CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC Gov Nyc 2014

Understanding the CR Q 14 Commercial Rent Tax 2nd Quarter Return

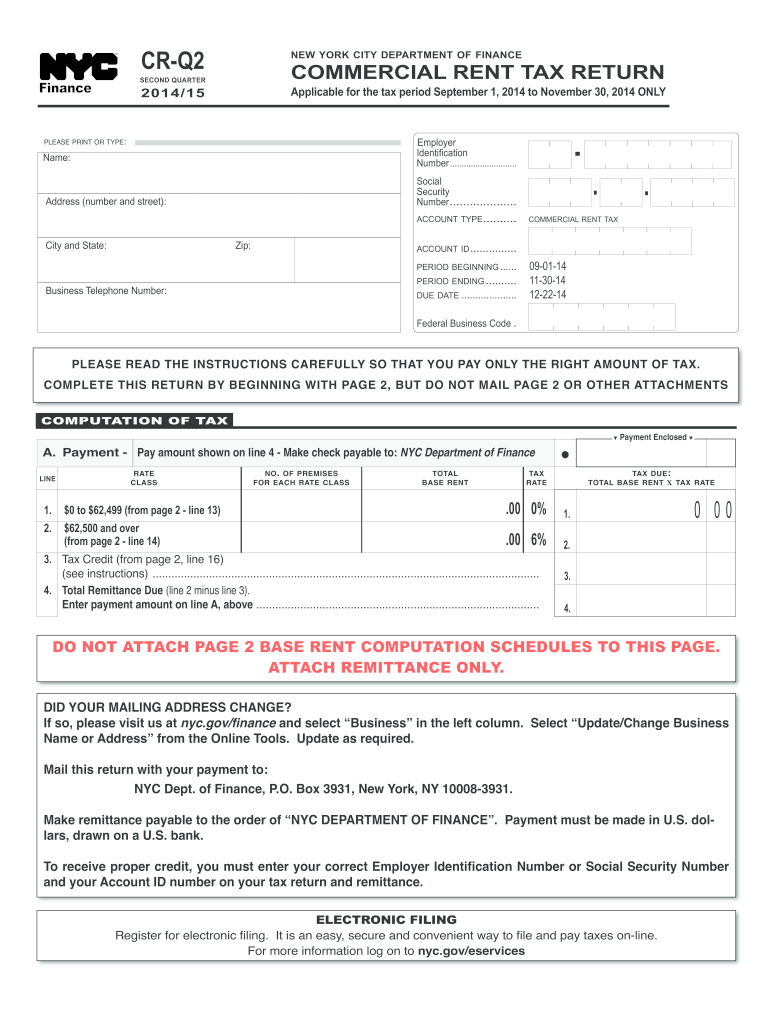

The CR Q 14 Commercial Rent Tax 2nd Quarter Return is a specific tax form used by businesses in New York City to report commercial rent tax liabilities for the second quarter of the fiscal year. This form is essential for landlords and tenants who are subject to the commercial rent tax, which applies to businesses renting space in the city. The tax is calculated based on the total rent paid for the leased premises, and timely submission of this form ensures compliance with local tax regulations.

Steps to Complete the CR Q 14 Commercial Rent Tax 2nd Quarter Return

Completing the CR Q 14 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including rental agreements and payment records. Next, accurately calculate the total rent paid during the second quarter. Fill out the form with the required information, ensuring that all figures are correct. After completing the form, review it for any errors before signing. Finally, submit the form either electronically or by mail, depending on your preferred method.

Filing Deadlines for the CR Q 14 Form

It is crucial to be aware of filing deadlines associated with the CR Q 14 Commercial Rent Tax 2nd Quarter Return. Typically, this form must be submitted by the end of the month following the end of the second quarter. For example, if the second quarter ends on June 30, the form would be due by July 31. Missing this deadline can result in penalties and interest on unpaid taxes, making timely submission essential.

Legal Use of the CR Q 14 Commercial Rent Tax 2nd Quarter Return

The CR Q 14 form is legally mandated for businesses subject to the commercial rent tax in New York City. It serves as an official record of tax obligations and compliance. Using this form correctly ensures that businesses adhere to local tax laws and avoid potential legal issues. Additionally, electronic submission of the form is recognized as legally valid, provided that it meets all necessary criteria for eSignature and submission.

Obtaining the CR Q 14 Commercial Rent Tax 2nd Quarter Return

The CR Q 14 form can be obtained through the official NYC government website or directly from the Department of Finance. It is available in both digital and printable formats, allowing businesses to choose the most convenient method for their needs. Accessing the form online facilitates easier completion and submission, especially for those who prefer digital documentation.

Penalties for Non-Compliance with the CR Q 14 Form

Failure to file the CR Q 14 Commercial Rent Tax 2nd Quarter Return on time can lead to significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action from the city. Understanding these consequences emphasizes the importance of timely and accurate filing, ensuring that businesses remain compliant with tax regulations.

Quick guide on how to complete cr q 2013 14 commercial rent tax 2nd quarter return nycgov nyc

Your assistance manual on how to prepare your CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc

If you’re curious about how to generate and file your CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to edit, draft, and finalize your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify information as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc in just a few minutes:

- Create your profile and start handling PDFs in moments.

- Utilize our directory to access any IRS tax form; browse through various versions and schedules.

- Click Get form to access your CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc in our editor.

- Complete the necessary fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Please be aware that submitting on paper can increase the chance of errors and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct cr q 2013 14 commercial rent tax 2nd quarter return nycgov nyc

Create this form in 5 minutes!

How to create an eSignature for the cr q 2013 14 commercial rent tax 2nd quarter return nycgov nyc

How to generate an electronic signature for your Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc online

How to generate an electronic signature for the Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc in Chrome

How to generate an electronic signature for signing the Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc in Gmail

How to make an electronic signature for the Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc right from your smartphone

How to generate an eSignature for the Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc on iOS devices

How to create an eSignature for the Cr Q 2013 14 Commercial Rent Tax 2nd Quarter Return Nycgov Nyc on Android OS

People also ask

-

What is the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc?

The CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc is a mandatory tax return that commercial tenants in New York City must file for the second quarter. This form helps ensure compliance with local tax regulations and is essential for managing commercial rental properties effectively.

-

How can airSlate SignNow assist with submitting the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc?

airSlate SignNow provides an easy-to-use platform for eSigning and managing documents, including the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc. Our solution allows businesses to fill out, sign, and submit this form electronically, streamlining the entire process.

-

What are the pricing options for using airSlate SignNow for commercial rent tax submissions?

airSlate SignNow offers flexible pricing plans tailored for different business needs, from startups to larger enterprises. Our affordable plans include features essential for submitting the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc, ensuring you get great value for managing your rental tax requirements.

-

What features does airSlate SignNow include to handle the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc?

Our platform includes key features like customizable templates, cloud storage, and secure electronic signatures, making it easier to manage the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc. These tools help businesses complete their documents efficiently and ensure compliance with local regulations.

-

Are there benefits to using airSlate SignNow for the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc?

Yes, using airSlate SignNow simplifies the process of completing the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc, saving you time and reducing errors. The convenience of digital submissions allows for quicker responses and stays organized with all your important documents in one place.

-

Can airSlate SignNow integrate with other accounting software for the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and property management software, allowing for efficient data transfer related to the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc. This integration helps maintain accurate records and enhances overall productivity.

-

How secure is the information I provide when filing the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc with airSlate SignNow?

Security is a top priority at airSlate SignNow. All information provided while filing the CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc is encrypted, ensuring that your sensitive data is protected against unauthorized access.

Get more for CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc

Find out other CR Q 14 Commercial Rent Tax 2nd Quarter Return NYC gov Nyc

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later