SS11 Thru SP12 Application for Tax Credit Umsl Form

Understanding the SS11 Thru SP12 Application for Tax Credit at UMSL

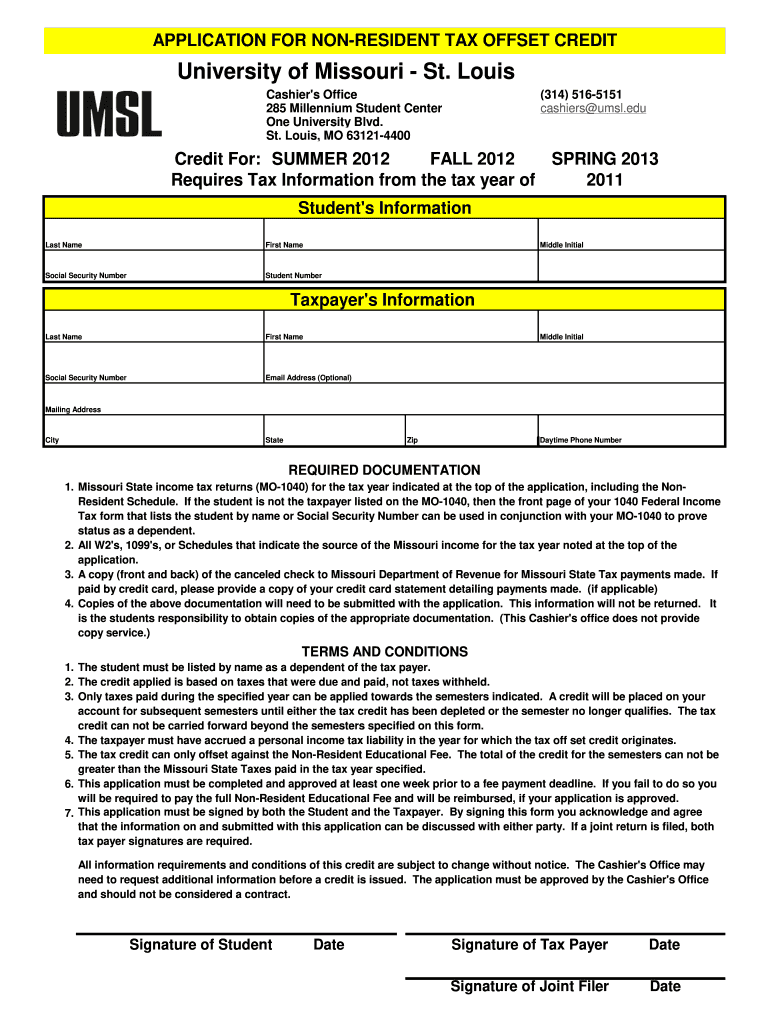

The SS11 Thru SP12 Application for Tax Credit at UMSL is designed for students who wish to apply for tax credits related to their educational expenses. This application is crucial for those who qualify for various tax benefits, which can significantly reduce their tax liabilities. The form encompasses several credits, including the UMSL tax offset credit, which is aimed at providing financial relief to eligible students. Understanding the nuances of this application can help students maximize their benefits and ensure compliance with tax regulations.

Steps to Complete the SS11 Thru SP12 Application for Tax Credit at UMSL

Completing the SS11 Thru SP12 Application involves several key steps:

- Gather necessary documents, including proof of enrollment and financial statements.

- Access the application form through the UMSL cashier's office or online portal.

- Fill out the required fields accurately, ensuring all personal and financial information is correct.

- Review the completed application for any errors or omissions.

- Submit the application either online, by mail, or in person at the UMSL cashier's office.

Following these steps carefully can help ensure a smooth application process and timely receipt of any tax credits.

Eligibility Criteria for the SS11 Thru SP12 Application for Tax Credit at UMSL

To qualify for the SS11 Thru SP12 Application for Tax Credit, applicants must meet specific eligibility criteria. Generally, students must be enrolled at UMSL and pursuing a degree or eligible coursework. Additionally, they should demonstrate financial need and meet the income thresholds set by the IRS for tax credits. It is essential for applicants to review these criteria thoroughly to determine their eligibility before submitting the application.

Required Documents for the SS11 Thru SP12 Application for Tax Credit at UMSL

When applying for the SS11 Thru SP12 Application, students need to prepare several documents to support their application:

- Proof of enrollment at UMSL, such as a student ID or enrollment confirmation letter.

- Financial statements, including tax returns and income documentation.

- Any additional forms required by the UMSL cashier's office for tax credit applications.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods for the SS11 Thru SP12 Application at UMSL

The SS11 Thru SP12 Application can be submitted through various methods, providing flexibility for applicants. Students can choose to submit their applications online through the UMSL portal, mail them directly to the cashier's office, or deliver them in person. Each method has its advantages, so students should select the one that best fits their needs and timelines. Ensuring that the application is submitted by the relevant deadlines is crucial for successful processing.

Legal Use of the SS11 Thru SP12 Application for Tax Credit at UMSL

It is vital for students to understand the legal implications of the SS11 Thru SP12 Application for Tax Credit. The application must be filled out truthfully and accurately, as providing false information can lead to penalties, including denial of the tax credit or legal repercussions. Students should ensure compliance with all relevant tax laws and regulations when completing and submitting their applications. Seeking guidance from tax professionals or the UMSL cashier's office can provide additional clarity on legal requirements.

Quick guide on how to complete ss11 thru sp12 application for tax credit umsl

The optimal method to locate and endorse SS11 Thru SP12 Application For Tax Credit Umsl

On the scale of your entire organization, ineffective workflows surrounding paper approvals can take up a signNow amount of work hours. Signing documents such as SS11 Thru SP12 Application For Tax Credit Umsl is a typical aspect of operations in every sector, which is why the effectiveness of each agreement’s lifecycle heavily impacts the overall efficiency of the business. With airSlate SignNow, signing your SS11 Thru SP12 Application For Tax Credit Umsl can be as straightforward and rapid as possible. You'll discover on this platform the most recent version of nearly any form. Even better, you can sign it instantly without the requirement of installing external software on your device or printing out physical copies.

Steps to obtain and sign your SS11 Thru SP12 Application For Tax Credit Umsl

- Browse through our library by category or use the search bar to find the form you require.

- Examine the form preview by clicking on Learn more to confirm it's the right one.

- Press Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your SS11 Thru SP12 Application For Tax Credit Umsl.

- Choose the signature method that suits you best: Draw, Generate initials, or upload a photo of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options if needed.

With airSlate SignNow, you have everything required to manage your documentation efficiently. You can discover, fill in, modify, and even send your SS11 Thru SP12 Application For Tax Credit Umsl in a single tab without any trouble. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the ss11 thru sp12 application for tax credit umsl

How to generate an electronic signature for the Ss11 Thru Sp12 Application For Tax Credit Umsl online

How to create an electronic signature for your Ss11 Thru Sp12 Application For Tax Credit Umsl in Google Chrome

How to generate an electronic signature for signing the Ss11 Thru Sp12 Application For Tax Credit Umsl in Gmail

How to make an eSignature for the Ss11 Thru Sp12 Application For Tax Credit Umsl from your smartphone

How to make an eSignature for the Ss11 Thru Sp12 Application For Tax Credit Umsl on iOS devices

How to create an electronic signature for the Ss11 Thru Sp12 Application For Tax Credit Umsl on Android

People also ask

-

What is the SS11 Thru SP12 Application For Tax Credit Umsl and how does it work?

The SS11 Thru SP12 Application For Tax Credit Umsl is a streamlined process designed for individuals and businesses to apply for tax credits efficiently. With airSlate SignNow, you can easily fill out, sign, and submit your application digitally, saving time and reducing errors. The platform ensures that your application is compliant with the necessary requirements, making the entire process straightforward.

-

How can airSlate SignNow help with the SS11 Thru SP12 Application For Tax Credit Umsl?

airSlate SignNow simplifies the SS11 Thru SP12 Application For Tax Credit Umsl by providing a user-friendly interface for document management and eSigning. You can access templates specifically designed for tax credit applications, ensuring you include all required information. This efficient workflow enhances accuracy and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for the SS11 Thru SP12 Application For Tax Credit Umsl?

Yes, using airSlate SignNow for the SS11 Thru SP12 Application For Tax Credit Umsl involves a subscription fee; however, it is a cost-effective solution compared to traditional methods. The pricing plans are designed to accommodate various business sizes, providing features that enhance document management and eSigning capabilities. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for the SS11 Thru SP12 Application For Tax Credit Umsl?

airSlate SignNow provides a variety of features specifically tailored for the SS11 Thru SP12 Application For Tax Credit Umsl, including customizable templates, secure eSigning, and real-time collaboration. Additionally, the platform offers cloud storage for easy access to your documents and compliance tracking to ensure your application meets all necessary guidelines.

-

Can I integrate airSlate SignNow with other software for the SS11 Thru SP12 Application For Tax Credit Umsl?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for the SS11 Thru SP12 Application For Tax Credit Umsl. You can connect with CRM systems, accounting software, and other tools to streamline the application process and keep all your documents organized in one place.

-

What benefits does airSlate SignNow provide for businesses applying for the SS11 Thru SP12 Application For Tax Credit Umsl?

Using airSlate SignNow for the SS11 Thru SP12 Application For Tax Credit Umsl offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which speeds up the approval process. Additionally, the electronic audit trails ensure that your application is tracked and compliant with regulations.

-

How secure is my data when using airSlate SignNow for the SS11 Thru SP12 Application For Tax Credit Umsl?

Security is a top priority for airSlate SignNow, especially when handling sensitive information like the SS11 Thru SP12 Application For Tax Credit Umsl. The platform employs advanced encryption protocols and multi-factor authentication to protect your data. Regular security audits and compliance with industry standards ensure that your information remains safe and confidential.

Get more for SS11 Thru SP12 Application For Tax Credit Umsl

Find out other SS11 Thru SP12 Application For Tax Credit Umsl

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement