FULL NAME PRIMARY TAXPAYER Form

What is the FULL NAME PRIMARY TAXPAYER

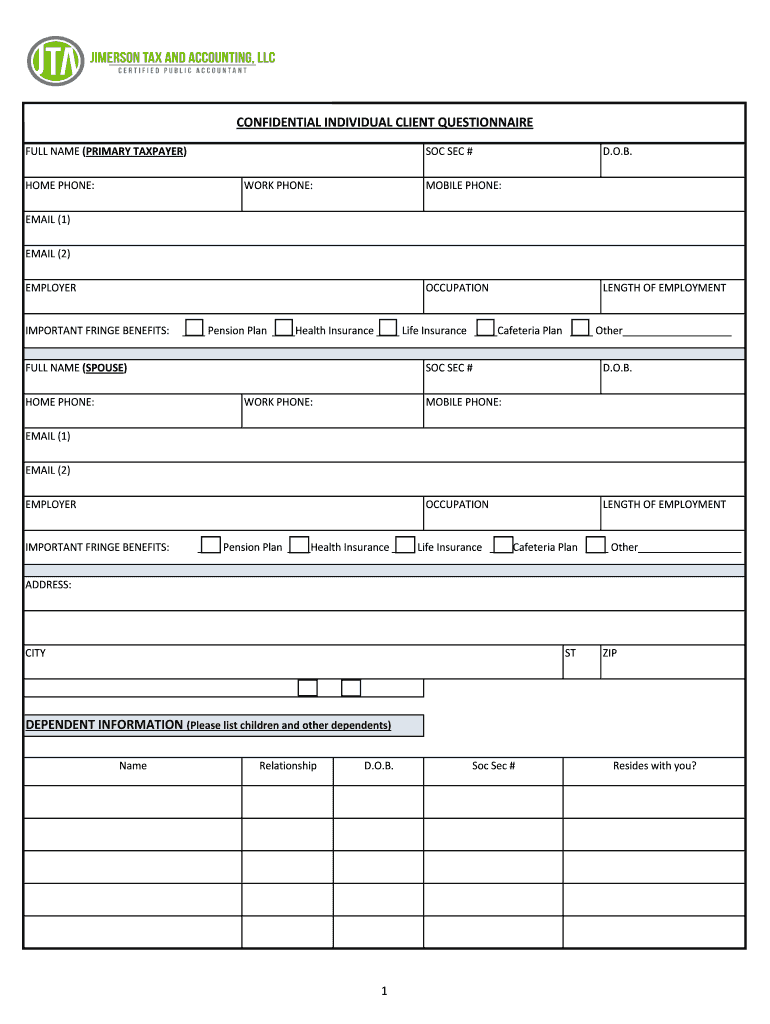

The full name primary taxpayer refers to the individual whose name appears first on a tax return. This person is typically responsible for reporting income, deductions, and credits to the Internal Revenue Service (IRS). The primary taxpayer's information is crucial for tax identification and processing, as it determines the tax liability for the household or entity. In cases where a joint return is filed, both spouses are considered taxpayers, but the primary taxpayer is the one whose Social Security number is listed first.

Steps to complete the FULL NAME PRIMARY TAXPAYER

Completing the full name primary taxpayer form involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary documents, including Social Security numbers, income statements, and any relevant deductions or credits. Next, accurately fill in the full name of the primary taxpayer, ensuring it matches the name on official identification documents. Review all entries for accuracy, particularly the Social Security number, as errors can lead to processing delays. Finally, sign and date the form, ensuring that all required fields are completed before submission.

Legal use of the FULL NAME PRIMARY TAXPAYER

The full name primary taxpayer form is legally binding when completed correctly and submitted to the IRS. It must adhere to the guidelines set forth by the IRS, which include providing accurate personal information and ensuring that all signatures are valid. Electronic signatures are accepted under the ESIGN Act, provided that the signing process meets certain criteria. This includes using a secure platform that complies with federal regulations to ensure the authenticity and integrity of the document.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the full name primary taxpayer form. It is essential to follow these guidelines to avoid penalties or delays in processing. Taxpayers should refer to the IRS website or official publications to understand the requirements for filing, including deadlines, acceptable forms of payment, and any changes to tax laws that may affect their filing status. Familiarity with these guidelines can help ensure compliance and optimize tax outcomes.

Examples of using the FULL NAME PRIMARY TAXPAYER

Examples of the full name primary taxpayer form can be found in various tax situations. For instance, when a married couple files jointly, one spouse will be designated as the primary taxpayer, whose name appears first on the return. In contrast, a single individual filing their tax return will naturally be the primary taxpayer. Understanding these examples can help clarify the role and responsibilities associated with being the primary taxpayer, particularly in relation to tax credits and deductions that may apply.

Required Documents

To complete the full name primary taxpayer form, several documents are typically required. These include:

- Social Security card or number

- W-2 forms from employers

- 1099 forms for additional income

- Records of deductible expenses, such as mortgage interest or medical expenses

- Any other relevant financial documents, such as investment income statements

Having these documents ready can streamline the process and help ensure that all information is accurately reported to the IRS.

Quick guide on how to complete full name primary taxpayer

Effortlessly Prepare FULL NAME PRIMARY TAXPAYER on Any Device

Managing documents online has gained traction among organizations and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools required to swiftly create, modify, and eSign your documents without delays. Manage FULL NAME PRIMARY TAXPAYER on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign FULL NAME PRIMARY TAXPAYER with Ease

- Obtain FULL NAME PRIMARY TAXPAYER and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign FULL NAME PRIMARY TAXPAYER to ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the full name primary taxpayer

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the role of the FULL NAME PRIMARY TAXPAYER in document signing?

The FULL NAME PRIMARY TAXPAYER is essential in the document signing process, as they are typically the individual responsible for managing tax-related documents. airSlate SignNow provides a platform that allows the FULL NAME PRIMARY TAXPAYER to easily eSign important documents securely and efficiently.

-

How does airSlate SignNow ensure security for the FULL NAME PRIMARY TAXPAYER?

Security is a priority for airSlate SignNow, especially for the FULL NAME PRIMARY TAXPAYER who handles sensitive information. We implement advanced encryption and compliance standards to keep all signed documents secure, ensuring that the FULL NAME PRIMARY TAXPAYER’s data is protected at all times.

-

Are there multiple pricing plans available for the FULL NAME PRIMARY TAXPAYER?

Yes, airSlate SignNow offers flexible pricing plans to cater to the needs of the FULL NAME PRIMARY TAXPAYER. Our plans are designed to fit various budgets and requirements, ensuring that every user can find a solution that meets their needs without compromising on features.

-

What features are available for the FULL NAME PRIMARY TAXPAYER in airSlate SignNow?

airSlate SignNow includes a range of features beneficial for the FULL NAME PRIMARY TAXPAYER, such as customizable templates, automatic reminders, and audit trails. These features streamline the document signing process and provide insights into the status of documents signed by the FULL NAME PRIMARY TAXPAYER.

-

Can the FULL NAME PRIMARY TAXPAYER integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers seamless integrations with various platforms that the FULL NAME PRIMARY TAXPAYER may already be using, including CRMs, accounting software, and cloud storage services. This flexibility enhances the workflow and efficiency of document management for the FULL NAME PRIMARY TAXPAYER.

-

What are the benefits of using airSlate SignNow for the FULL NAME PRIMARY TAXPAYER?

Using airSlate SignNow allows the FULL NAME PRIMARY TAXPAYER to simplify document signing processes, save time, and reduce costs associated with traditional signing methods. The easy-to-use interface empowers users to manage their documents effectively, enhancing productivity and compliance.

-

How quickly can the FULL NAME PRIMARY TAXPAYER start using airSlate SignNow?

The FULL NAME PRIMARY TAXPAYER can start using airSlate SignNow within minutes of signing up. Our straightforward setup process, combined with a user-friendly interface, ensures that the FULL NAME PRIMARY TAXPAYER can quickly begin sending and eSigning documents without any hassle.

Get more for FULL NAME PRIMARY TAXPAYER

- Ochsner release of medical information

- Resurgen orthopedics form

- Rv basic rental agreement form

- New customer contact and information form company brightree

- Promissory note uccc no default rate coloradogov form

- Harris county jury duty form

- Summons date of offense details about the prohibited mtainfo form

- Joint account form

Find out other FULL NAME PRIMARY TAXPAYER

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors