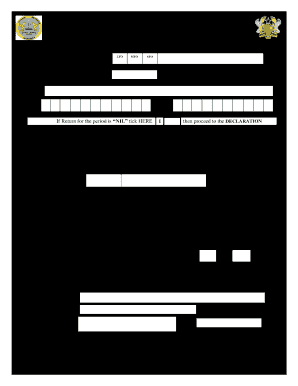

DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN Form

What is the Domestic Tax Revenue Division Monthly PAYE Deductions Return?

The Domestic Tax Revenue Division Monthly PAYE Deductions Return is a crucial document for employers in the United States. It serves as a formal report of the Pay As You Earn (PAYE) tax deductions made from employees' salaries during a specific month. This return is essential for ensuring compliance with federal tax regulations and accurately reporting income tax withheld from employees. Employers must submit this form to the appropriate tax authority to maintain transparency and accountability in their payroll practices.

Steps to Complete the Domestic Tax Revenue Division Monthly PAYE Deductions Return

Completing the Monthly PAYE Deductions Return involves several key steps:

- Gather employee payroll data for the month, including total earnings and tax deductions.

- Calculate the total PAYE deductions for each employee based on their earnings and applicable tax rates.

- Fill out the form with accurate information, ensuring all sections are completed to avoid errors.

- Review the completed form for accuracy, checking calculations and employee details.

- Submit the form to the Domestic Tax Revenue Division by the specified deadline, either electronically or via mail.

Legal Use of the Domestic Tax Revenue Division Monthly PAYE Deductions Return

The Monthly PAYE Deductions Return is legally required for all employers who withhold taxes from employee wages. This form ensures compliance with tax laws and regulations set forth by the Internal Revenue Service (IRS) and state tax authorities. Failure to submit this return or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is essential for employers to understand the legal implications of this document and ensure timely and accurate submissions.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Monthly PAYE Deductions Return. Typically, the return is due on the last day of the month following the reporting period. For example, the return for January must be submitted by the end of February. It is crucial for employers to keep track of these deadlines to avoid late submission penalties and ensure compliance with tax regulations.

Required Documents

To complete the Monthly PAYE Deductions Return, employers need several key documents:

- Employee payroll records for the reporting month.

- Tax withholding tables or guidelines provided by the IRS.

- Any relevant state tax documents that may affect deductions.

Having these documents readily available will streamline the process of completing the return and ensure accuracy in reporting.

Who Issues the Form

The Monthly PAYE Deductions Return is issued by the Domestic Tax Revenue Division, which operates under the jurisdiction of the IRS. This division is responsible for overseeing tax compliance and ensuring that employers fulfill their tax obligations. Employers can obtain the form directly from the Domestic Tax Revenue Division's website or through official tax publications.

Quick guide on how to complete domestic tax revenue division monthly paye deductions return

Complete DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN effortlessly on any device

An online document management system has become increasingly popular with businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can easily find the required form and securely store it online. airSlate SignNow provides all the functionalities you require to create, modify, and eSign your documents quickly without any holdups. Handle DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and eSign DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN with ease

- Locate DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds equivalent legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN and ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the domestic tax revenue division monthly paye deductions return

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is 'engaged employees schedule dt 0107b' and how does it relate to airSlate SignNow?

'Engaged employees schedule dt 0107b' refers to a framework that enhances employee engagement through streamlined document management. airSlate SignNow supports this concept by providing businesses with efficient solutions for sending and eSigning documents, promoting a more engaged workforce.

-

How can airSlate SignNow improve employee engagement?

By utilizing airSlate SignNow, businesses can enhance employee engagement through fast and efficient document workflows. The platform allows employees to sign important documents quickly, which streamlines processes and fosters a culture of trust and collaboration linked to 'engaged employees schedule dt 0107b.'

-

What pricing options does airSlate SignNow offer?

airSlate SignNow provides various pricing plans tailored to meet diverse business needs. Each plan includes features that support the 'engaged employees schedule dt 0107b,' with customizable options for both small businesses and large enterprises to optimize their document management.

-

What key features does airSlate SignNow provide to support engaged employees?

Key features of airSlate SignNow include easy electronic signature capabilities, template creation, and workflow automation. These features are especially beneficial for implementing the 'engaged employees schedule dt 0107b,' as they ensure that employees can interact with important documents efficiently.

-

Can airSlate SignNow integrate with other tools we already use?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business tools, including CRM and project management systems. This integration is vital for facilitating the 'engaged employees schedule dt 0107b,' enabling businesses to maintain smooth workflows without switching between platforms.

-

How does airSlate SignNow enhance compliance for engaged employees?

airSlate SignNow enhances compliance by providing secure eSigning solutions with audit trails and data encryption. Businesses that prioritize the 'engaged employees schedule dt 0107b' can trust that their document processes meet legal standards while keeping employees informed and involved.

-

What are the benefits of using airSlate SignNow for a remote workforce?

For a remote workforce, airSlate SignNow offers flexibility through its cloud-based platform, allowing employees to access and sign documents from anywhere. This enhances the 'engaged employees schedule dt 0107b' by ensuring that remote employees remain connected and can easily participate in essential tasks regardless of their location.

Get more for DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN

- Bir form 1700 pwc

- Bail bond premium receipt fl 02 2007 may 2007fcsdoc application for deregistration form

- Ehr 7 curriculum vitae form

- Patient authorization for release of health records aspen dental form

- Form 96 a

- Air force form 1562

- Td72 8 10 form

- Mico university college transcript request 281403854 form

Find out other DOMESTIC TAX REVENUE DIVISION MONTHLY PAYE DEDUCTIONS RETURN

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation