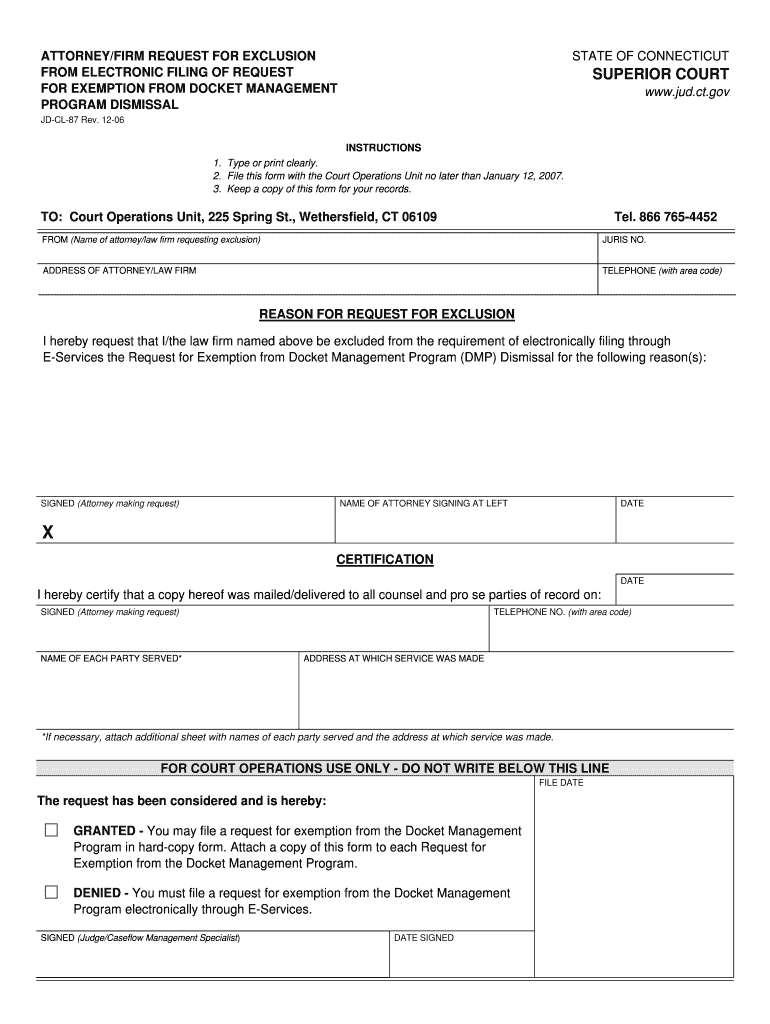

Request Exclusion Form

What is the request exclusion?

The request exclusion is a formal document that allows individuals or businesses to exclude certain income or transactions from taxation or reporting requirements. This form is often utilized in various financial and legal contexts, enabling taxpayers to clarify their obligations under specific circumstances. It is essential for those seeking to manage their tax liabilities effectively and ensure compliance with IRS regulations.

How to use the request exclusion

Using the request exclusion involves understanding the specific circumstances under which it applies. Taxpayers should first identify the income or transaction they wish to exclude. Once identified, they can complete the request exclusion form, providing necessary details such as the nature of the income, relevant dates, and applicable tax years. Properly submitting this form can help in achieving the intended tax treatment.

Steps to complete the request exclusion

Completing the request exclusion form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including personal identification and financial details.

- Clearly state the reason for the exclusion and the specific income or transaction involved.

- Complete the form accurately, ensuring all required fields are filled out.

- Review the form for accuracy before submission to avoid delays.

- Submit the completed form through the appropriate channels, whether online or by mail.

Legal use of the request exclusion

The legal use of the request exclusion is governed by IRS guidelines and specific tax laws. To ensure compliance, taxpayers must understand the legal framework surrounding the exclusion. This includes knowing the eligibility criteria, the types of income that can be excluded, and any deadlines for submission. Adhering to these legal requirements is crucial for the exclusion to be recognized and accepted by tax authorities.

Key elements of the request exclusion

Several key elements must be included in the request exclusion form to ensure its validity. These elements typically consist of:

- Taxpayer identification information, such as name, address, and Social Security number or Employer Identification Number.

- A clear description of the income or transaction being excluded.

- The specific tax year or period for which the exclusion is requested.

- Supporting documentation, if necessary, to substantiate the request.

Eligibility criteria

Eligibility for the request exclusion varies based on the nature of the income or transaction. Generally, taxpayers must meet specific criteria set forth by the IRS, which may include:

- Being a resident or citizen of the United States.

- Having income or transactions that fall under the exclusion provisions.

- Filing the request exclusion form within the designated time frame.

Quick guide on how to complete request exclusion

Effortlessly complete Request Exclusion on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Manage Request Exclusion on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Request Exclusion effortlessly

- Locate Request Exclusion and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Request Exclusion while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request exclusion

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the process to request exclusion for specific documents in airSlate SignNow?

To request exclusion for specific documents in airSlate SignNow, navigate to the document settings and select the exclusion options. This allows you to specify which documents should be exempt from certain workflows. Make sure to follow the guidelines outlined in our help center for a smooth request.

-

Are there any costs associated with requesting exclusion on documents?

There are no additional costs specifically for requesting exclusion in airSlate SignNow. Our pricing plans are designed to provide a cost-effective solution for all features, including document exclusions. Check our pricing page for more details about our subscription tiers.

-

What benefits does the request exclusion feature provide?

The request exclusion feature in airSlate SignNow provides signNow benefits such as enhanced control over document workflows and compliance. By excluding certain documents, businesses can streamline approvals and reduce administrative burdens. This flexibility ultimately saves time and improves efficiency.

-

Can I integrate request exclusion capabilities with other apps?

Yes, airSlate SignNow allows for integrations with various applications that can enhance the request exclusion functionality. Explore our integrations with tools like Salesforce and Zapier for a comprehensive workflow. Check our integrations page to see all available options.

-

How does request exclusion improve document management in my organization?

Requesting exclusion helps improve document management by allowing businesses to prioritize and streamline important workflows. By excluding certain documents from general processes, teams can focus on high-priority items that require immediate attention. This targeted approach leads to better efficiency and productivity.

-

What types of documents can I request exclusion for in airSlate SignNow?

You can request exclusion for any document type that is processed within airSlate SignNow, such as contracts, agreements, and forms. This flexibility allows for customized handling of sensitive or less critical documents. Always consider the specific needs of your business when setting exclusions.

-

Is training provided for new users to understand the request exclusion feature?

Absolutely! airSlate SignNow offers comprehensive training resources, including tutorials and webinars, to help new users understand how to request exclusion effectively. Our customer support team is also available to assist with any questions on using this feature. Make the most of our resources for a seamless onboarding experience.

Get more for Request Exclusion

- Pta audit report form dates which audit covers illinois pta illinoispta

- Application to connect an inverter energy system western power form

- Cf1r alt 05 e certificate of compliance form

- Imm 5669 e schedule a background declaration cic gc form

- Membership card template the american legion of iowa amlegionauxwi form

- Doh 5088 form

- Dch 0838 2015 form

- Satisfactory academic progress sap appeal form grambling gram

Find out other Request Exclusion

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online