Fin 318 Form

What is the Fin 318?

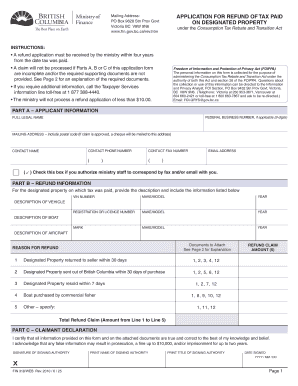

The Fin 318 form, also known as the sales tax refund form 318 BC, is a document used by businesses in the United States to request a refund of sales tax that has been overpaid. This form is essential for ensuring that businesses can reclaim funds that they are entitled to, which can significantly impact their cash flow. Understanding the purpose and requirements of the Fin 318 is vital for any business that deals with sales tax transactions.

How to use the Fin 318

Using the Fin 318 form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim for a refund, such as receipts and tax payment records. Next, fill out the form with precise information regarding your business and the sales tax amounts in question. It's important to double-check all entries for accuracy to avoid delays. Once completed, submit the form according to the specified submission method, which may include online submission or mailing it to the appropriate tax authority.

Steps to complete the Fin 318

Completing the Fin 318 form requires careful attention to detail. Follow these steps:

- Collect all relevant documentation, including sales records and proof of tax payments.

- Fill out the Fin 318 form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form through the designated method, ensuring you retain copies for your records.

Legal use of the Fin 318

The legal use of the Fin 318 form is governed by specific tax regulations that ensure its validity. To be considered legally binding, the form must be filled out correctly and submitted within the designated time frame. Compliance with state and federal tax laws is essential, as improper use of the form could result in penalties or denial of the refund request. Understanding these legal requirements helps businesses navigate the process effectively.

Eligibility Criteria

Eligibility to use the Fin 318 form typically includes businesses that have overpaid sales tax on purchases or transactions. To qualify for a refund, businesses must demonstrate that the tax was paid in error or that the goods were returned. Additionally, businesses must be registered with the appropriate tax authority and have valid documentation to support their refund claim. Reviewing these criteria ensures that businesses can successfully file for a refund.

Form Submission Methods

The Fin 318 form can be submitted through various methods, depending on the guidelines set by the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method can streamline the refund process and ensure timely processing.

Quick guide on how to complete fin 318

Complete Fin 318 seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Fin 318 on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Fin 318 without any hassle

- Find Fin 318 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Fin 318 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 318

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is fin 318 and how does it relate to airSlate SignNow?

Fin 318 is a crucial aspect of our financial compliance features within airSlate SignNow. It ensures that the electronic signatures and document management align with regulatory requirements, helping businesses streamline their processes while remaining compliant.

-

How can airSlate SignNow help my business with fin 318 compliance?

airSlate SignNow simplifies the management of documents related to fin 318 compliance by providing secure, legally binding electronic signatures. This allows businesses to efficiently handle contracts and agreements without the hassle of paperwork, reducing the time spent on manual processes.

-

Is airSlate SignNow cost-effective for businesses focusing on fin 318?

Absolutely! airSlate SignNow offers competitive pricing tailored to businesses focused on fin 318 compliance. By reducing overhead associated with traditional document signing processes, your business can save money while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for fin 318 documentation?

airSlate SignNow provides various features essential for fin 318 documentation, including document templates, user-friendly eSigning, and advanced tracking capabilities. These features help maximize efficiency and accuracy, ensuring your compliance processes are seamless.

-

Can I integrate airSlate SignNow with other tools for fin 318 compliance?

Yes, airSlate SignNow easily integrates with various third-party applications, making it a versatile tool for fin 318 compliance. By connecting with your existing systems, you can enhance workflow automation and sync data across platforms.

-

What benefits does my business gain from using airSlate SignNow for fin 318?

Using airSlate SignNow for fin 318 offers numerous benefits, including enhanced document security, rapid turnaround times, and improved team collaboration. These advantages can signNowly accelerate business processes while ensuring compliance with financial regulations.

-

How does airSlate SignNow ensure the security of fin 318-related documents?

airSlate SignNow employs industry-leading security protocols to protect your fin 318-related documents. Our platform uses encryption and secure authentication measures to guarantee that your sensitive information remains safe during the signing process.

Get more for Fin 318

Find out other Fin 318

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word