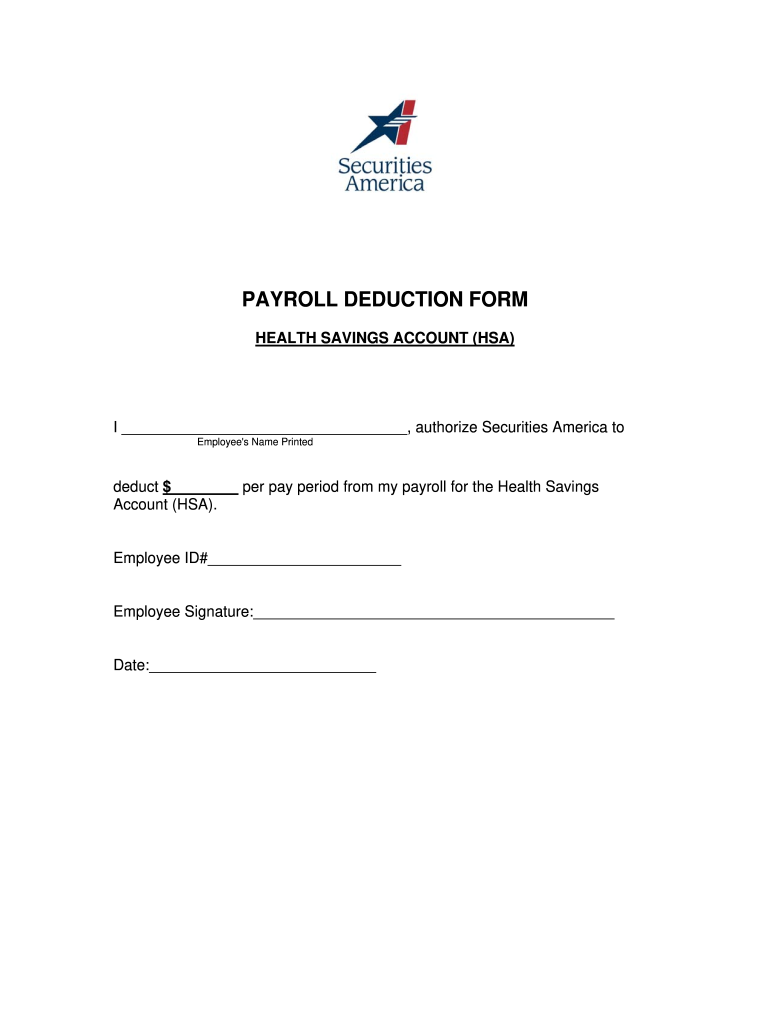

- Employee Information: Full name, employee ID, and contact details.

- Deduction Details: Types of deductions, amounts, and frequency (e.g., weekly, bi-weekly).

- Authorization Signature: Employee's signature to confirm consent for deductions.

- Employer Information: Company name and contact details for record-keeping.

- Date: The date when the form is completed and signed.

Steps to Complete the Payroll Deduction Form

Completing a payroll deduction form is a straightforward process that involves several steps to ensure accuracy and compliance. Employees should follow these steps:

- Obtain the Form: Access the payroll deduction form from your employer or HR department.

- Fill in Personal Information: Provide your name, employee ID, and any other required details.

- Specify Deductions: Clearly indicate the type of deductions you wish to authorize and the amounts.

- Review the Information: Double-check all entries for accuracy to avoid errors.

- Sign the Form: Provide your signature to authorize the deductions.

- Submit the Form: Return the completed form to your HR department or payroll office.

Legal Use of the Payroll Deduction Form

The payroll deduction form must comply with federal and state regulations to be legally binding. Employers are required to ensure that deductions are authorized by the employee and are in accordance with applicable labor laws. This includes providing clear information about the deductions being made and ensuring that employees understand their rights regarding these deductions. Non-compliance with legal requirements can lead to disputes and potential penalties for employers.

How to Obtain the Payroll Deduction Form

Employees can typically obtain the payroll deduction form through various channels, including:

- Human Resources Department: Request the form directly from HR personnel.

- Company Intranet: Access the form online if your company has an internal website for employee resources.

- Email Request: Send an email to HR or payroll requesting a copy of the form.

Examples of Using the Payroll Deduction Form

There are several common scenarios where the payroll deduction form is utilized:

- Health Insurance Premiums: Employees authorize deductions for their health insurance plans.

- Retirement Contributions: Employees opt to contribute a portion of their salary to retirement accounts.

- Loan Repayments: Employees set up automatic deductions for personal loans or advances.

Quick guide on how to complete payroll deduction form

Effortlessly Prepare Payroll Deduction Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Payroll Deduction Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Payroll Deduction Form with Ease

- Locate Payroll Deduction Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Payroll Deduction Form and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is a payroll deduction form template?

A payroll deduction form template is a standardized document that allows employees to authorize deductions from their wages for various purposes, such as health insurance, retirement savings, or other benefits. It streamlines the process of collecting employee consent and helps ensure compliance with payroll regulations.

-

How can I create a payroll deduction form template using airSlate SignNow?

With airSlate SignNow, you can easily create a payroll deduction form template by using our intuitive document editor. Simply select a pre-built template or start from scratch, customize the fields, and then share it with your employees for eSignature, making it quick and efficient.

-

Is there a cost associated with using the payroll deduction form template?

airSlate SignNow offers flexible pricing plans that include access to a payroll deduction form template and a range of other features. You can choose a plan that best fits your business needs and budget, ensuring you get a cost-effective solution for managing payroll deductions.

-

What are the benefits of using a payroll deduction form template?

Using a payroll deduction form template saves time and reduces errors in the payroll process. It provides a clear and consistent way for employees to authorize deductions, which can improve compliance and enhance employee trust in the payroll system.

-

Can I integrate the payroll deduction form template with other software?

Yes, airSlate SignNow allows for seamless integration with various HR and payroll software, making it easy to incorporate the payroll deduction form template into your existing systems. This integration helps streamline data flow and minimizes the chances of discrepancies.

-

How secure is the payroll deduction form template in airSlate SignNow?

Security is a top priority for airSlate SignNow. Our payroll deduction form template is protected with advanced encryption and secure access controls, ensuring that sensitive employee information remains confidential and safe from unauthorized access.

-

Can I customize the payroll deduction form template for specific deductions?

Absolutely! airSlate SignNow allows you to customize the payroll deduction form template to accommodate specific deductions unique to your organization. You can add or remove fields and adjust the formatting to meet your specific requirements.

Get more for Payroll Deduction Form

- Cedars sinai authorization form

- Holy spirit medical records form

- Ocps medicine form 2017

- Kaiser hawaii release medical form

- Compton unified school district recordsd mailing address form

- Dshs 09 form

- Hospital note osf form

- Www1 nyc govassetsbuildingssupplemental investigation questionnaire site safety coordinator form

Find out other Payroll Deduction Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy