To Claim a Child for Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% of the Childs Financial Form

Understanding the Purpose of the Form

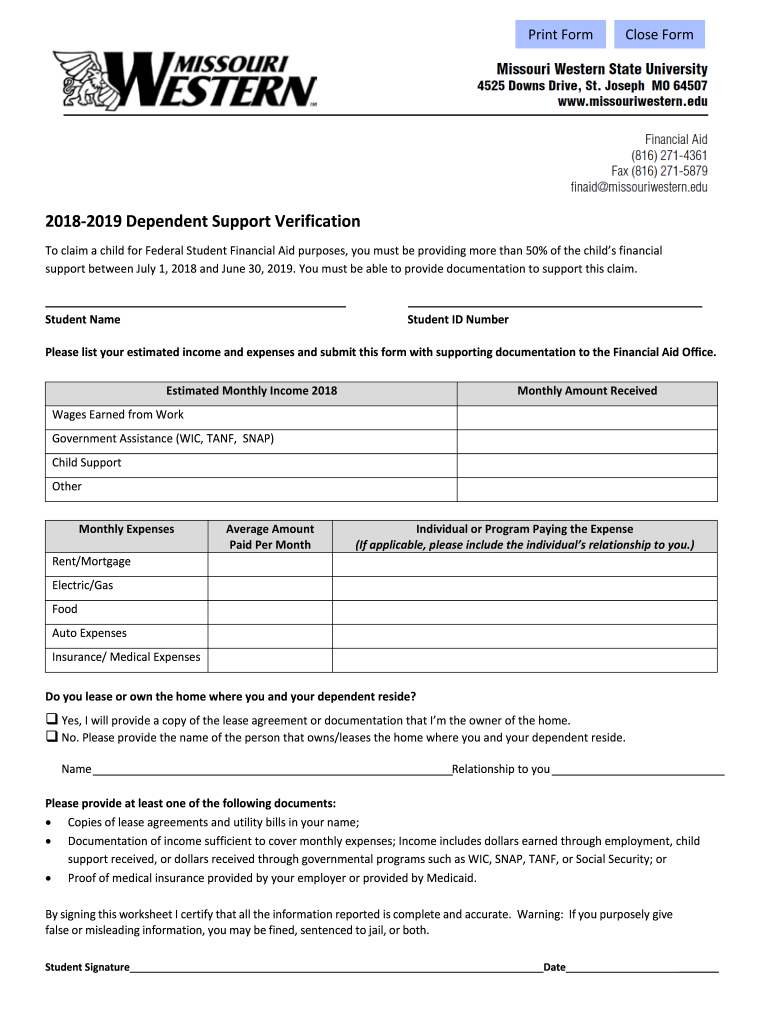

The form to claim a child for federal student financial aid purposes is essential for determining eligibility for financial assistance. It specifically requires that the individual claiming the child provides more than fifty percent of the child's financial support. This criterion is crucial for parents or guardians seeking to access federal aid for educational expenses. Understanding this requirement helps ensure that the right individuals are applying for financial aid on behalf of the child.

Steps to Complete the Form

Completing the form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents that demonstrate your support for the child. This may include tax returns, bank statements, and proof of expenses related to the child's care. Next, fill out the form carefully, ensuring that all sections are completed and that the information provided is truthful and accurate. Finally, review the completed form for any errors before submitting it to the relevant financial aid office.

Legal Use of the Form

The legal use of the form is governed by federal regulations that dictate how financial aid is allocated. It is important to understand that misrepresenting your financial support can lead to serious consequences, including the denial of financial aid or legal repercussions. Therefore, it is essential to provide honest and verifiable information when completing the form to avoid any potential issues with compliance.

Eligibility Criteria for Claiming a Child

To claim a child for federal student financial aid purposes, certain eligibility criteria must be met. The individual claiming the child must demonstrate that they provide over fifty percent of the child's financial support. Additionally, the child must meet specific age and dependency requirements as outlined by the federal government. Familiarizing yourself with these criteria can help streamline the application process and ensure that you meet all necessary qualifications.

Required Documents for Submission

When preparing to submit the form, it is important to gather all required documents. This typically includes proof of income, tax returns, and any documentation that supports your claim of financial support for the child. Having these documents ready not only facilitates the completion of the form but also strengthens your application by providing clear evidence of your financial contribution.

Form Submission Methods

The form can be submitted through various methods, including online submission, mailing, or in-person delivery to the appropriate financial aid office. Each method has its own advantages, such as the speed of online submission or the personal touch of in-person delivery. It is advisable to choose the method that best suits your needs and ensures that your application is processed in a timely manner.

Common Scenarios for Claiming a Child

Understanding common scenarios can help clarify who is eligible to claim a child for federal student financial aid. For instance, single parents, guardians, or relatives who provide significant financial support may qualify. Additionally, situations where parents are divorced or separated can complicate claims, making it essential to understand how financial support is defined in these contexts. Each scenario may have unique considerations that impact eligibility and the completion of the form.

Quick guide on how to complete to claim a child for federal student financial aid purposes you must be providing more than 50 of the childs financial

Easily Prepare To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it in the cloud. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial

- Obtain To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive data using the tools that airSlate SignNow offers for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to claim a child for federal student financial aid purposes you must be providing more than 50 of the childs financial

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What does it mean to claim a child for federal student financial aid purposes?

To claim a child for federal student financial aid purposes, you must be providing more than 50% of the child's financial support. This includes covering living expenses, tuition, and other educational costs. Understanding your financial contribution is crucial for determining eligibility for various financial aid programs.

-

How can airSlate SignNow help with financial aid document management?

airSlate SignNow simplifies the management of financial aid documents by allowing you to easily send, sign, and store essential files securely. This ensures that all necessary documentation is organized and readily accessible. By managing documentation effectively, you can streamline the process of demonstrating that to claim a child for federal student financial aid purposes, you must be providing more than 50% of the child's financial.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to suit different needs, including individual and business options. Each plan includes a variety of features designed for ease of use. By finding a plan that fits your budget, you can ensure that managing student aid documents is both efficient and cost-effective.

-

Is it easy to integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with numerous applications like Google Drive, Dropbox, and Salesforce. This allows for a more cohesive workflow when managing student financial aid documentation. By utilizing these integrations, you can more easily demonstrate that to claim a child for federal student financial aid purposes, you must be providing more than 50% of the child's financial.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents offers numerous benefits, including enhanced security and time efficiency. It allows you to sign documents anytime, anywhere, with a user-friendly interface. This is especially beneficial when you need to provide proof of financial support to claim a child for federal student financial aid purposes.

-

Can I track the status of my documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of documents, allowing you to see when they have been viewed, signed, or completed. This feature is particularly useful for managing financial aid documents, ensuring all information is properly submitted. It supports the process of demonstrating that to claim a child for federal student financial aid purposes, you must be providing more than 50% of the child's financial.

-

What types of documents can I prepare using airSlate SignNow?

airSlate SignNow supports a variety of document types, including agreements, contracts, and financial aid applications. This flexibility allows you to prepare and manage all necessary paperwork related to claiming financial aid. Dealing with these documents efficiently helps ensure that to claim a child for federal student financial aid purposes, you must be providing more than 50% of the child's financial.

Get more for To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial

- Notification of postsquadron commanders amp adjutants txlegion form

- Hltaid003 provide first aid 1 day pre course review pack form

- Form lease condominium 2014 2019

- Scholarship application senator douglas jj peters form

- 2013 demonstration jump insurance application uspa form

- A3490 internetformular deutsche rentenversicherung deutsche rentenversicherung

- Choice of superannuation fund standard choice form cbus

- Cbus withdrawal form

Find out other To Claim A Child For Federal Student Financial Aid Purposes, You Must Be Providing More Than 50% Of The Childs Financial

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now